Certified ethical investing specialists

Ethical investing is constantly evolving. At Evergreen Advice, we're at the forefront, providing investment solutions grounded in the latest research. We believe in making responsible investing a central part of all portfolios. This allows you to achieve your financial goals while ensuring your money isn't going towards damaging industries.

Investing ethically can align your money with your values, manage risk, or both. We demystify ethical investing to give you clarity on where your money is invested and tailor your portfolio to your specific preferences.

Certified by the Responsible Investment Association of Australasia

Mindful Money 'Best Ethical Investment Adviser' finalist

Our approach to ethical investing

We believe in making responsible investing a core part of all portfolios. Our portfolios emphasise environmental and social responsibility while upholding the cornerstones of successful investing: cost-efficiency and diversification. This allows you to achieve your financial goals without harming the planet.

Invest in companies with the best environmental and social practices. Environmental considerations include factors affecting nature, such as waste, pollution, resource depletion, greenhouse gas emissions and deforestation. Social considerations include factors affecting people, such as working conditions, human rights issues and community impacts.

Exclude harmful industries. We avoid investing in certain industries, including controversial weapons, companies cited for human rights violations, civilian firearms and tobacco, to name a few. While diversification is important, there are certain industries that are detrimental to society and we don’t want to support them.

Reduce greenhouse gas emissions. We measure the carbon intensity of companies and reduce or remove exposure to companies with a high environmental impact, particularly those that produce a high level of greenhouse gas emissions.

Engage with companies to create change. We work with our fund managers to take a proactive role in encouraging companies to act responsibly and give greater consideration to the social and environmental impact their company may have – through Board decisions and during shareholder voting at Annual General Meetings.

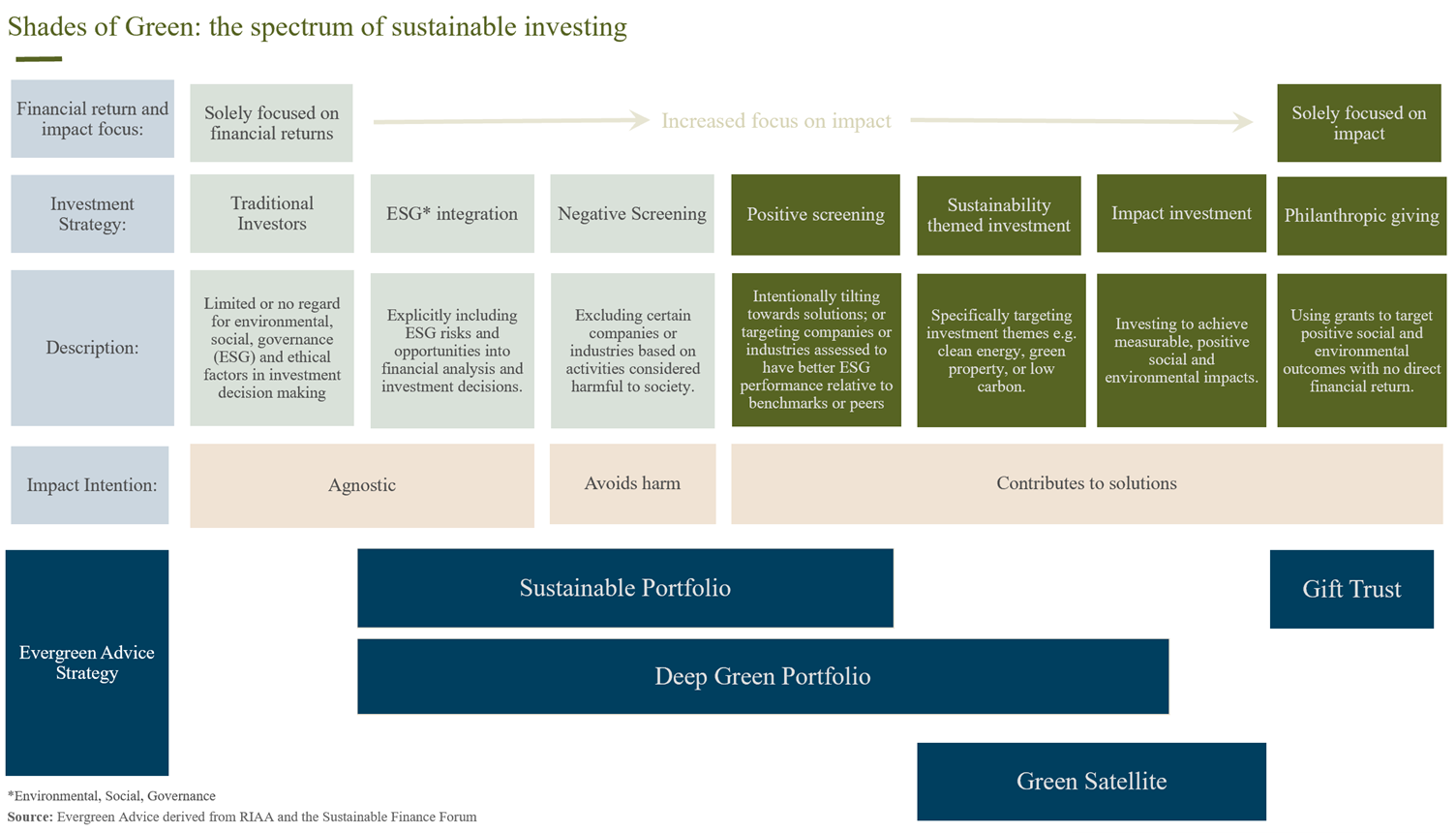

Our strategies are designed to cover a range of responsible investment preferences

How our portfolios at Evergreen Advice fit within the responsible investing framework.

Evergreen Advice Deep Green Portfolio

Portfolios for people who want to invest in solutions and influence change.

This portfolio invests more heavily in leading sustainable businesses and companies delivering solutions in alignment with the United Nations Sustainable Development Goals (SDGs). We select fund managers who have a genuine commitment to ethical investment and business practices.

Learn more about ethical investing

We regularly write articles to take the mystery out of ethical investing.

Our Climate Action Plan

By Mike Ross and Chelsea Traver We founded Evergreen Advice with the purpose to invest for a better...

Will I earn a lower return if I invest responsibly?

By Mike Ross at Evergreen Advice One of the most common questions we receive from investors is: Will inves...

Shades of green: What does it all mean?

By Chelsea Traver at Evergreen Advice Investing responsibly can be a confusing process. You can start with...

Not just avoiding the bad - rating ethical KiwiSaver Funds

By Mike Ross at Evergreen Advice In recent years responsible investing has gone mainstream and now almost ...

Does responsible investing make the world a better place?

By Mike Ross I once met with a fund manager who told me his business had started offering responsible in...

Are you being greenwashed?

By Chelsea Traver at Evergreen Advice There has been an explosion of interest in responsible investing wit...