Are you being greenwashed?

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

There has been an explosion of interest in responsible investing with 76% of New Zealanders wanting their money invested ethically or responsibly according to research done by RIAA. With such strong consumer demand, it’s no wonder that most investment managers now claim that they incorporate responsible investment considerations into their process, with many also having released specialised ethical funds. Given this recent rise in ethical investment demand, there is an understandable concern that fund managers are mispresenting or overstating their responsible investment practices. This leaves investors wondering how to spot Greenwashing and how to ascertain how ethical their investments actually are.

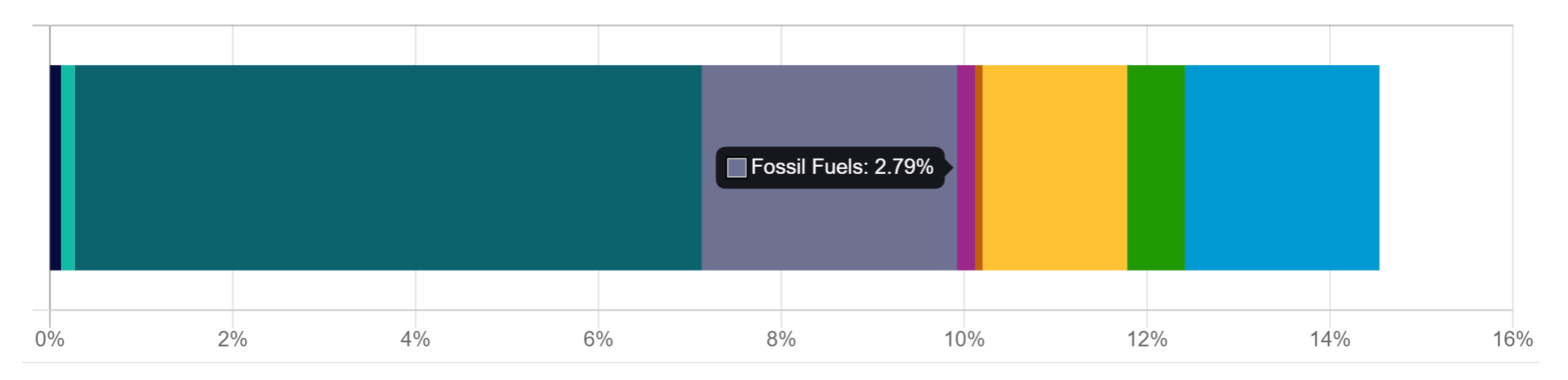

To begin with, the first layer of responsible investing is excluding the companies you don’t want to invest in. For this Mindful Money is an excellent resource as the one-stop shop for seeing what areas of concern a fund is invested in. By selecting an investment fund or KiwiSaver, the tool reviews the underlying holdings to see if the companies that fund is invested in are involved in any areas of concern. The potential areas they identify include weapons, tobacco, human rights violations, and animal testing to name a few. It covers a wide range of areas so you can decide which categories you feel most passionately about excluding.

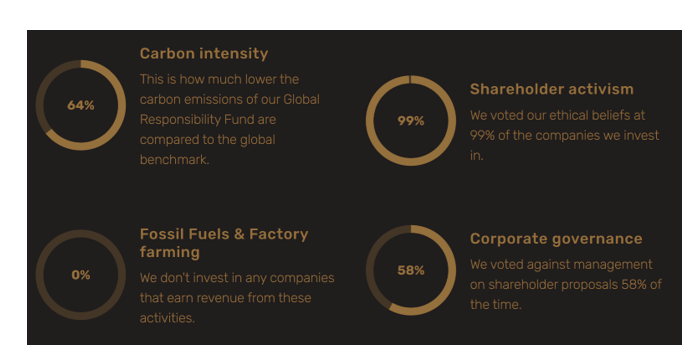

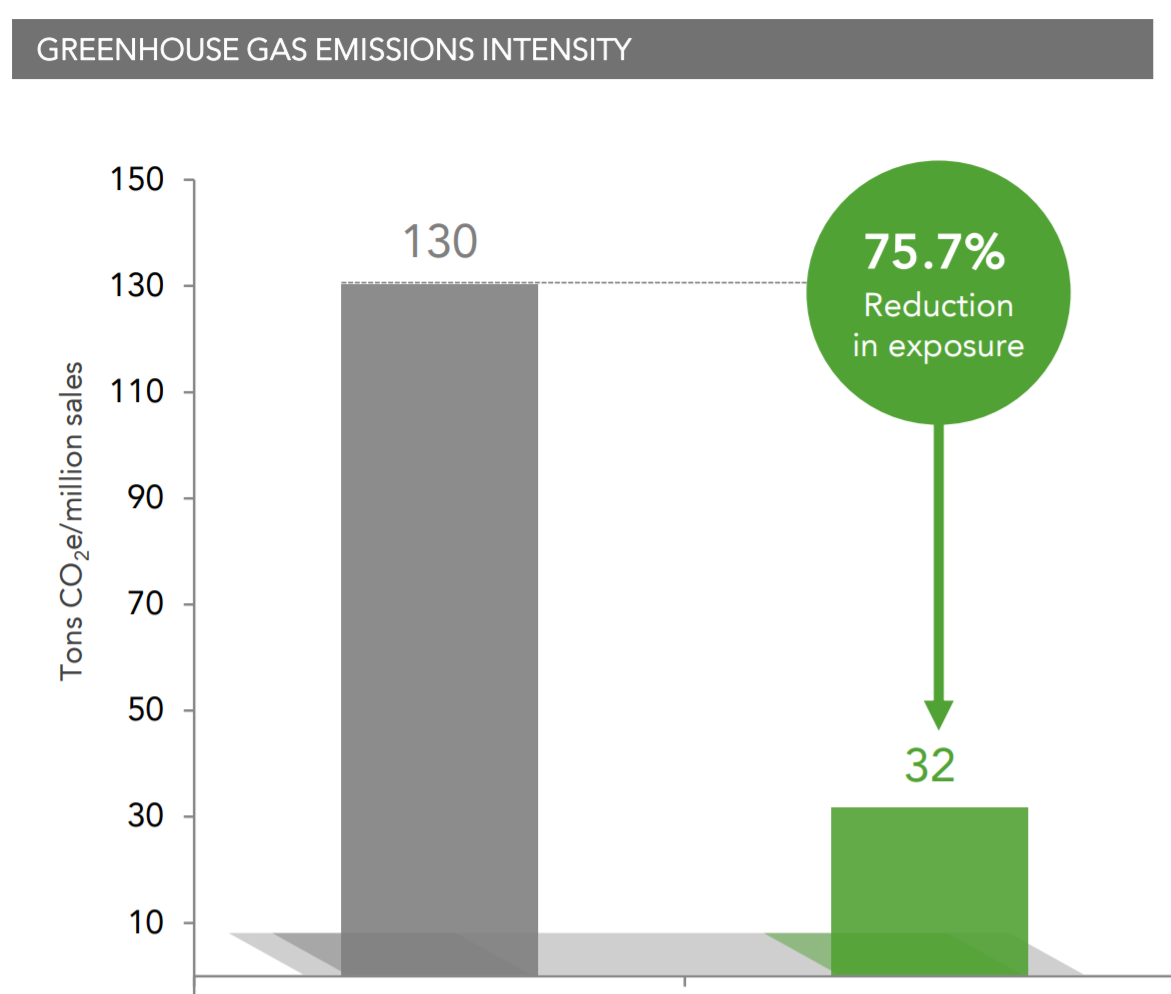

While it’s good to know what a fund excludes, most ethical investors want a lot more from their investments than just getting rid of the bad stuff. This is where you may need to do some research to identify how green your investments actually are. By going on the investment provider’s website, you can start to get an idea of what their ethical investment process is by reviewing their Responsible Investing Policy and looking to see if they have anything to back up those claims. For example if they have any sustainability reporting available. Some managers have a completely separate sustainability report whereas others include these metrics in their regular fact sheet. Here are a few examples from managers we use:

While it may be difficult to know what you’re looking for when you glance through your fund manager’s website, by the time you review a few you’ll get an idea of the managers who take it more seriously.

Finally, look to see if they have any external verification. For example:

- RIAA certified funds

- Awards for responsible invest

There is an increased focus on company transparency and disclosure which should help fund managers to create meaningful sustainability reporting, which in turn will help investors. In 2021, New Zealand became one of the first countries to formally require the assessment and reporting of climate change risks. A formal reporting process will make a significant difference in fund sustainability reporting as fund managers will have access to clear, and comparable metrics.

Unfortunately, even with all this research, it still can be hard to tell if a fund invests according to your values or not. Responsible investing has a lot of nuisances to it and subjective judgements need to be made. For example:

- Tesla, the darling of many ethical fund managers for its part in accelerating the use of electric vehicles, is currently being sued by the state of California over alleged rampant discrimination against Black employees. Does it belong in an ethical fund? Does its importance in helping to fight climate change make up for the fact that it scores more poorly on social and governance issues?

- Conversely, many ethical funds exclude nuclear power despite the fact that it could be a key driver in reducing the planet’s reliance on fossil fuels.

It’s this nuance that makes investing responsibly difficult and why it’s so important to ensure your ethical investments have a clear methodology and a process for updating it based on new criteria and controversies. While there is no easy checklist to identify greenwashing, by doing some digging you can better understand how ethical your investments actually are.