Our Process

You're in safe hands with experts who share your values

We use a collaborative process and a research-driven investment approach to help individuals, families, and charities set a clear path forward.

Seed

We start off by having a detailed conversation.

Plan

Once we understand your values and what's important to you, we determine what's possible.

Plant

Now we let the plan(t) take root.

Tend

As your life changes so should your investments.

Grow

As your portfolio grows so do your options.

![]()

How we work with clients

1. Free Initial Consultation

We start with an initial consultation for prospective clients.

This is an informal no-obligation conversation over the phone or Microsoft Teams where you can tell us a bit about yourself and what you're looking for.

2. Discovery Meeting

To get an understanding of what is important to you, and what you’re trying to achieve with your money, as well as any sustainable investing preferences you might have.

At the end of this meeting, we will confirm the plan fee.

3. Investment Plan

We then build and present an investment plan with specific recommendations to help you achieve your goals.

The plan also includes the building blocks we used to create the recommendations so you get a better understanding of investing.

4. Monitor and Adapt

For ongoing advice clients, we monitor your investments and recommend changes as needed.

We regularly check in to make sure your investments are still aligned with your life and to help with important life decisions such as how much you need for a comfortable retirement or how to help your children into their first home.

Our fees

Transparency is important to us. All fees will be clearly disclosed and agreed upon.

We offer a free initial consultation so prospective clients see whether our services would be a good fit.

If you decide to proceed then all fees will be clearly disclosed and agreed upon. The exact fee will depend upon the type of service provided to you but below are some fees that may apply:

- Initial Investment Plan fee: This generally ranges from $1,500 to $3,000 (plus GST). For complex foreign tax residents or entities (rather than individuals) a higher fee of $3,000 to $5,000 may be applicable. The fee will be clearly disclosed and agreed upon before we proceed with the plan. The fee will be clearly disclosed and agreed upon before we proceed with the plan.

- Ongoing advice fees: Our maximum advice fee is 1% (+ GST) per annum of the value of the assets under management, with reductions for accounts above $500,000.

- Other ongoing fees: custody, and fund management fees (paid to third parties, not Evergreen Advice) will depend on the investment strategy that we recommend.

If you would like us to manage your investments and provide ongoing financial planning, we generally work with clients with over $200,000 in investable funds. We are happy to provide self-managed advice on any portfolio size. You will be charged a fixed, pre-agreed fee or an hourly rate depending on the complexity.

For more information on how we operate see our Financial Advice Disclosure Statement.

![]()

What is fee-only, independent advice?

Fee-only, independent investment advisers are about your interests and only your interests. We get paid solely by our clients. We aren’t tied to any specific provider so we can focus on recommending the most appropriate solution for your situation. Because of this, our clients can be confident that we will select the most appropriate investment options for them and only transact when necessary, rather than having an incentive to use a certain investment or trade unnecessarily to earn a higher salary.

We started Evergreen Advice because we firmly believe that fee-only, independent advice is the best way to make sure our clients are at the heart of what we do. We don’t have our own products; we make sure the fees we charge are clear and transparent; and we don’t accept commissions.

Our Investment Approach

Our investment strategies are based on academic evidence and detailed research.

We offer a range of investment options to suit your personal goals, risk appetite, and values. Our strategies seek to manage fees and taxes to leave you with better returns.

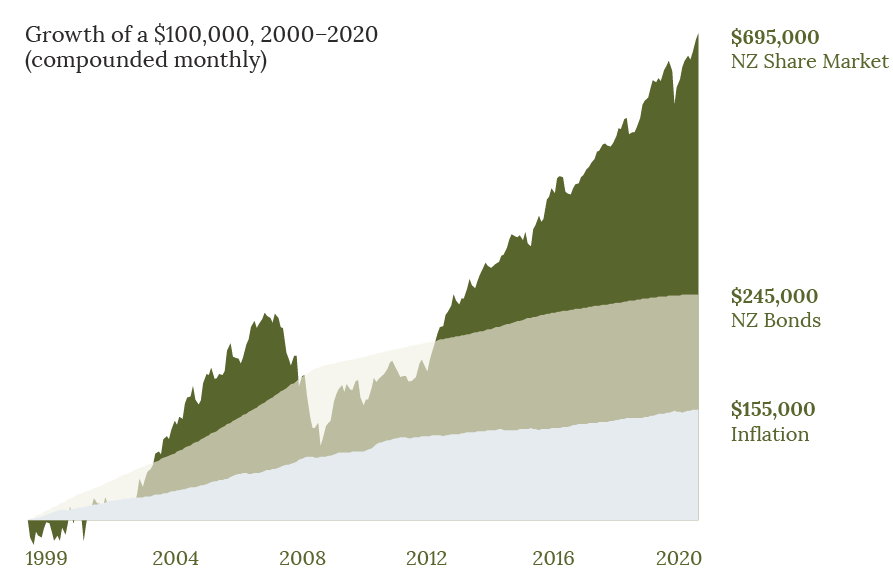

Risk drives return

To achieve higher returns you have to take on more risk (volatility) and stay invested for the long-term.

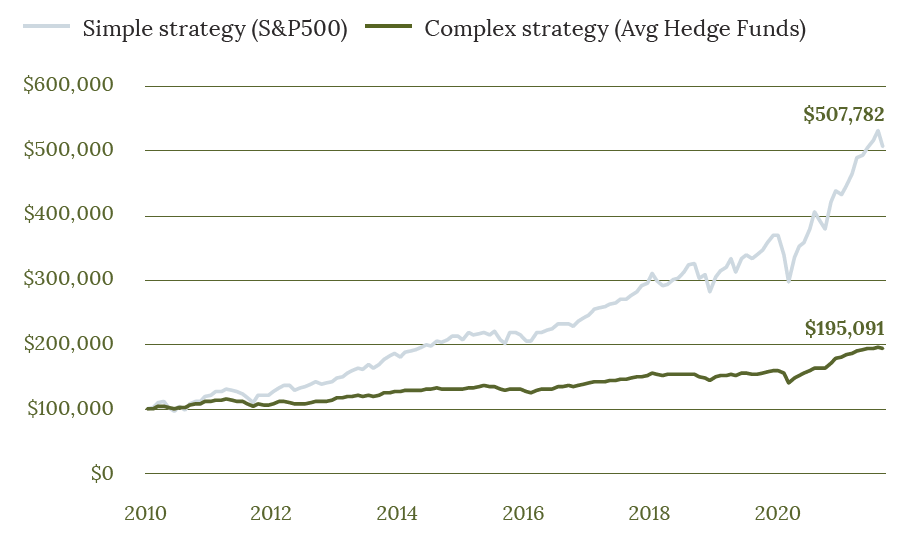

Simple beats complicated

Complex investment strategies tend to be expensive and often lead to poor performance. We aim for simple, inexpensive strategies for the core of your portfolio.

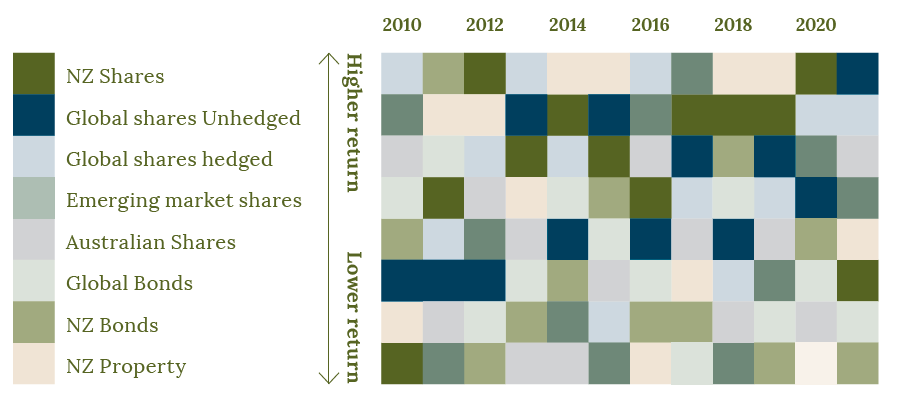

No one can predict the future, that’s why we diversify

Broad diversification across asset classes, regions and sectors minimizes risk and increases return.

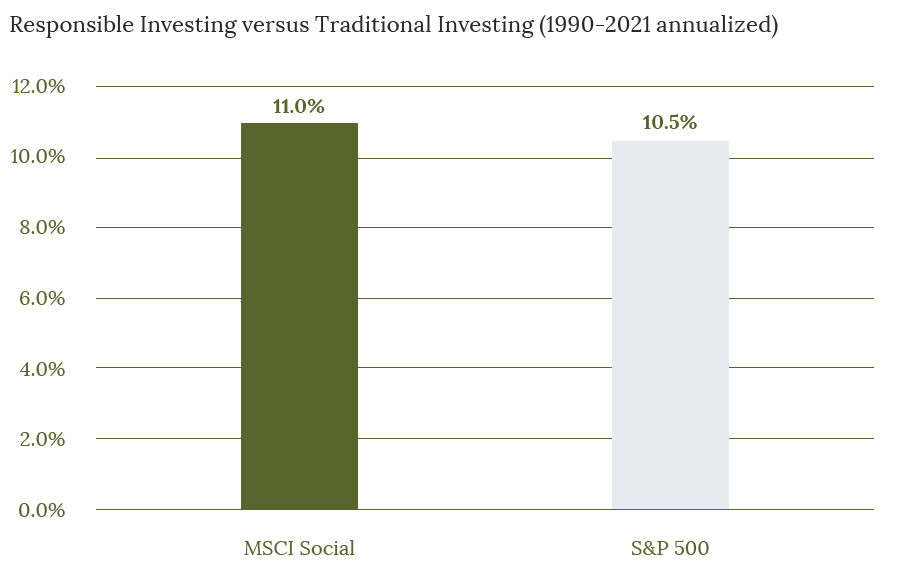

Ethical investing should be a core part of all portfolios

By investing ethically, you can still earn great returns while staying out of harmful industries.