Shades of green: What does it all mean?

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

Investing responsibly can be a confusing process. You can start with good intentions then get lost in a sea of jargon: ESG, SRI, and negative screening, to name a few. Conversely, if you simply select a fund claiming to invest responsibly, you may be disappointed when you learn what you are actually invested in.

Here we take some of the mystery out of responsible investing by describing what the different terms mean, and how they fit in the responsible investing spectrum.

The many names of responsible investing

There are a range of different terms used to describe various forms of responsible investing. These terms include:

• Socially Responsible Investing (SRI)

• Sustainable Investing

• Green Investing

• Ethical investing

• Values-based investing

• Environmental, Social, and Governance (ESG) criteria

With all these different names it’s easy to see why investors are confused! Unfortunately, there is no universally agreed-upon definition, but generally, all of these can be, and are, used interchangeably. That’s why, when looking at investments, it’s important to look beyond the name to the underlying intention and investment philosophy.

Shades of Green: The spectrum of sustainable investing

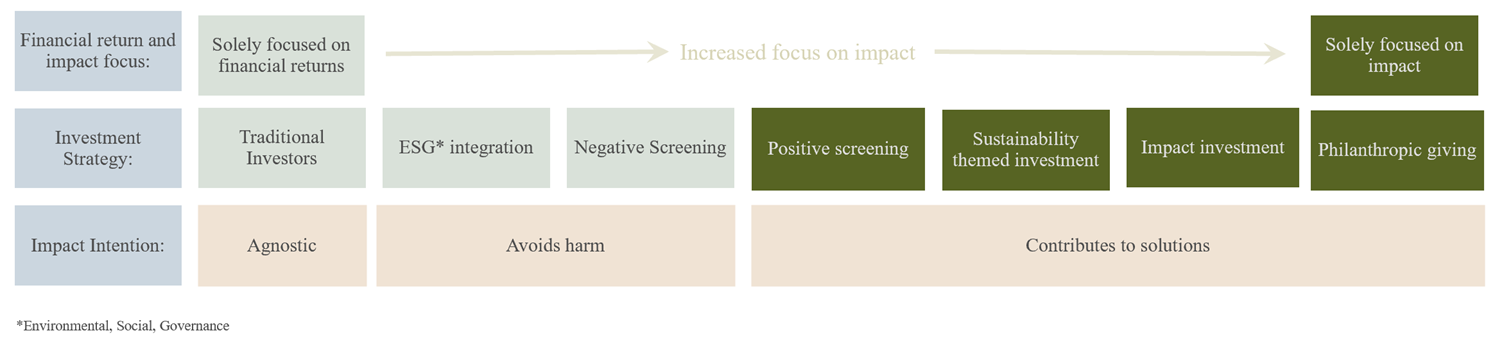

Source: Evergreen Advice derived from RIAA and the Sustainable Finance Forum

On the left is traditional investing which is solely focused on financial returns. On the right is philanthropy which is solely focused on impact and contributing to the welfare of others for a better world. While everything in the middle is considered responsible investing, not all strategies will achieve what investors want so it’s important to understand the different options.

Avoids Harm

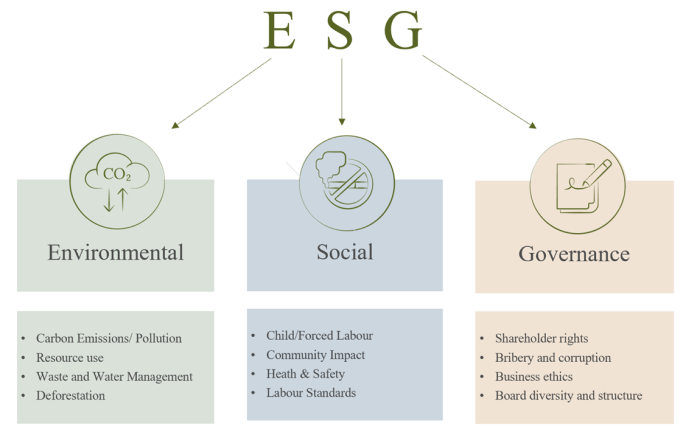

Environmental, Social and Governance (ESG) Integration

This is the most widely used method of integrating responsible investing. It involves including Environmental, Social and Governance risks and opportunities into financial analysis and investment decisions.

“In practice, money managers may be ‘aware of’ and ‘take into account’ ESG factors when making investment decisions,” said Rob Du Boff, an analyst at Bloomberg Intelligence. “But they’re not necessarily compelled to act on that information”. ESG integration is a good start, but for most investors who are looking to invest responsibly, it doesn’t go far enough.

Negative Screening

Funds that apply negative screening generally exclude certain companies or industries based on activities considered harmful to society. For example, many New Zealand funds exclude investment in companies involved with nuclear weapons or tobacco production. Other common exclusions include:

• Fossil fuel producers,

• Gambling,

• Human rights violations (such as slave or child labour), and

• Civilian firearms

The basis for negative screening is that there are companies that investors view as being detrimental to society, and therefore do not want to support them through investment. A helpful resource for people looking to check what exclusions their investments have is Mindful Money.

Contributes to Solutions

Positive Screening

Positive screening involves intentionally tilting investment towards companies or industries assessed to have better environmental and social scores. This also means it is tilting away from companies that do not score as highly.

To look at the airline industry as an example, rather than invest across all available airlines, a fund that employs positive screening would invest in airlines that have lower carbon emissions, low waste and treat their staff well. By investing more with these high standard companies, you are encouraging the lower-rated companies to improve their practices. If they improve their practices, more investors will invest in their shares, their share prices will increase, and they will have access to more funding when required. Additionally, companies that are more sustainable might be more likely to be successful in the future because of their better business practices, leading to higher returns for their investors.

Sustainability Themed Investment

Sustainability themed investment involves specifically targeting investment themes, for example:

• clean energy,

• electric vehicles

• green property, or

• affordable housing

This is also called thematic investing. The goal of these funds is to support companies in a specific area so that they can do more. Since these areas are generally high growth investors might also be looking to achieve higher returns.

Impact Investment

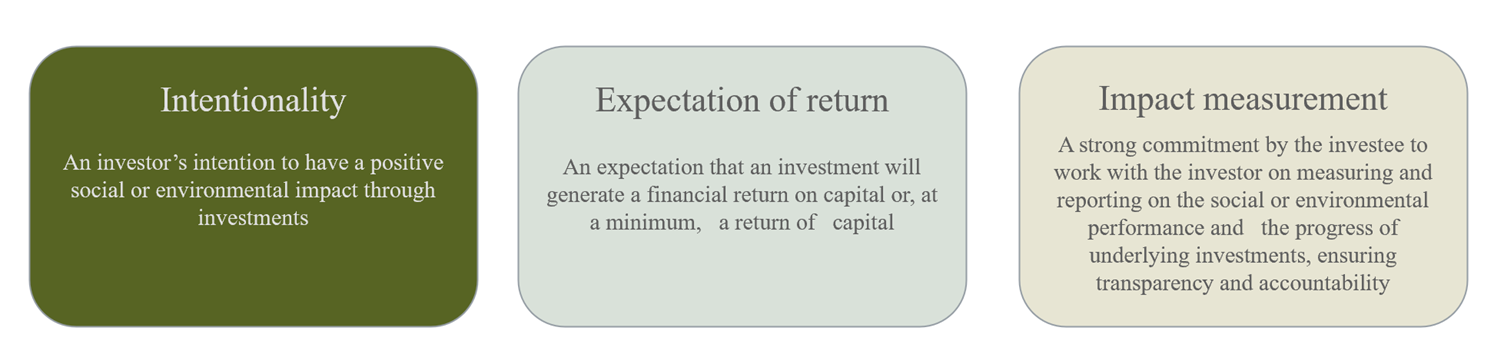

This is the responsible investing strategy most focused on making a difference. It involves investing to achieve measurable, positive social and environmental impacts. According to the Overview of Impact Investing Report in Aotearoa, impact investing has three core characteristics:

In New Zealand some impact investments include a social housing community; a company that has developed a platform for delivering chronic disease management and treatment programmes digitally; and a business that produces a range of certified organic fertiliser, biostimulant and crop protection products manufactured from seaweed. The main point is that impact investing is investing in companies with the intention to do good, while also achieving some financial return.

What does this mean for you?

There is a wide world of investment options available to investors who want to put their money to work, not just for themselves, but also for the world at large. While these options are fantastic, it does mean investors need to do their research to ensure their investments match their intentions.

At Evergreen Advice, we use positive screening and exclude those industries that we and our investors deem to be harmful. In addition, we engage with companies to affect change by using our voting rights and taking a proactive role in encouraging companies to act responsibly.

We also offer our clients personalised options to invest in sustainable themes and impact investments to further align their investments with their values.