Not just avoiding the bad - rating ethical KiwiSaver funds

By Mike Ross at Evergreen Advice

By Mike Ross at Evergreen Advice

In recent years responsible investing has gone mainstream and now almost all New Zealand fund managers incorporate some form of responsible investment into their selection process. The primary method used by fund managers (although to differing degrees) is not investing in harmful industries such as controversial weapons and tobacco, essentially, avoiding investing in the bad. This is also the area that garners the most scrutiny and headlines when it comes to light that funds are investing in areas that the public would not want their money. No one wants to select a responsible investment, only to see the fund in Russian government bonds while Russia is invading the Ukraine.

In our view, discussion is too often dominated by avoiding harmful industries, when it is just the first step in responsible investing. In this article we describe a range of criteria that investors should consider when selecting a responsible investment fund and delve into three case studies of well-known KiwiSaver fund managers to see how they stack up.

Our Responsible Investing Criteria

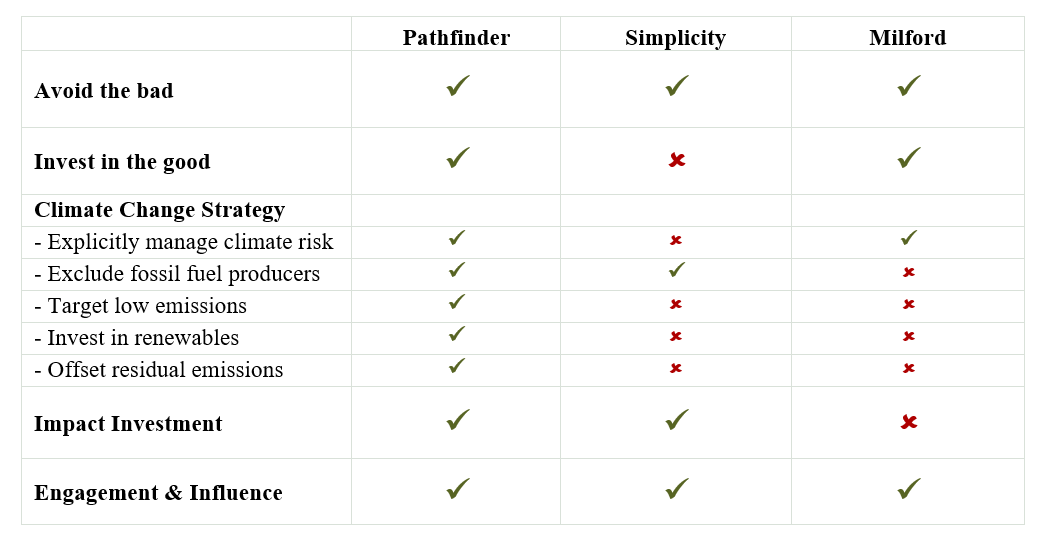

When looking at investing ethically we measure how “green” a fund is using the below framework:

- Avoid the bad: Exclude harmful industries and activities. If you want to take a deeper look into what different funds avoid investing in, then Mindful Money is a great resource.

- Invest in the good: Invest in companies with better environmental and social scores. Environmental considerations include issues that affect nature, such as waste and pollution, resource depletion, deforestation, and climate change. Social considerations include issues that affect people, such as working conditions, human rights issues, and community impacts.

- Climate change strategy: Exclude investments in oil and gas production, target low emitting companies and invest in technologies that help mitigate climate change. Climate change is one of the greatest risks of our time and ask such deserves special consideration.

- Engagement and influence: Engage with companies by using shareholder voting rights and seat at the table to take a proactive role in encouraging companies to act responsibly.

- Impact investment: The intention to generate a positive, measurable, social and environmental impact alongside a financial return.

How do KiwiSaver managers invest ethically based on our criteria?

Below we review three KiwiSaver managers who take different approaches to responsible investment:

Pathfinder Simplicity Milford.

Pathfinder

Pathfinder was founded in 2009 with a sole focus on ethical investing. They started offering KiwiSaver funds in 2019 and are a market leader in this space having won multiple industry awards in recent years. Pathfinder employs an active management strategy and offers conservative, balanced and growth KiwiSaver funds. Pathfinder is a B-Corp which is an internationally recognised certification that is awarded to entities that meet certain social, sustainability and environmental performance standards.

Avoid the bad: Yes

Pathfinder employs the most thorough negative screening criteria in the KiwiSaver market, excluding investment in:

- Weapons (military, civilian, controversial)

- Alcohol

- Recreational cannabis

- Adult entertainment

- Tobacco

- Gambling

- Animal testing, Factory farming, livestock export, whaling, and animals for entertainment.

- Companies that do not have at least one woman on the Board

Invest in the good: Yes

Pathfinder invests in companies with higher ESG (Environmental, Social and Governance) scores with the goal of reducing risk and improving returns. They also specifically look to invest in responsible themes such as renewable energy and water management.

Climate change strategy: Yes

Pathfinder’s KiwiSaver excludes fossil fuel producers, targets low carbon emitting businesses (so that the carbon emissions are approximately 65% lower than the market) and invests in renewable energy businesses. Additionally, they more than offset their share of carbon emissions from the companies they invest in using carbon offsets.

Engagement & Influence: Yes

Pathfinder seeks to influence change in businesses through shareholder voting, and engagement with company management. They are also members of various investment lobby groups including the Investor Group on Climate Change. CEO John Berry is a frequent contributor to stuff.co.nz commenting on responsible investment issues.

Impact investment: Yes

Pathfinder makes impact investments in private markets. Areas where they have made impact investments include solar power (Lodestone), mental health app (Groov), biodegradable bandages (Wool+Aid), social housing (through community finance bonds) and micro-finance (Womens’ Livelihood Bonds in South-East Asia). Pathfinder also donates 20% of its management fee to charitable causes.

Other considerations

Even if responsible investing is your primary consideration, it is still worth considering other factors including investment philosophy and process, fees, investment team, and governance. Pathfinder’s three funds have delivered market leading performance in their three years since inception. However, their management fee is relatively high and their investment team is relatively small compared to other fund managers. The funds also tend to be more concentrated (i.e. they invest in fewer businesses than comparable funds) which may mean they are more volatile than other, more diversified funds.

Simplicity

Simplicity offers widely diversified, low-cost, passively managed KiwiSaver funds. Simplicity started in 2016 and was instrumental in bringing down KiwiSaver fees and making responsible investment a more mainstream topic. They have since become one of the go-to low-cost managers.

Simplicity looks to invest responsibly through a combination of exclusions and impact investments. They are also set up as a not-for-profit and donate a portion of their management fee to charity.

Avoid the bad: Yes

Simplicity excludes investment in:

- Weapons

- Tobacco

- Alcohol

- Cannabis

- Gambling

- Adult entertainment

- Fossil fuel exploration and extraction

- Companies that have contravened the principles of the UN Global Compact including controversies in corruption, human rights, environment and labour.

Invest in the good: No

Being a passive manager, Simplicity does not specifically invest in companies with high environmental and social ratings, other than the impact investments mentioned below.

Climate change strategy: Yes

Simplicity excludes investment in all companies that have coal reserves and/or oil and natural gas reserves and companies involved with fossil fuel exploration, drilling and refining of oil and gas products.

Engagement & Influence: Yes

Simplicity actively engages with the NZ companies that they invest in, challenging executive compensation and diversity at the board and executive level. Internationally, Simplicity invests through Vanguard who engages with the businesses that they invest in. Additionally, Simplicity has worked with Vanguard to develop responsible investment funds in which Simplicity invests in. CEO Sam Stubbs is often featured in the media publicly challenging corporate behaviour and has been a vocal advocate for responsible investing. Most recently he called out Fletcher Building due to their role in the GIB board shortages in NZ.

Impact investment: Yes.

Simplicity has recently begun investing in a ‘Build-to-Rent’ scheme with the intention to build quality, affordable apartments and townhouses for long term rent across New Zealand, and to help alleviate the NZ housing crisis. They also invest in a bond supporting women in developing nations though micro-loans. Simplicity donates 15% of its management fee to charitable causes.

Other Investment Considerations

If you’re new to investing the concept of a passive fund may sound odd – wouldn’t I want to invest in a small selection of quality businesses rather than in all businesses? But there is strong evidence globally that most active managers underperform passive funds, in large part due to the higher fees that they charge. Simplicity charges low fees and has delivered above industry average returns since inception.

But one of the drawbacks of passive investing from an ethical investment perspective is how widely you are invested. This means that when ‘controversies’ happen (e.g. the Russian invasion of Ukraine) you are likely to find that a small percentage of your money is invested in that controversy (Simplicity owned some Russian government bonds). This can happen with any investment fund but is just more likely to happen with a strategy like Simplicity’s which is spread so widely.

Milford

Milford is a popular KiwiSaver provider and boasts (arguably) the best long-term performance track record in the industry. Milford is also an interesting test case given it made headlines during the recent DGL controversy where its CEO made sexist and racist comments about Nadia Lim, the celebrity chef and founder of My Food Bag.

Milford wasn't founded as a responsible investment manager but its concentration in this area now provides a good example of how investment managers more generally are looking to incorporate responsible investment considerations into their investment framework.

Avoid the bad: Yes

Milford excludes investments in:

- Weapons,

- Tobacco,

- Cannabis,

- Companies cited for poor ESG practices.

Invest in the good: Yes.

Milford completes a detailed analysis of the companies that they invest in. Evaluating a business’ exposure to climate change and social harm, and how these risks are being managed, is an important component of this comprehensive analysis.

Climate change strategy: Yes

Climate risks (including carbon emissions) are estimated and incorporated into the investment decision-making process.

Engagement & Influence: Yes.

Milford engages with companies via regular management meetings, meetings with Boards and management in response to particular events (for example major breaches of environmental or social requirements), and through shareholder voting.

In regards to the DGL controversy, Milford engaged with the company on the issue rather than simply selling down their holding automatically. This allowed Milford to share the impact of the remarks and the changes they thought DGL needed to make. Following this meeting, they exited their position in DGL. We believe that from an investment perspective this kind of engagement leads to better business practices.

Impact investment: No.

Additional Investment Considerations

As previously mentioned, Milford has delivered industry-leading long-term investment performance, supported by one of the largest and most experienced investment teams in NZ. Milford has won many investment industry awards including being named Fund Manager of the Year by Morningstar in 2022. Also of note is that Milford charges relatively high fees (both management fees and performance fees).

What this means for you

At the end of the day the question for KiwiSaver investors is what type of responsible or ethical investment you are after.

Milford, as an example, looks to incorporate sustainable investment criteria into their investment process with the main goal of delivering better performance, whether that be through reduced risk or increased return.

Pathfinder and Simplicity take it a step further (and in Pathfinder’s case a few steps) with goals that go beyond investment returns and include impact investing and charitable giving.

Disclaimer: This article is general in nature and does not constitute financial, tax or legal advice in any way. Should you require such advice, please contact Evergreen Advice or a suitably qualified professional.