Four big questions for 2024

By Mike Ross

By Mike Ross

As a general rule, we’re an anti-forecast shop. Predicting how markets will perform over the short term tends to be an impossible task, and basing your investment strategy on picking the next market crash is a great way to lose money

That disclaimer made, it's always interesting to look ahead and wonder what the next year will bring, so in our article this month we discuss four big questions for 2024:

- Have interest rates peaked?

- Wil shares outperform term deposits?

- Will Big Tech keep delivering?

- Is greenwashing happening in NZ?

Have interest rates peaked?

Over the last two years, we've written about interest rates more than we care to remember. High inflation forced central banks to increase interest rates at a historic speed which pushed up long-term interest and mortgage rates. Higher rates then resulted in poor returns in both share and bond markets. They reached a high point in October and have fallen since in reaction to strong evidence (particularly in the US) that inflation has sustainably reduced.

Central banks, including the RBNZ, are still saying there's a good chance that they increase interest rates again next year. We think this is probably not required as inflation is falling so the current high rates are having their desired effect. This means there's a good chance interest rates have peaked.

Will shares outperform term deposits?

As share markets feel during October the most common question we were fielding from prospective clients was "Why don't we just invest in term deposits?" We covered our answer in an article earlier this year, but the last 6 weeks have been a live reminder of the benefits of investing at least some of your money into more volatile assets like shares.

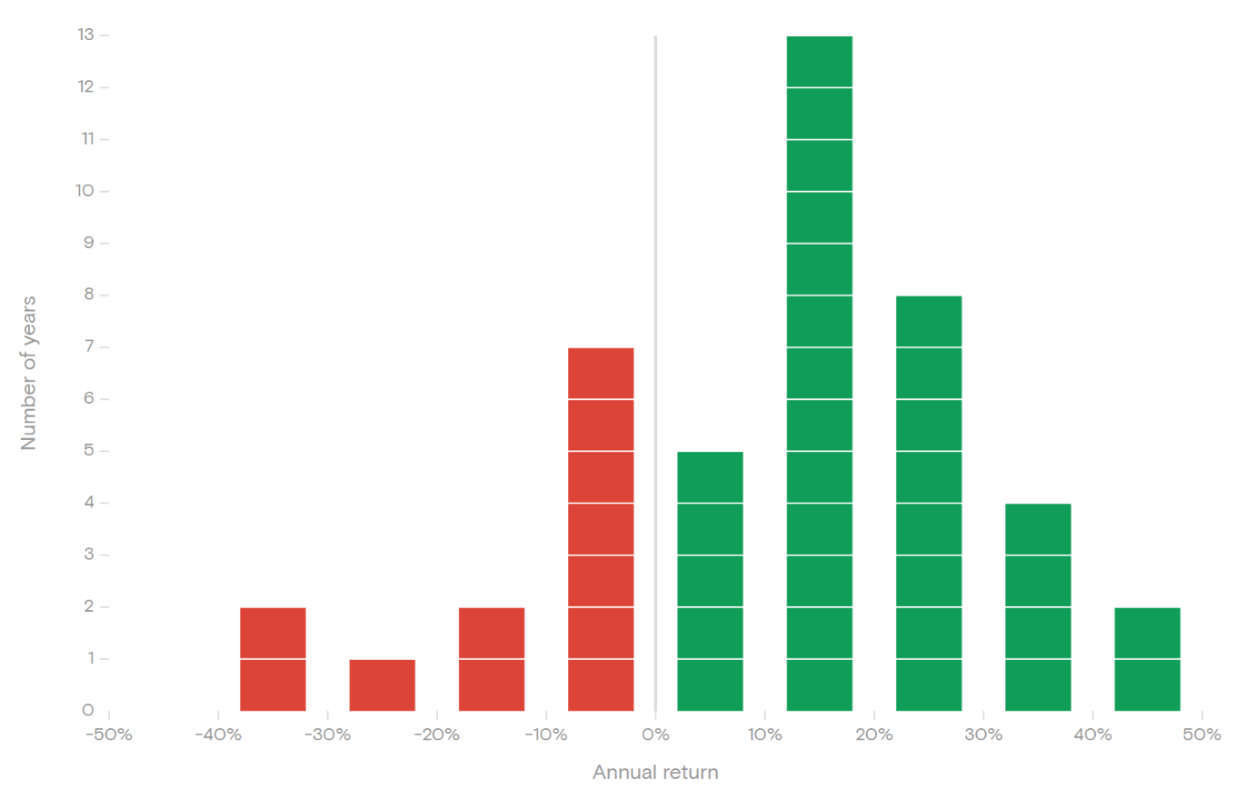

The global share markets have delivered positive returns in more than 70% of years and have returned more than 10% in close to 60% of years. Given this, share markets will likely outperform term deposits next year, and almost certainly over the next 10.

Global stock market performance over the past 44 years

Will Big Tech keep delivering?

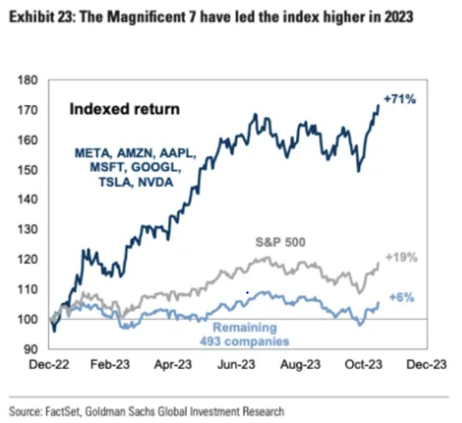

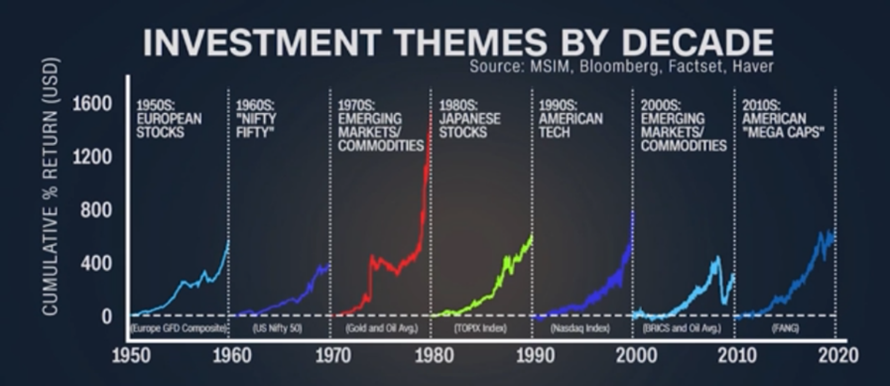

I started managing investments for clients 10 years ago. A widely held view at the time was that US technology stocks – think Apple, Google, Amazon, Facebook, and Microsoft – were overvalued. Fast forward 10 years and those same stocks, along with Tesla and Nvidia, have performed better than ever, being the driving force behind the strong performance of the stock market this year.

Leading companies tend to be overtaken by newer, more disruptive businesses, but so far the large US tech companies have held others at bay (in part by buying many of their competitors). They also have benefited from major new themes such as work-from-home and AI. These technology businesses will be overtaken at some point, but don’t build an investment strategy on picking when that will happen. Instead, include some exposure to tech while also diversifying into other areas.

Is greenwashing happening in the NZ?

Greenwashing has been a hot topic in responsible investing. Globally, a number of providers have been found guilty of greenwashing by regulators. In Australia, this has included well-respected investment providers Vanguard and Mercer who have both faced major fines from their regulator ASIC. The NZ investment industry has observed these events and improved their practices and disclosures. But it's definitely not perfect and it would seem to be a matter of time before the FMA (the NZ regulator) brings a case for greenwashing. Outside of investing, Consumer NZ recently brought a case against Z Energy for making misleading claims about its emissions. Z Energy has stated “We’re in the business of getting out of the petrol business” while still increasing both its fuel sales and carbon emissions. We’ll watch with interest to see how this plays out.