Client Qs: Should I just invest in Term Deposits?

By Chelsea Traver

By Chelsea Traver

If you’re currently wondering "Why not just invest in Term Deposits?" then you’re not alone. It's a question we are encountering from prospective clients who are enticed by the attractive returns now being offered. With term deposits earning 5% plus, it's natural for this easy solution to appeal. However, to outpace inflation and achieve real returns and growth, a degree of risk is necessary.

What are Term Deposits good for?

Term Deposits undoubtedly have their merits, especially when you have short-term financial goals in mind. They serve as an excellent investment option if you require funds for purposes like a new build deposit, an upcoming overseas trip, or a car purchase. In these scenarios, they can help you generate a guaranteed return on your investment. However, it's crucial to acknowledge that term deposits generally offer relatively low returns, usually hovering around the rate of inflation. The recent increase in term deposit rates is primarily due to the prevailing high inflation rate, with New Zealand experiencing inflation at over 6%.

To achieve a return above inflation you need to take on more risk.

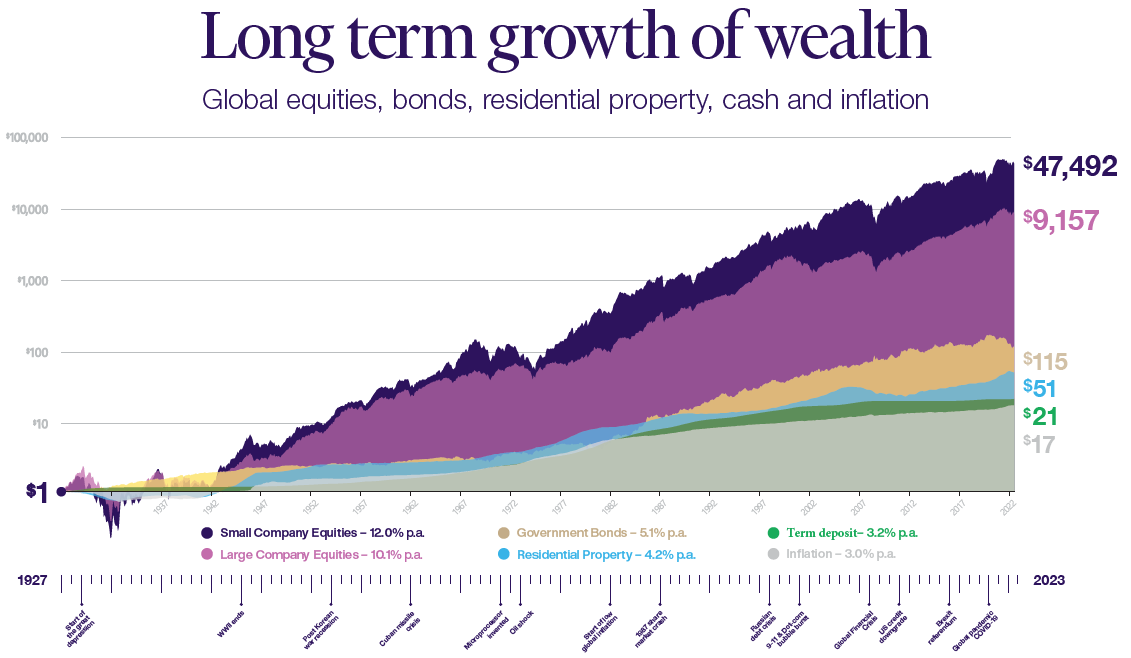

To illustrate the risk/return relationship, let's see review what’s happened historically:

Very low-risk investments such as term deposits have typically tracked along with the inflation rate, yielding approximately 3%. Bonds, on the other hand, have delivered an average return of around 5% per year. However, for those seeking higher returns, shares have historically outperformed other asset classes, offering an average annual return of approximately 10% (before tax and fees). This higher return potential compounds over time, which significantly grows your investment.

But what about the short term?

Why should you assume the greater risk when term deposits offer a guaranteed 5% return? The answer lies in the impact of rising interest rates, which have elevated the expected return across other investment options. Consider the following:

- Term Deposits: You can now secure 5% plus on term deposits.

- Bonds: A few years ago, bond yields (the expected return on bonds) were at historic lows, yielding around 2%. However, as interest rates have risen so have bond yields meaning bonds are now yielding around 6%.

- Shares: Although subject to market fluctuations, a long-term return of 8%-10% can still be assumed for shares.

By diversifying your portfolio with a combination of shares and bonds, you can expect a meaningful return premium over term deposits, and ahead of inflation. If you have an investment timeframe longer than five years, which allows you ample opportunity to recover from any temporary setbacks, it is well worth embracing the ups and downs of an investment portfolio or diversified investment fund.

While term deposits have their place in specific short-term financial scenarios, they fall short when it comes to long-term growth and surpassing inflation. By going into higher-risk investments such as shares and bonds, you allow for greater potential returns by unlocking the power of compounding growth.

Disclaimer: This article is general in nature and does not constitute financial, tax or legal advice in any way. Should you require such advice, please contact Evergreen Advice or a suitably qualified professional.