Why is inflation so high and what can you do about it?

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

For the last 10 years, inflation has crept along at 1% to 2%, with market commentators and central banks more concerned about deflation than rising prices. However, this has dramatically changed recently as the side-effects of the pandemic, exacerbated by the Russian invasion of Ukraine, has seen prices at the supermarket and petrol station spike, and investment markets fall.

What’s going on with inflation?

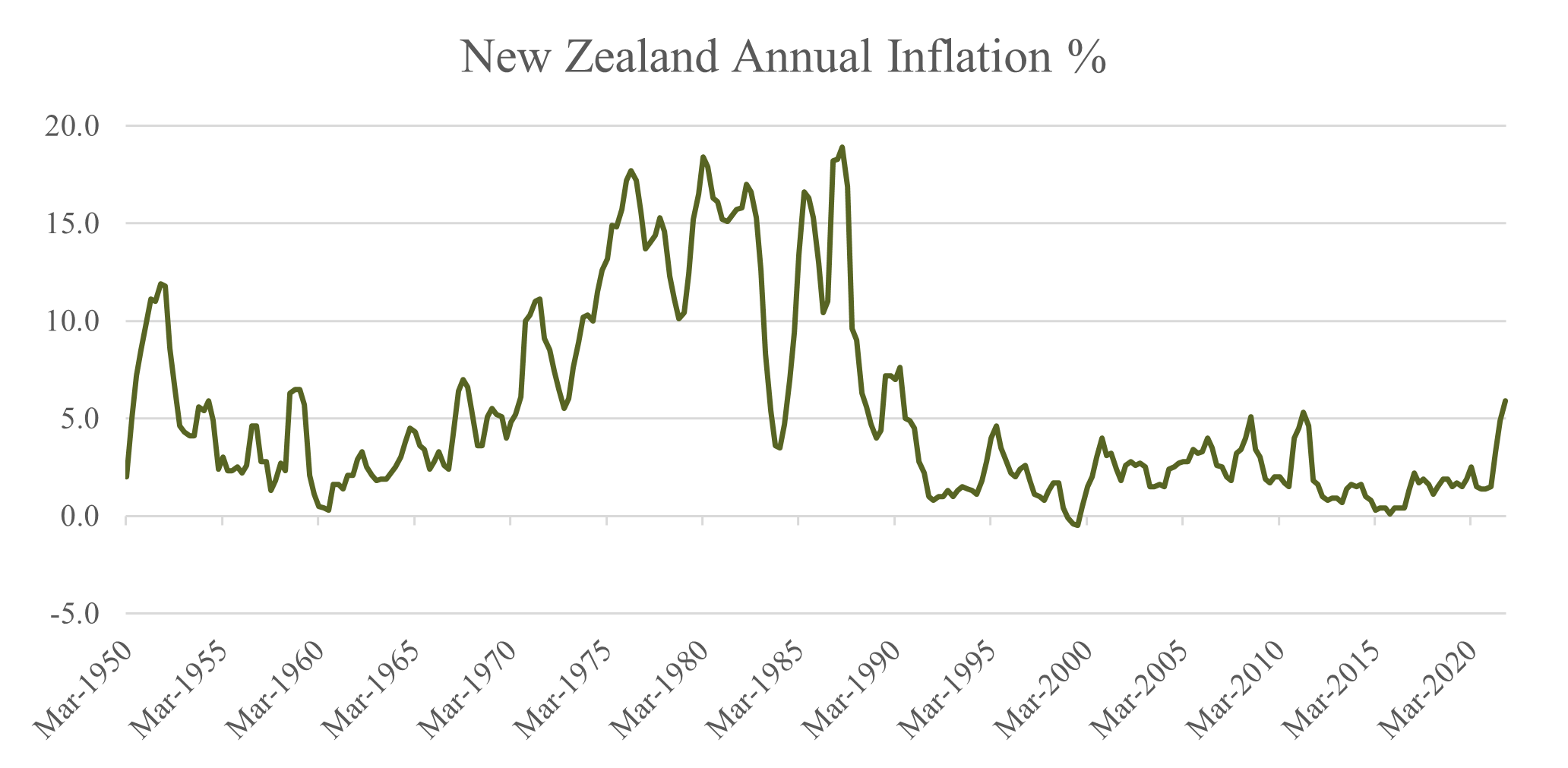

The year-to-date drop in both share and fixed interest markets was partially caused by inflation concerns, as central banks around the world have been forced to respond to inflation numbers not seen since the early 1980s. US annual inflation surged to 8.5% on 31 March 2022, the highest in 40 years. New Zealand inflation rose 6.9% over the same period, the highest in more than 30 years.

Due to these high inflation rates, the US Federal Reserve is now expected to raise interest rates five times during 2022, while the market expects the RBNZ to raise rates seven times this year. Most recently the RBNZ did a large hike on 13 April to curb inflation.

What caused it?

It has been the perfect storm for inflation but the primary factors responsible are government intervention to cushion the economic impacts of Covid-19, supply shortages, and most recently the Russian invasion of Ukraine.

Governments

Back in 2020, as governments scrambled to mitigate the economic effects of Covid-19, they introduced many policies and programs designed to support their citizens. These included fiscal policies, such as direct cash payments to citizens or struggling businesses, and monetary policies such as decreasing the official cash rate and buying back bonds (quantitative easing) to stimulate demand.

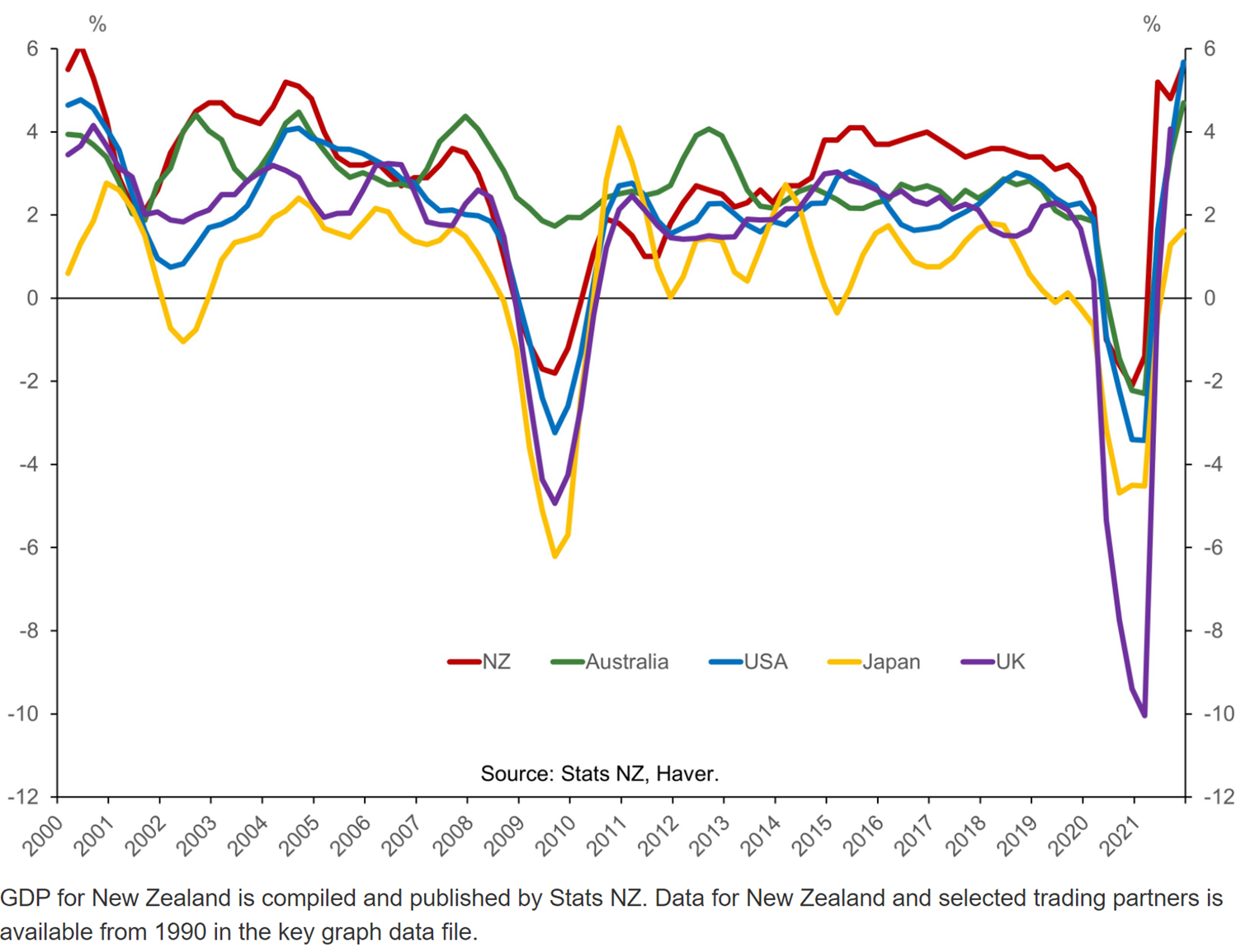

This was an important and necessary step for governments to take at the time and this likely helped ensure that there was not a more sustained recession in 2020. Markets bounced back quickly with only 6 weeks from the top of the market to the bottom, followed by a significant upward trend in 2020, continuing in 2021. Economies also bounced back relatively quickly, avoiding what some commentators thought could turn into a deep economic recession.

Real Gross Domestic Product — since 2000

The problem is, that by putting a lot of extra money into the economy, people had more funds in their pockets and wanted to use it on purchases. While this is exactly what governments wanted in 2020, in 2022 this extra demand has pushed up prices dramatically.

Supply shortages

When people went to buy, they often had to pay an increased price and potentially deal with a delay because of the lingering effects of Covid-19. These were caused by a range of supply chain issues such as staff shortages, shipping delays, and underlying component scarcities. The world is more interconnected than ever, and this means if you wanted a laptop, for example, you might have had to either pay up or wait until they could source the microchip components from Taiwan and find a ship with open space to get it to NZ.

When inflation is low, people notice if a price rises and they might consider not purchasing the item or waiting for it to drop in price. However, when price rises are everywhere, people are more likely to accept them for fear that they will rise further in future.

The war between Russia and Ukraine

This conflict has exacerbated inflationary pressures as Russia is a major oil producer. The oil price spiked to more than $130 per barrel, a level not seen since 2008, as the war put further stress on an already tight European gas market.

According to KiwiBank economists “Petrol spend in particular was up 8 per cent in the month of March as Russia’s invasion of Ukraine sent commodity prices spiralling higher. Unfortunately, there is little relief on the horizon as geopolitical tensions remain elevated and China faces its largest Covid outbreak in two years. A locked-down China adds pressure on already strained supply chains, exacerbating cost pressures.’’

What are the effects of inflation?

Inflation in and of itself isn’t a bad thing. Normally governments target around 1% to 3% inflation and when it does get a bit higher it’s a sign of a booming economy where people are earning and spending more. The issues come when inflation gets too high:

- Goods and services cost more and unless your salary or income keeps up with this rise in prices, you will have a lower net income over the month.

- Erodes the value of your cash savings by lowering your purchasing power. Even higher interest accounts like term deposits generally don't keep up with inflation, especially in high inflation environments. Thus, your savings will purchase less in the future than they would today.

- Reduces real investment returns as returns must first keep up with the rate of inflation in order to increase real purchasing power. While inflation’s effects are often mitigated by shares, high inflation environments are particularly harmful for fixed interest returns.

What can you do?

- Have a good hard look at your cash savings and decide if you have any excess cash that you could invest. If you have a shorter time frame look at term deposits and bonus savings accounts – these may not fully offset the effects of inflation but it’s better than earning nothing in a standard savings account. However, remember to set aside some funds for emergencies

- Review your investments to ensure you have the appropriate exposure to investments that provide some inflation protection. Both shares and property provide some inflation protection over the long term as companies can put up prices, and landlords can put up rents, to offset the effects of inflation.

- Negotiate a raise considering the current high inflation and the tight job market. Alternatively, if you are unhappy at your current job, now is a great time to look at other, higher-paying, options.

- Petrol has been one of the areas that have increased in cost the most. While the NZ government implemented some policies to mitigate these increases, you can also consider taking public transport. The government has cut public transport fees in half so now is the time to relook at your bus, train or even ferry options to reduce petrol costs.

- Consider your food purchases and decide if you can reallocate from areas items where prices have gone up the most. For example, beef prices have gone up significantly so consider chicken, or vegetarian alternatives. You’ll have the added benefit of reducing your carbon footprint!

High inflation doesn’t last forever so you don’t need to dramatically change things in your life to “fight inflation”. Instead, use this as an opportunity to check if your money is working as hard as it can for you and see if there are any lifestyle tweaks to mitigate the effects of inflation.

Disclaimer: This article is general in nature and does not constitute financial, tax or legal advice in any way. Should you require such advice, please contact Evergreen Advice or a suitably qualified professional.