Why invest in bonds

By Mike Ross

By Mike Ross

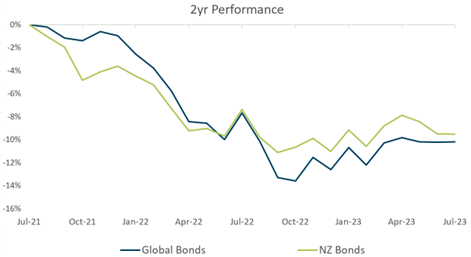

Over the last two years, bonds have delivered negative returns for investors, falling in value by more than 10%. And when you also account for the high inflation over that period, bonds have delivered particularly poor investment outcomes. These results have seen us field questions from clients on how bonds work and perform. Below we describe the basics of bonds and how, despite recent poor performance, they do have an important role to play in your investment strategy.

How do bonds work

When you invest in a bond, you are essentially lending money to a company (or government entity). In return, they promise to pay you back the original amount you invested (known as the principal) after a certain period of time, along with regular interest payments along the way.

The interest rate on a bond, also known as the coupon rate, is determined when the bond is issued. It's usually a fixed percentage of the bond's face value. For example, if you invest $1,000 in a bond with a 5% coupon rate, you'll receive $50 in interest payments per year.

If you hold a bond until maturity, you'll receive the full principal amount, regardless of interest rate changes. However, if you decide to sell your bond before it matures, the current interest rate environment will impact its market value.

What affects a bond's value

The value of a bond (unlike say a term deposit) can change over time, and one of the key factors influencing this change is interest rates. When interest rates in the market go up, it means that new bonds being issued are offering higher coupon rates. This makes them more attractive to investors because they provide a higher return. As a result, existing bonds with lower coupon rates become less valuable. For example:

- If you own a bond with a 5% coupon rate and market interest rates rise to 6%, new bonds will offer higher returns than yours. Investors will want those higher returns, so they won't be willing to pay as much for your bond with the lower coupon rate. As a result, the value of your bond will decrease because its fixed interest payments are now less competitive compared to newer bonds.

- Conversely, if market interest rates fall, new bonds will offer lower coupon rates. This makes your bond with a higher coupon rate more attractive, as it provides a higher return than the newly issued bonds. Investors will be willing to pay a premium for your bond, driving up its value.

What happened with bonds over the last few years?

The poor performance of bonds over the past two years was driven by a unique set of circumstances. Interest rates were at historic lows. Then inflation took off as a result of loose monetary policy and global supply chain problems stemming from the pandemic.

What will the future hold?

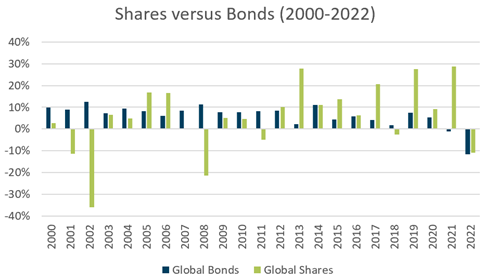

The situation has changed now, with interest rates significantly higher, providing an expected return of 6% plus on bond investments. Plus, the fundamental reasons for investing in bonds still holds: they provide a steady income, value stability (relative to shares), and often (though not always as last year proved) perform well when share markets fall.