What does the election mean for house prices?

By Mike Ross

By Mike Ross

Since founding Evergreen Advice three years ago we've spent a lot more time talking to clients about the property market than we would have thought. After all, we don’t specialise in property investment advice. However property, particularly in NZ, is such a central part of people’s overall wealth and investment strategy that it's understandable it forms a large part of our conversations with clients. It’s also of interest from a responsible investment perspective given the implications for inequality in unaffordable housing.

Earlier this year we wrote an article highlighting that the economics of property investment weren’t what they used to be given lower rental yields, higher expenses (including interest), and less favourable tax treatment. The election results change these calculations somewhat, with the likelihood that tax deductibility on interest costs will be reinstated in the coming years.

A common rental property strategy

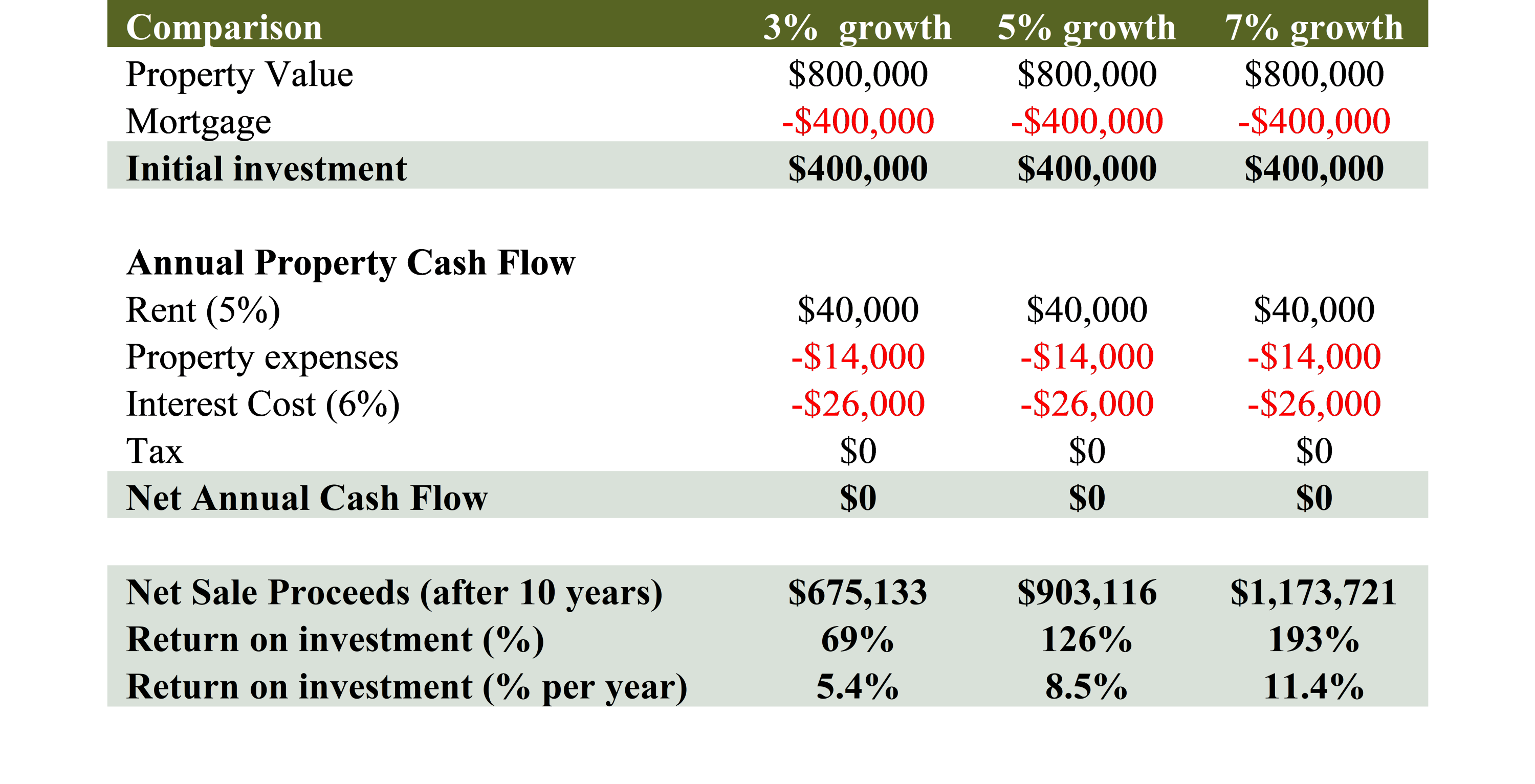

To see how the recent election might affect property owners, below is a common strategy for investing in rental property assuming interest deductibility:

- Purchase an investment property for $800k with $400k of your own money (a 50% deposit) and a $400k mortgage.

- Use the rental income to pay for operating expenses and interest costs.

- Pay no income tax on the property, because interest and expenses fully offset rental income leaving no taxable profit

- Your investment return becomes the (leveraged) house price growth.

We modelled this investment scenario under three house price growth assumptions, 3% per year, 5% per year, and 7% per year.

As the table highlights, with house price growth of 3%, you can achieve a (respectable) 69% return over a 10-year period. But at 7% growth, you can almost triple your initial investment!

What will be the future house price growth rate?

The (literal) million dollar question becomes at what rate will house prices grow?

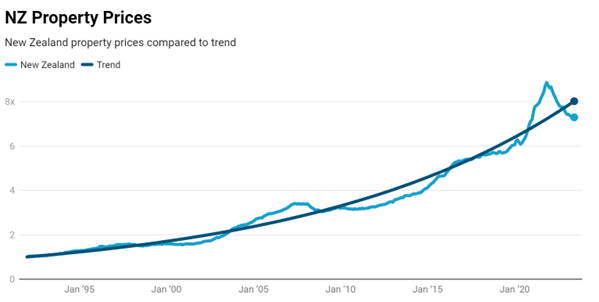

We see a number of growth predictions around 6%-7%, in line with historical price growth. At first glance this logic seems reasonable, there will be some short-term variability but over the long term the trend will continue:

But to use an extreme example, if I told you that Bitcoin had grown at 239% per year since it was created in 2009 and I was going to use this as a forecast for the future, you might agree that more analysis is required before extrapolating past price growth into the future.

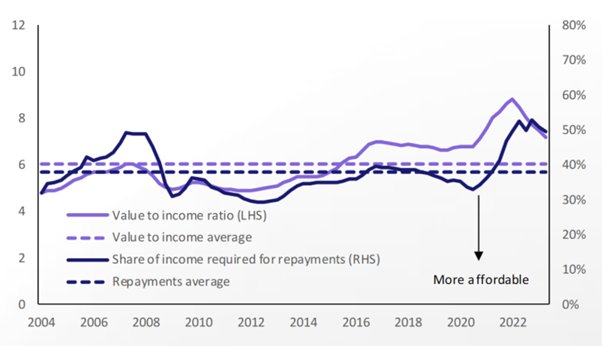

While house prices have grown at 6%-7%, household incomes have only grown at 3% - 4%. This means we’re spending a far larger percentage of our incomes on housing costs, currently approximately 50%, compared to a 20-year average of less than 40%.

This isn’t breaking news. It’s been an ongoing topic of discussion in this country for the past two decades but this level of growth isn’t sustainable.

We’re not predicting that house prices relative to incomes will revert to historic levels. There are structural issues with infrastructure investment not keeping up with population growth which means the NZ housing prices aren’t likely to revert to “affordable” levels in the foreseeable future.

However, the historic trend of house price growth far outpacing income growth, is unlikely to continue because it is simply unaffordable.

What’s a reasonable property growth assumption?

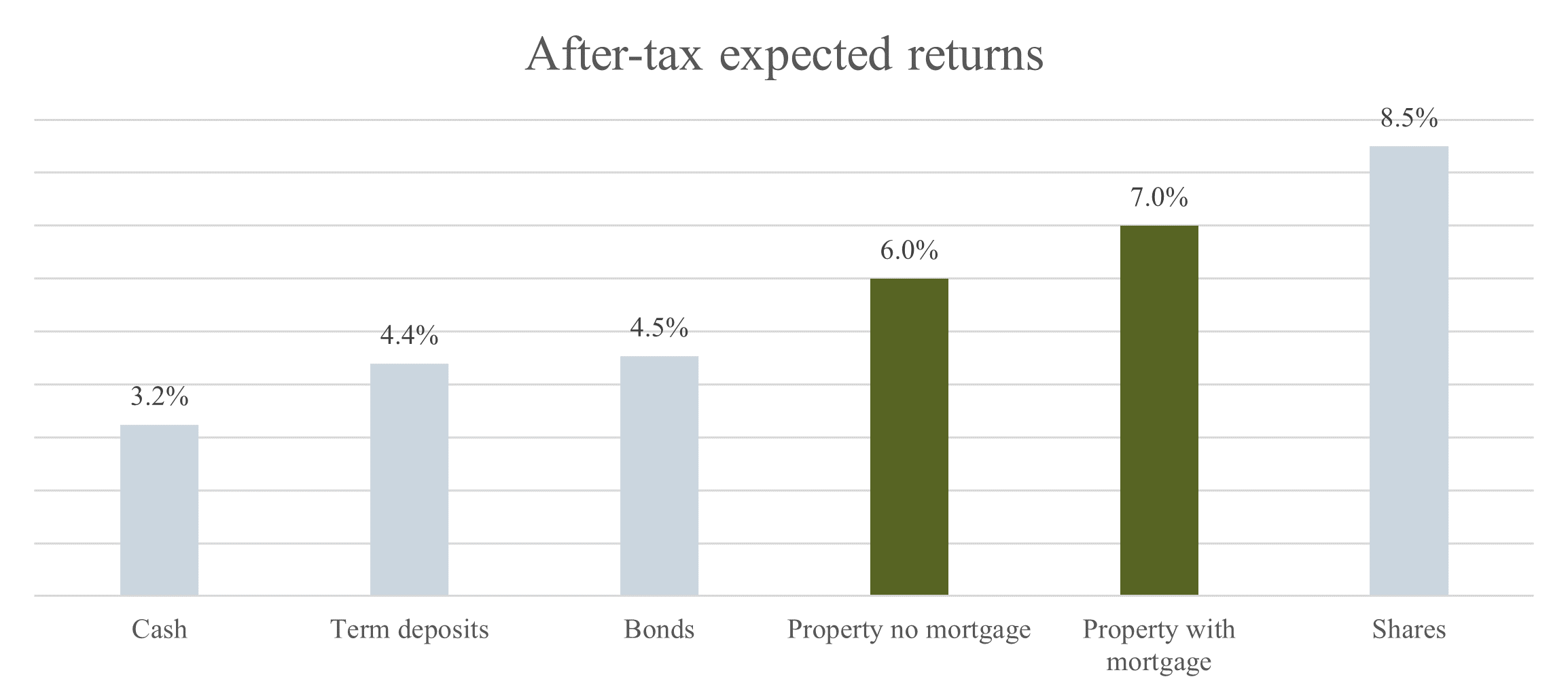

We’d suggest 4% (or between 3%-5%) per year, in line with income growth. Below we compare the expected return from property investment to other types of investment such as shares and bonds (given current interest rates).

The graph shows that property, either leveraged (with a mortgage) or unleveraged (no mortgage) still has the potential to offer attractive returns.

Like any investment, it comes with its own set of pros and cons:

|

Pros - Steady Income - Ability to borrow to fund the purchase |

Cons -Expensive to transact -Cannot partially sell for income - Tenant risk |

The election results will likely have a positive impact on property investor returns, however, property still isn't the slam dunk it was in the past and should just form a part of people's investment strategies going forward.