Market Update September 2021

By Mike Ross at Evergreen Advice

By Mike Ross at Evergreen Advice

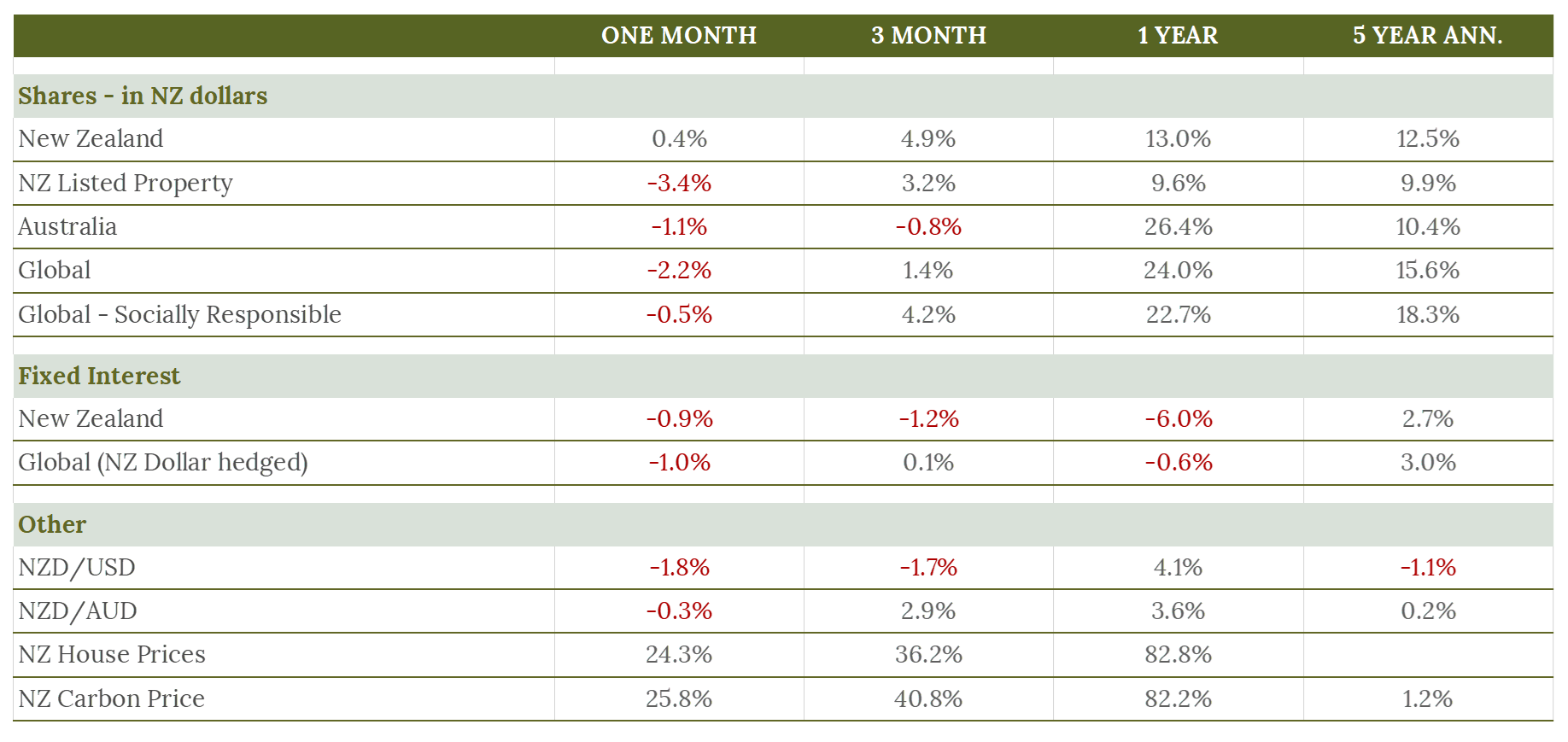

September has historically been a weak period for share markets, and this September continued the trend. In fact, both equity and bond markets delivered negative returns. The one bright spot was the New Zealand share market which had a slightly positive performance (+0.4%).

During the month, it was announced that the NZ economy had grown at 2.8% in the June quarter, well ahead of expectations. This could help explain the relatively strong performance of the NZ stock market during September. It also drove the negative performance of the New Zealand fixed interest market, as interest rates rose, and expectations that the Reserve Bank will hike the official cash rate were consolidated. These expectations became a reality when the Reserve Bank lifted the cash rate on 6 October from 0.25% to 0.50%.

Global share markets fell due to a growing list of factors that concerned investors. These included:

- slowing global growth,

- the potential default of major Chinese property developer Evergrande,

- a developing energy crisis in Europe and China that has seen oil and coal prices spike,

- global supply chain constraints,

- rising inflation, and a standoff between US legislators about raising the debt ceiling.

While this list looks intimidating, investors should keep in mind that there is always a list of risks. They do not tell us how markets will perform over the coming weeks and months. The risk of investing in shares is the reason that investors can achieve such strong returns over the long term. For the month, global shares returned -4.2%, though this was partially mitigated for NZ investors (unhedged) as the NZ dollar weakened.