Market Update October 2025

By Mike Ross

By Mike Ross

Global Share Markets

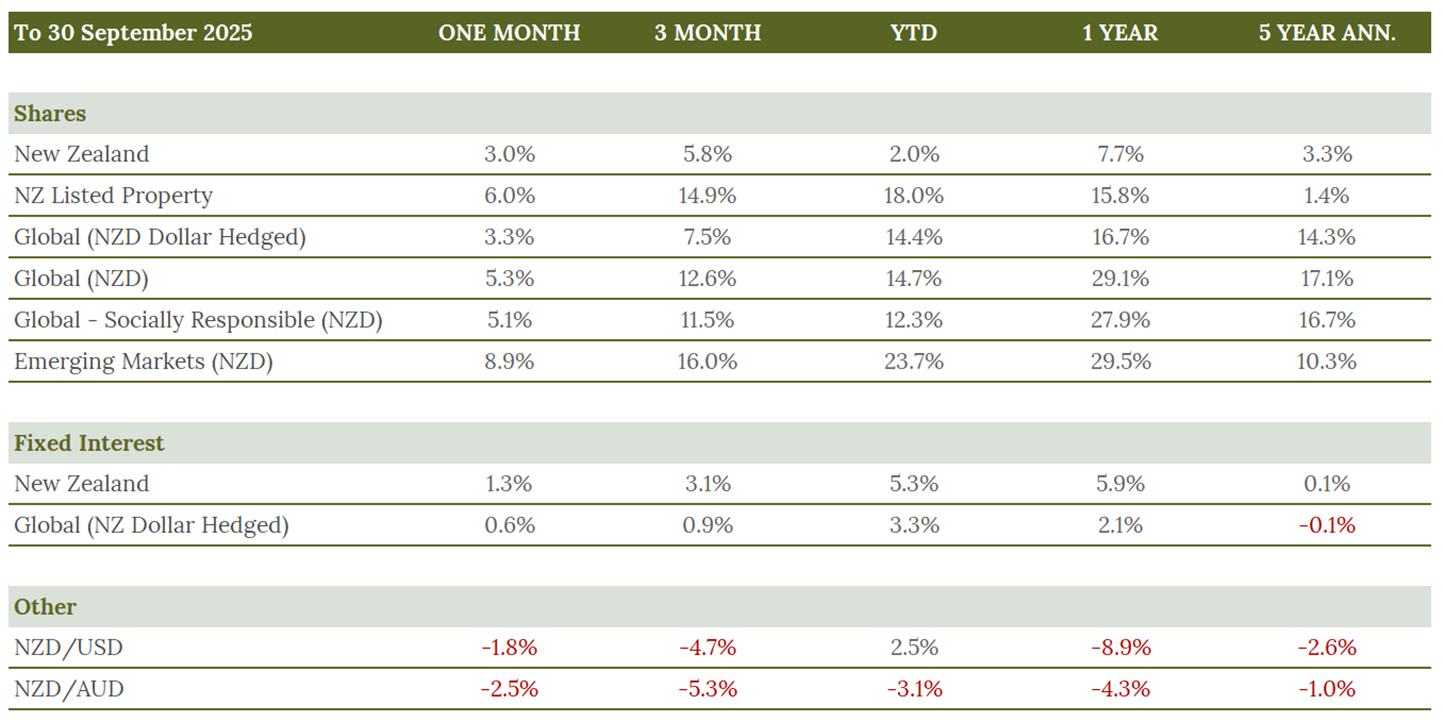

Global shares strong robust returns in September 2025, with hedged global shares rising 3.3% and unhedged exposures surging 5.3% in NZD terms. These gains were largely driven by the US Federal Reserve’s shift into a rate-cutting cycle, which sparked optimism for risk assets. The technology sector, particularly AI infrastructure and semiconductor stocks, provided leadership globally, supported further by resilient earnings. Despite this, concerns have begun to intensify over high valuations concentrated in mega-cap names and the sustainability of AI investment.

New Zealand Share Market

The NZ share market recorded a solid 3% gain for the month, and climbed 5.8% for the quarter, though year-to-date returns remain a modest 2%. June’s weaker GDP figure (-0.9%) reinforced prospects for further RBNZ rate cuts, boosting investor confidence as the equity market positions for recovery. Notably, listed property rebounded with a 6% monthly gain and 14.9% for the quarter. The market benefited from declining yields and renewed interest in dividend-paying and defensive stocks, with growing optimism that the NZ economy has moved beyond its weakest phase.

Bonds Markets

Bond markets delivered modest but positive gains in September: NZ fixed interest returned 1.3%, while global fixed interest (NZD-hedged) rose by 0.6%. The backdrop was shaped by dovish central bank signals and weaker global growth data, with rate cuts in NZ now increasingly priced for 2026. Although NZ bonds have achieved stronger year-to-date returns of 5.3%, their long-term annualised results remain subdued at 0.1% for local bonds and slightly negative for global fixed interest at -0.1%.

Outlook

Monetary policy has become more accommodating as global and local markets enter the fourth quarter. The US Federal Reserve's approach is boosting risk assets, though there are concerns about potential overheating in AI sectors. In NZ, easier monetary conditions, a stabilising property market, and strengthening business sentiment may bolster the market, while rate cuts are expected to help economic growth.