Market Update November 2024

By Mike Ross

By Mike Ross

Global Share Market

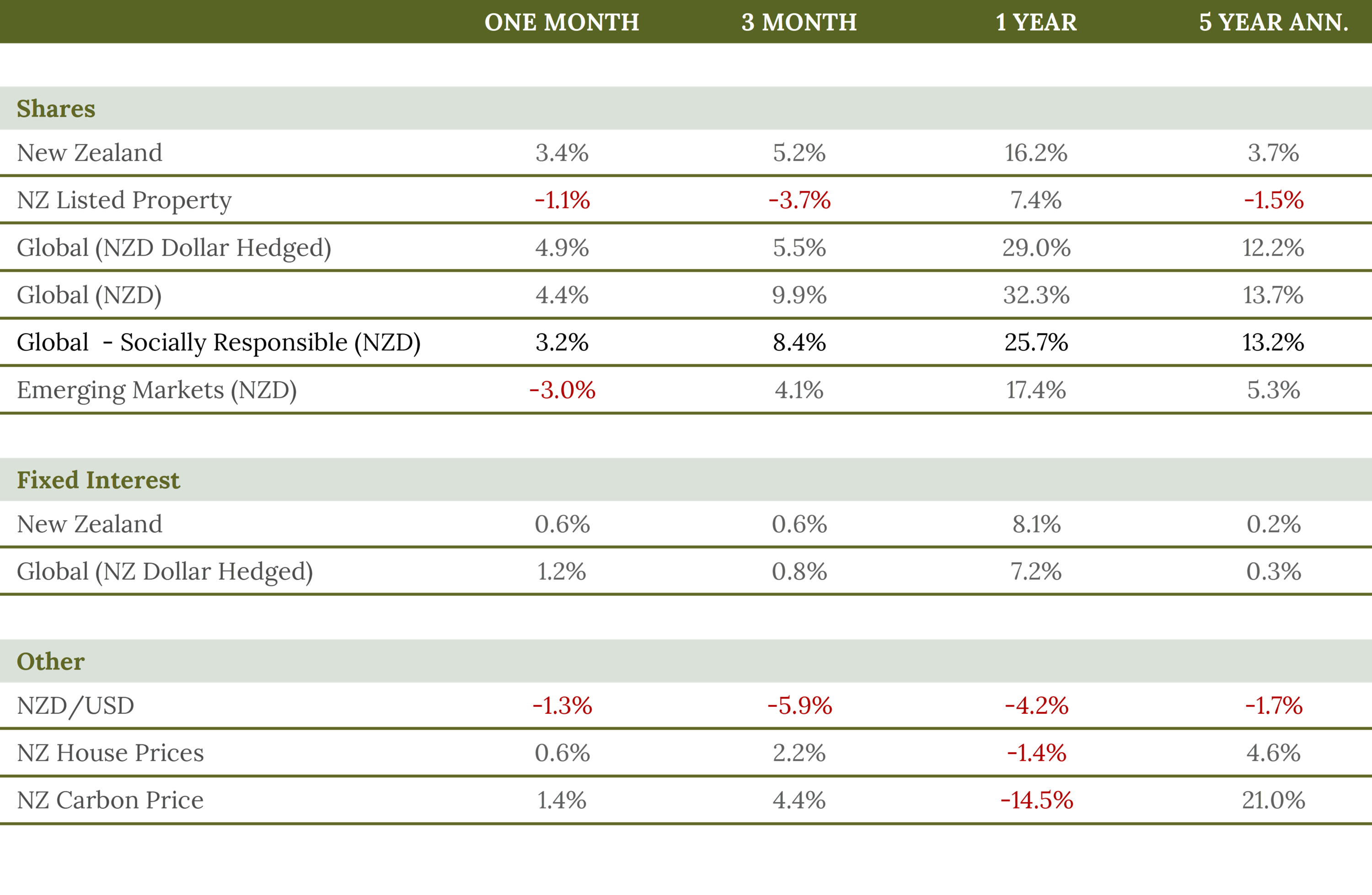

Global share markets delivered strong performance in November 2024, rising 4.4%. The S&P500 index (the main US stock market indicator) had an exceptional month, marking its best monthly performance of the year with an increase of 5.7%. This contributed to the S&P 500's year-to-date return to 26.5%, its best year since 1997!

New Zealand Share Market

The New Zealand stock market also had a strong November, gaining 3.4% for the month. The Australian market performed well, with the S&P/ASX 200 Index rising 3.8% (3.7% in NZD terms). This positive performance was supported by improved consumer confidence in New Zealand, which reached its highest level in over three years.

Fixed Interest

Bond markets showed positive results in November. NZ bonds gained 0.6%, reversing October's decline. Global bonds performed even better, returning 1.2% for the month. US 10-year government bond yields decreased by 12 basis points to end at 4.17%, while New Zealand 10-year yields dropped 10 basis points to finish at 4.38%. The Reserve Bank of New Zealand (RBNZ) cut the Official Cash Rate (OCR) by 50 basis points to 4.25%, with indications of another 50 basis point cut likely in February.

Outlook

Looking ahead, the global economic outlook remains cautiously optimistic but uncertain. Most analysts expect annual economic growth of around 3% for 2025, similar to 2024. The recent US presidential election results have fueled expectations of policy changes, but there is still uncertainty about domestic and foreign policy implications. In New Zealand, despite soft economic data, improved consumer and business confidence signals optimism for the future. The housing market is expected to respond to the approximately 120 basis point drop in mortgage rates since mid-year, although challenges such as moderating population growth and rising unemployment persist.