Market Update May 2025

By Mike Ross

By Mike Ross

Global Share Markets

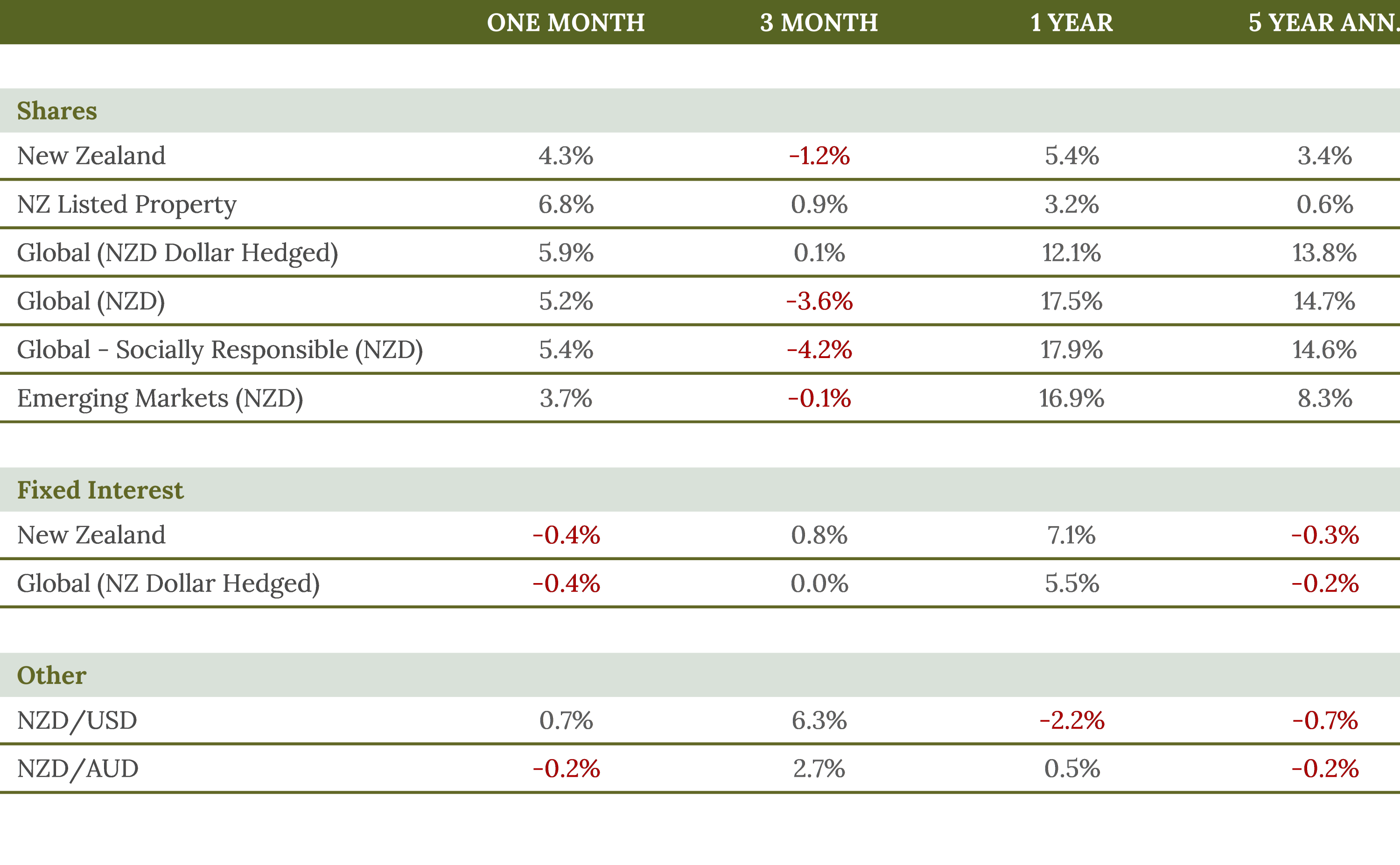

Global share markets delivered exceptional returns in May, with the recovery largely attributed to the relief rally following President Trump's announcement of a 90-day pause on additional tariffs in late April. Since reaching its lowest closing value on 8 April, when initial tariff announcements sent markets plummeting, global markets have rebounded approximately 18%. The postponement of steeper tariffs that were set to impact around 80 countries has notably mitigated recession concerns, reducing the likelihood of a US recession in 2025 considerably. Nevertheless, trade tensions persist as governments continue to negotiate tariff rates and exemption policies, resulting in ongoing uncertainty despite the current rally.

New Zealand Share Market

The NZ share market partook in the global rally, yielding a 4.3% return in May. NZ Listed Property outperformed with a 6.8% monthly return, although its 12-month performance remains modest at 3.2%. Within local markets, Fisher & Paykel Healthcare, Infratil, and Mainfreight reported positive results, while Sky City and Fletcher Building continued to underperform. The Commerce Commission announced the approval of Contact Energy’s acquisition of Manawa Energy, leading to an increase in the share price of the latter.

Bond Markets

Bond markets experienced challenges in May, with both NZ and global (NZD hedged) fixed interest indices posting -0.4% returns for the month. The decline reflects mounting concerns about US government debt. Thirty-year Treasury yields have risen above 5%, their highest level since 2007, driven by apprehension that Trump's proposed tax plan could increase the deficit by an estimated $4 trillion over the next decade. This increasing government debt burden is causing contagion effects across global bond markets, as borrowing costs in many countries move in tandem with US treasuries. Despite the monthly decline, NZ bonds have returned 7.1% over the year, while global bonds (NZD hedged) are up 5.5%.