Market Update May 2023

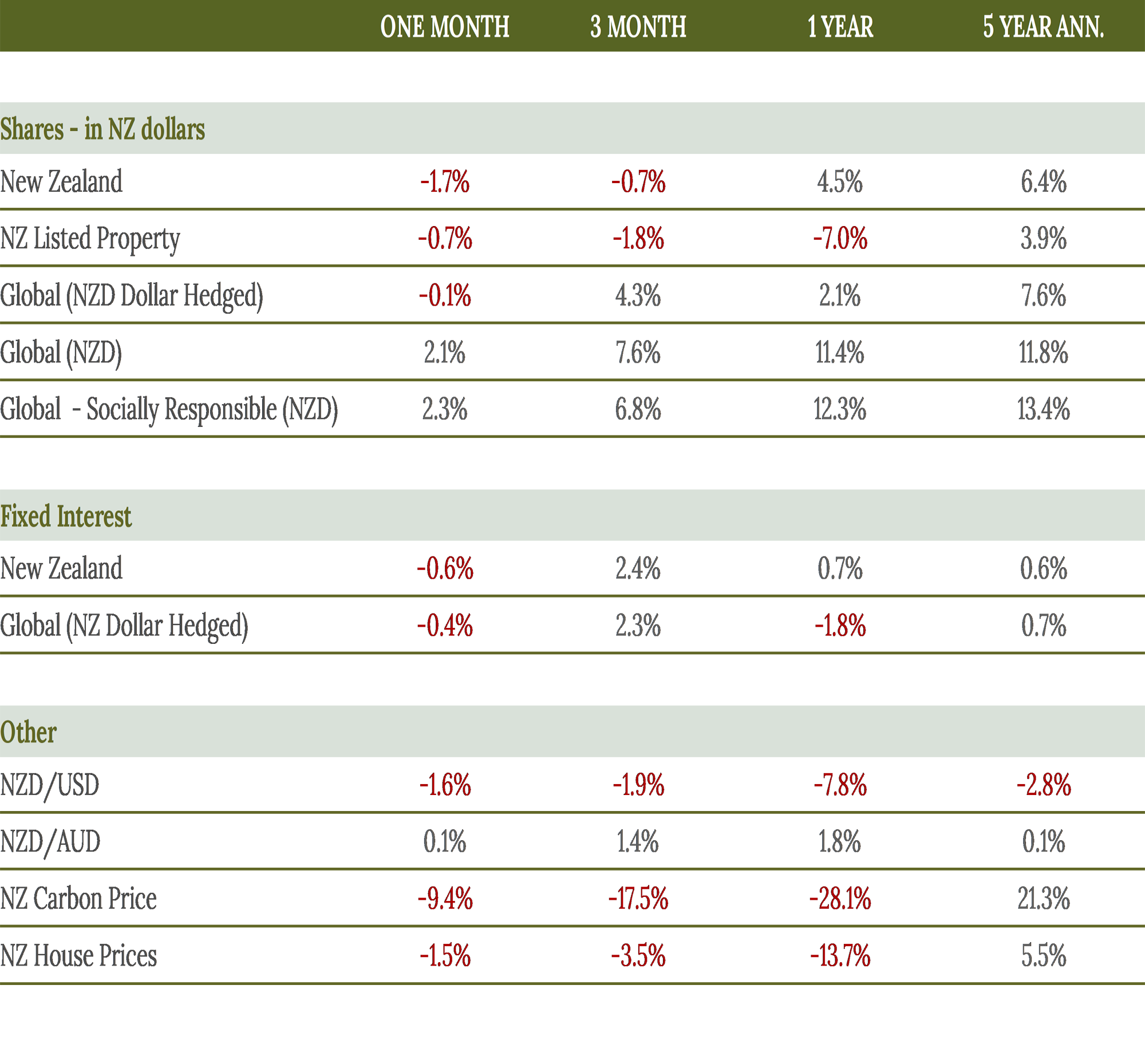

Global share markets were relatively flat during the month of May. Concerns over US banking stress, debt ceiling issues, and mixed economic data have contributed to the uncertain economic outlook. However, the IT sector continued its strong start to the year, driven by businesses likely to benefit from the AI boom. New Zealand-based investors benefited from a (further) weakening in the New Zealand dollar.

The New Zealand share market had a negative month, falling -1.7%. Many companies reported earnings results during the month, with many companies' management generally cautious about the outlook for the economy.

The New Zealand bond market also fell as the RBNZ lifted the Official Cash Rate to 5.5%. Commentators expect this was the final rate hike the RBNZ will make this cycle, although there is still a risk that persistent inflation will necessitate another rate increase.

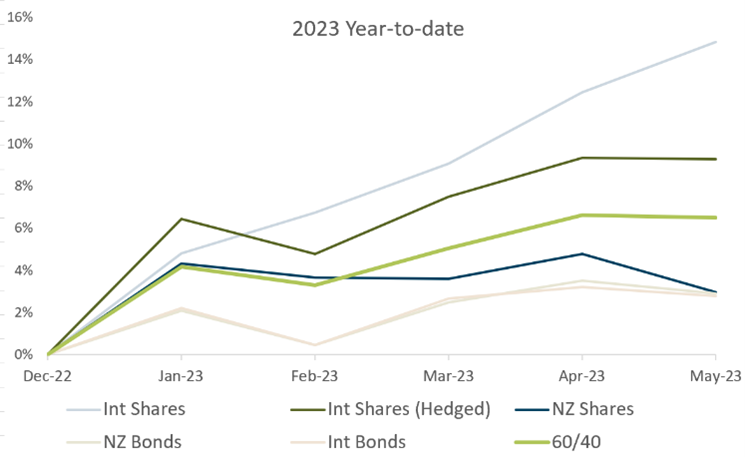

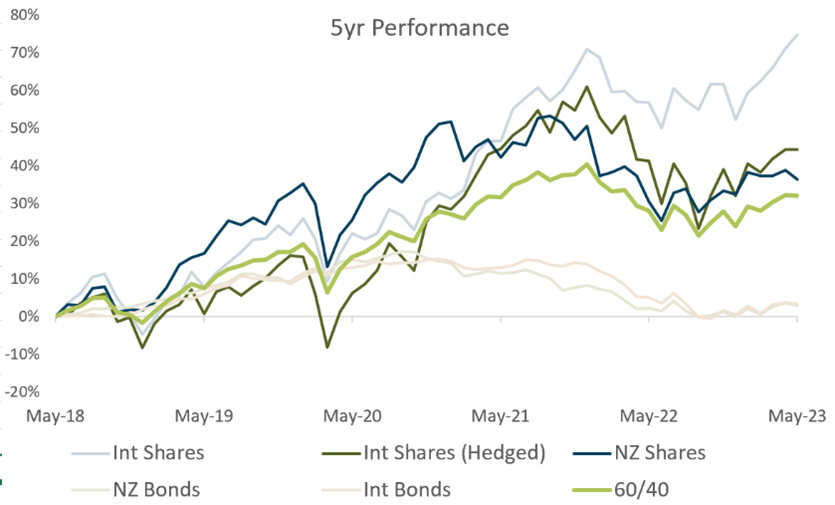

Bad news makes for better headlines than good, and so often dominates the economic news cycle. As investors, it is important to keep things in perspective. As the graphs below show, it has been a positive start to the year, and the past five years have delivered strong returns too, despite featuring a pandemic and a sharp rise in interest rates.

* 60/40 shows the performance of a ‘Balanced’ portfolio with 60% shares and 40% bonds.