Market Update May 2022

By Mike Ross at Evergreen Advice

By Mike Ross at Evergreen Advice

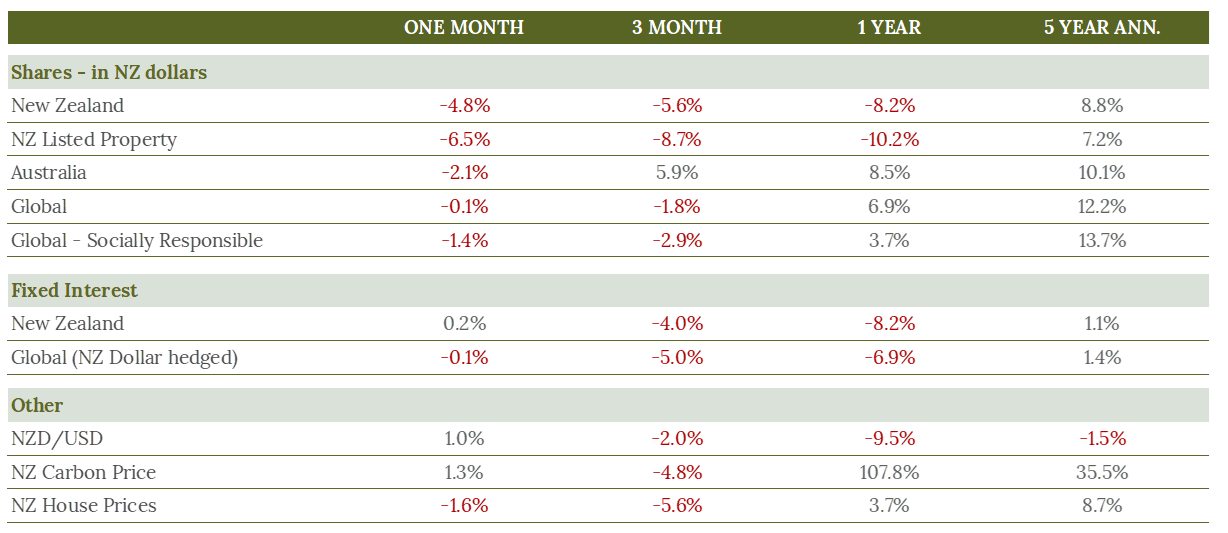

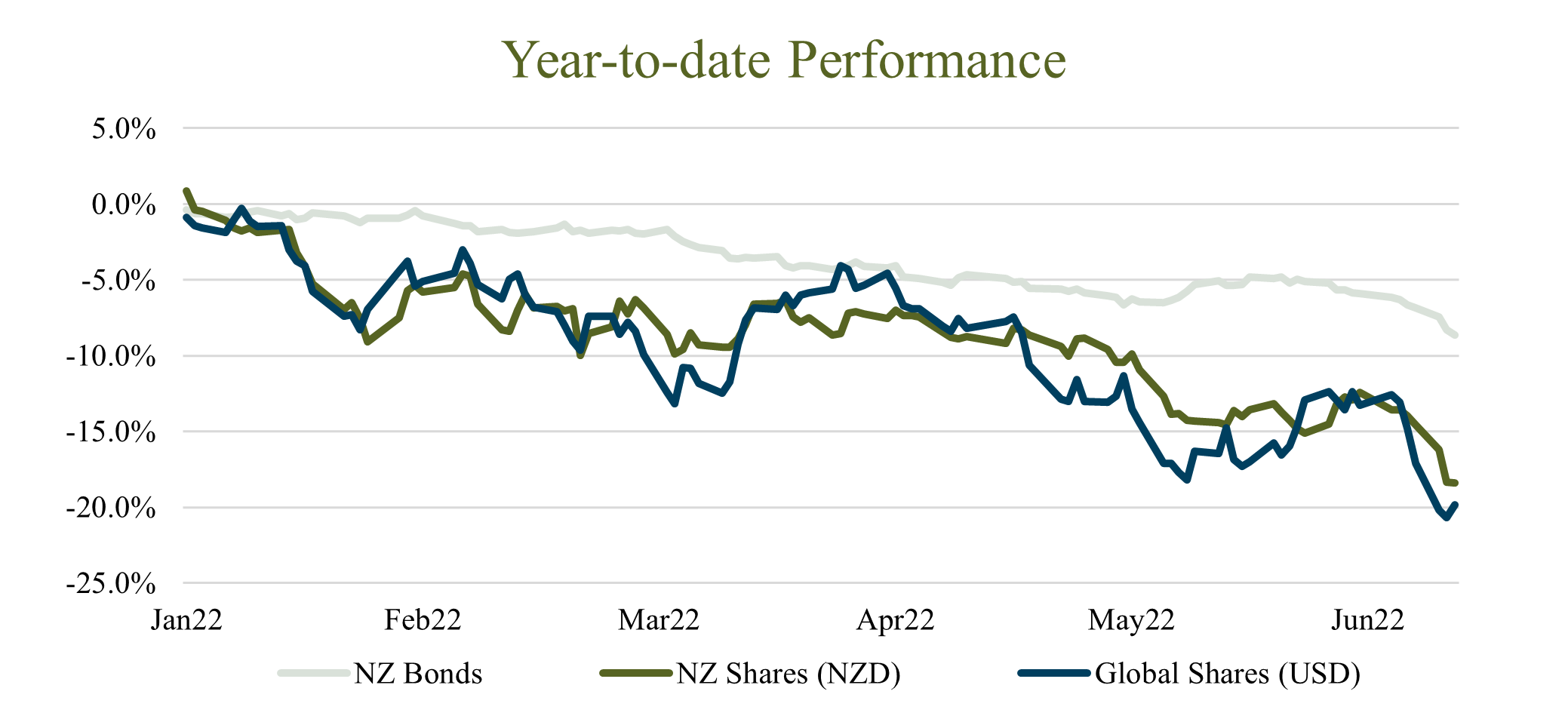

May was another challenging month for investment markets. New Zealand shares were down -4.8%, though global shares (-0.1%) rallied late in the month to almost fully recover their losses. In June shares have continued their steep decline in reaction to continued high inflation, rising interest rates and concern that we could be headed for a recession. Share markets have now officially entered ‘Bear Market’ territory, defined by a 20% fall from the market’s recent peak. Bonds markets have also fallen again in June in response to rising interest rates and are now down more than 10% from their peaks in 2021.

To highlight just how challenging the market environment is, the usually unflappable NZ housing market has also fallen from its high in late 2021. The most recent data published by the Real Estate Institute shows that house prices have fallen -8% nationwide. There have been larger declines in major cities such as Auckland (-12%) and Wellington (-13%), with the potential for further declines to come across the country as mortgage rates continue to increase.

We won’t even begin to comment on the state of the cryptocurrency market at the moment….

There’s no doubt that 2022 has been a difficult time to be an investor, with all major asset classes falling significantly. Even if you had some of your money in cash, its value is going down given how high inflation has been. We know we sound like a broken record, but our recommendations remain consistent:

You must take the downs if you want the ups, stick with the plan

Over the long-term shares have delivered 8% to 10% per year. After accounting for fees and taxes, this means you can double your investment on average every 10 years. This is well in excess of other investment options such as term deposits.

The price you must pay for these higher returns is volatility – you have to accept that your investments will fall in value, sometimes significantly. No one can successfully predict what the share market will do over the coming days, weeks or months and so there is no way to avoid it. Selling shares when markets are going down often leads to investors missing the market recovery and therefore not achieving the 8% to 10% long-term returns that shares can provide.

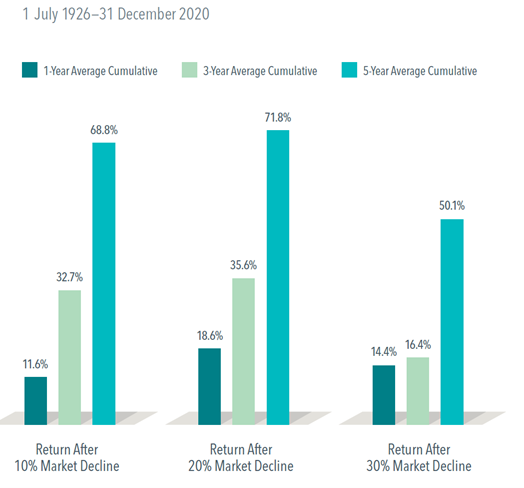

Bear markets often precede strong recoveries

We know it can be hard to see fast, sharp portfolio declines. When shares fall it feels like they’re going to continue falling. If they fall 10%, surely they are going to keep plummeting…until they don’t. The graph below from fund manager Dimensional shows the average performance of the (US) stock market after material market declines, highlighting the potential returns ahead. We don’t know when the markets will recover, but we’re confident that investors who stay invested and stick to their plan will reap the benefits in time.