Market Update July 2025

By Mike Ross

By Mike Ross

Global Share Markets

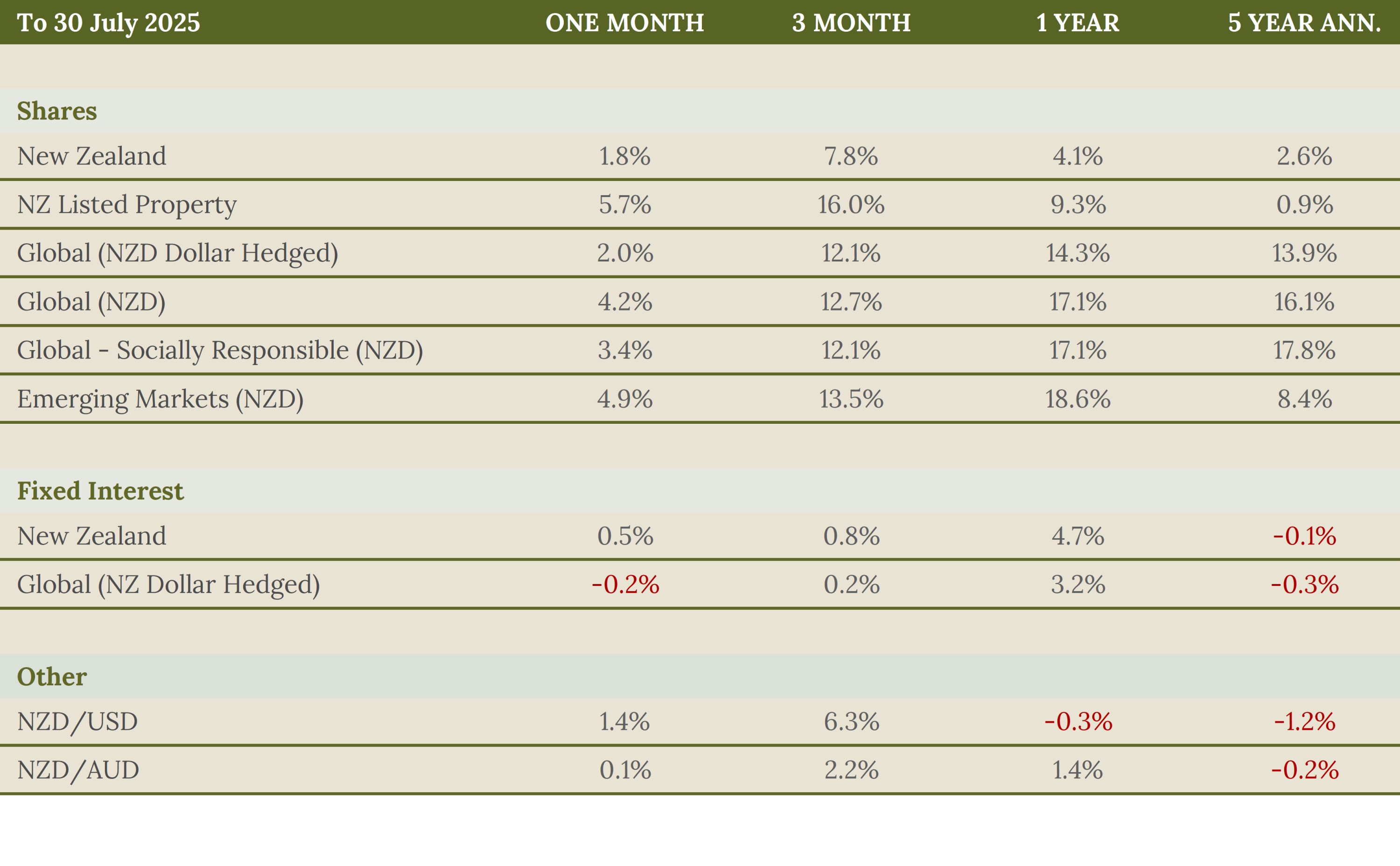

Global equities delivered another strong month in July, with the MSCI World Index up 4.2% in NZD terms and 2.0% on a currency-hedged basis. Emerging markets outperformed, rising 4.9% for the month and 18.6% over the year, boosted by strong Chinese data and a rebound in the Hang Seng Index. Technology and AI sectors, especially in the US, continued to drive gains globally with strong earnings and efficiencies.

NZ Share Market

The NZ market gained 1.8% in July, contributing to a 4.1% over the year. Property stocks led with a 5.7% monthly and 9.3% annual return, helped by easing bond yields and strong investor appetite in real assets. Defensive sectors like utilities, consumer staples, and aged care (Summerset and Ryman) outperformed, while cyclical stocks lagged due to weak domestic demand.

Bond Markets

Bond markets delivered mixed returns in July. NZ fixed interest rose 0.5%, with a stable RBNZ monetary policy which kept the cash rate at 3.25% while signalling an easing bias. Inflation figures surprised on the downside, reinforcing expectations of potential cuts later in the year. Global fixed interest fell -0.2% for the month but remained in positive territory over the year (+3.2%). Global yields (long-term interest rates) were pressured higher by rising US Treasury yields and concerns over fiscal sustainability, leading to steeper yield curves. Longer-term maturity NZ bonds now seem attractive with the potential for capital gains if rate cuts materialise.

Outlook

The outlook is mixed, with optimism tempered by caution. While strong earnings in key sectors and favourable monetary policy support equity markets, high valuations, speculative activity, and macro risks, such as tariffs and inflation, could lead to volatility, especially if cost pressures affect corporate earnings forecasts.