Market Update July 2022

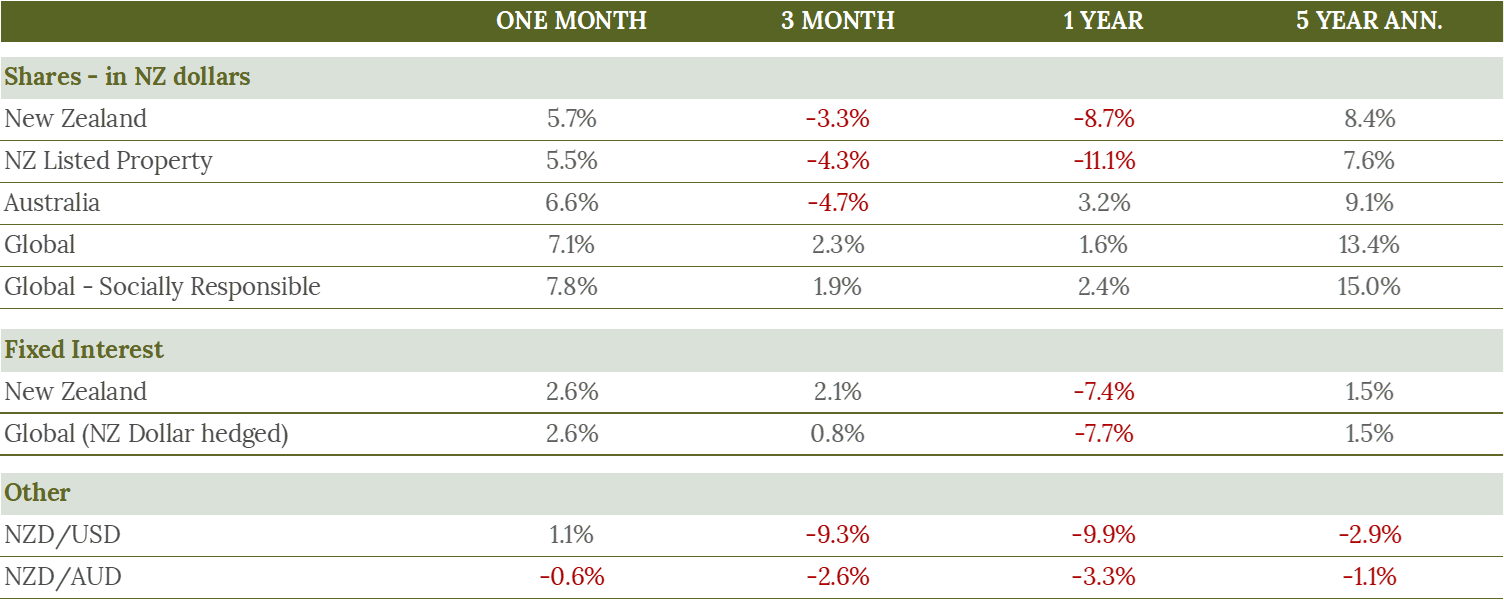

Markets bounced in July with all asset classes, from shares to fixed interest, generating positive performance. This was a welcome reprieve from the prior six months of negative performance.

This rally is due to the slight reduction in interest rate rise expectations, and better-than-expected earnings results from the annual general meetings that companies hold in July. This month also saw a large sector rotation out of value stocks and back into growth stocks which had been hard hit in the first half of the year.

High inflation is no longer the primary concern in financial markets due to slowing global growth. In Q2, the US GDP shrank for the second straight quarter. Given the continued strength of the labour market (almost 3 million jobs were gained in the first half of the year), this is unlikely to qualify as a recession, however forwards activity indications have gotten worse which raises concerns about if the economy is turning.

The question this raises is was July the start of a sustained recovery in share markets? Or was it a slight upturn before a further decline? The truth is no one knows the answer to this despite the many predictions you will hear, so your investment strategy shouldn’t be based around guessing which way the market will move next.

For a more detailed market review see this article from one of our fund managers, Harbour Asset Management.