Market Update January 2025

By Mike Ross

By Mike Ross

Global Share Market

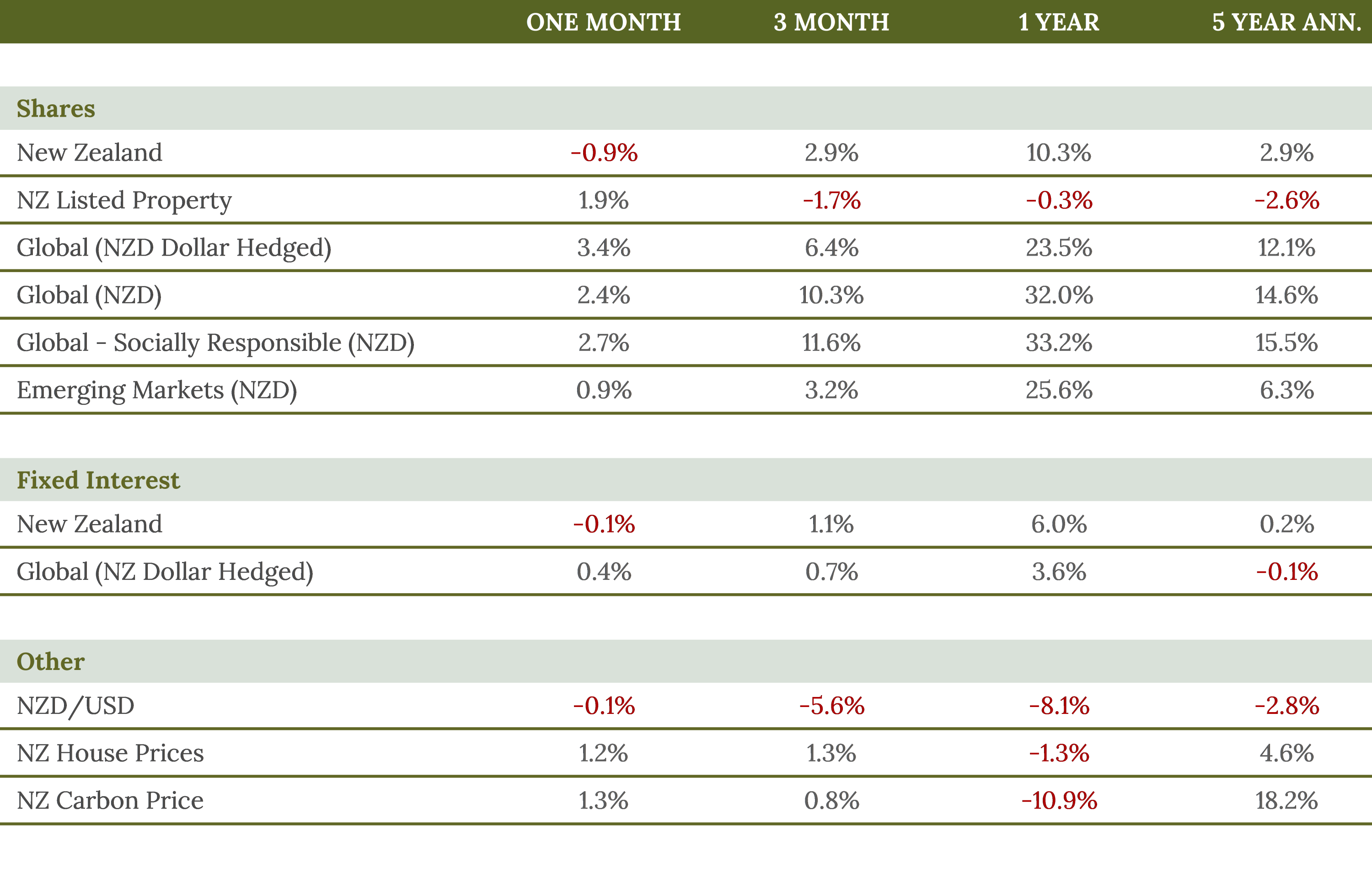

Global equity markets have started 2025 on a volatile note, with President Trump’s return to the White House introducing fresh uncertainty. Global equities remain resilient, returning 3.4% for the month. Health Care (+6.8%), Communication Services (+9.1%), and Financials (+6.5%) leading the gains amid resilient economic data, more than offset the fall in the Information Technology sector (-2.9%) due to a DeepSeek-driven sell-off .

New Zealand Share Market

The New Zealand share market decline of 0.9% in January, though the market remains up 10.3% over the past year as falling interest rates and robust corporate fundamentals support investor sentiment. An important drive of the NZ market going forward will be the performance of its largest stock, Fisher & Paykel Healthcare. It fell -1.5% in January, and has fallen a further 6% in January. The company has significant manufacturing operations in Mexico and will be directly affected by US tariffs.

Bond Market

Bond markets have been mixed as central banks navigate inflationary pressures and economic uncertainties. New Zealand bonds posted modest returns of -0.1% in January but remain up 6% over the past year due to falling local interest rates and expectations of further RBNZ rate cuts. Global bonds (NZD Hedged) gained 0.4% in January and returned 3.6% over the last year, reflecting cautious optimism amid geopolitical risks and tighter monetary policy in major economies. In the US, the Federal Reserve has maintained its policy rate above neutral as inflation progress has stalled, with Chair Powell emphasizing patience before further rate adjustments

Outlook

Volatility is expected to remain a central theme for financial markets in 2025 as investors react President Trump’s tariff policies. Higher tariffs could pressure global growth and corporate earnings while fueling inflationary pressures, particularly in sectors reliant on imports like retail and manufacturing. Domestically, New Zealand’s economy is poised to benefit from lower interest rates but faces challenges from rising unemployment and slowing wage growth