Market Update January 2024

The US economy has continued to be an outperformer in the month of January as its economic strength grew. This is due to the continued view that the US Federal Reservice might have successfully created a ‘soft-landing’ for the US economy (i.e. inflation coming back under control without unduly impacting the wider economy ). Increased hopes for this goldilocks scenario, which is vastly more preferable than the economy slumping into recession, saw share prices continue to climb.

The US January labour market reports also helps to explain consumer optimism with significant job gains, no change to unemployment and an increase in wage growth.

In contrast, the New Zealand share market saw more modest returns adding 0.9% for the month.

Bond markets experienced mild negativity in January, with both local and global bond indices posting losses. Looking ahead, the outlook for bond markets remains slightly uncertain, influenced by factors such as inflationary pressures and central bank policies.

Overall, while global share markets began the year positively, concerns over inflation and central bank policies have introduced some uncertainty into the outlook. In New Zealand, economic data indicating a slowdown in activity has prompted a cautious approach from the RBNZ, with a focus on managing inflationary pressures. As markets await further economic indicators and central bank decisions we will see where the rest of 2024 heads.

New Zealand housing comment from Harbour Asset Management

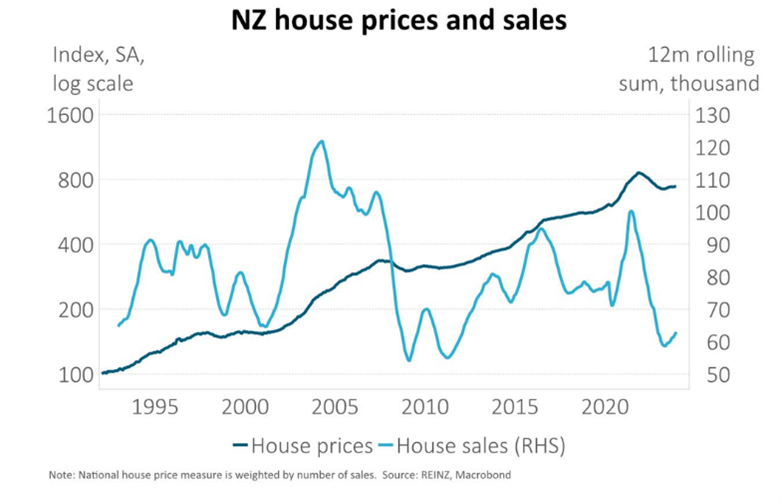

Despite historically high rates of net migration, December data suggest a stabilisation in housing market activity, rather than acceleration. After falling 16% between November 2021 and April 2023, New Zealand house prices have lifted just 2% in the past 7 months and sales have remained well below average. Most economists, however, expect migration to eventually support an increase in house prices over the coming year and more than offset the negative impact of rising unemployment. It’s also likely that the new National-led Government’s housing policies will encourage a recovery in house prices and activity.

The RBNZ, for example, forecasts a 5% increase in house prices this year and a 16% increase over the next three years. These numbers seem reasonable as they are broadly in line with the RBNZ’s forecast for average hourly earnings over the next three years, implying that houses don’t become more expensive on a house price-to-income basis.

Annual house price gains of more than 5% are harder to justify, however. The economy is stagnating, and unemployment is likely to rise meaningfully this year. Houses are extremely expensive for a new borrower, requiring c.60% of household disposable income to service an average mortgage. For existing borrowers, half of all outstanding mortgages will roll on to higher rates this year.