Market Update January 2022

By Mike Ross at Evergreen Advice.

By Mike Ross at Evergreen Advice.

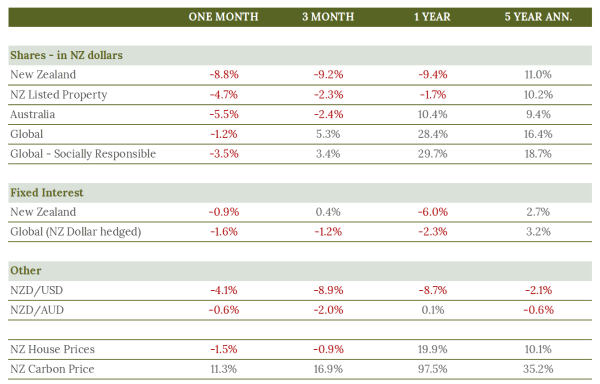

It was a rough start to the year for investors as markets fell heavily in January. At their low point, global shares were down approximately -8%, though they recovered in the second half of the month to be down just -4.9% by month-end. The pain was mitigated for local investors who benefited from a weakening NZ dollar resulting in global shares falling just -1.2% in New Zealand dollars.

The New Zealand share market was one of the worst performing (developed) share markets, falling -8.8% in the month of January. A key drag on the local market was the retirement village sector with Ryman Healthcare the worst hit, falling -19.2% in reaction to a potentially slowing housing market.

Both local and global fixed interest investments also had negative returns for the month, following on from a challenging 2021.

Why did the market fall?

The fall in both share and fixed interest markets was catalysed by rising interest rate expectations, as central banks around the world are forced to respond to inflation numbers not seen since the early 1980s. US inflation has been 7.5% over the past 12 months, the highest print in 40 years. New Zealand inflation rose 5.9% in 2021, the highest rate in more than 31 years. Because of these high inflation rates the US federal reserve is now expected to raise rates five times (or by 1.25%) during 2022, while the market expects that RBNZ to raise rates seven times this year.

Interest rates are a key driver of returns on all assets. In equities interest rates affect businesses and their share price in various ways:

- Many companies use debt. If interest rates go up, so do their mortgage costs, reducing the company’s profitability.

- Companies that pay dividends can become less attractive when interest rates go up – if an investor can get an increased return by putting money in a savings account or term deposit, they are less likely to want to take on risk by investing in shares for income.

- Technology stocks tend to have high valuations based on expectations of strong growth and future profits. As interest rates increase, investors demand a higher return on all investments, and this has a magnified effect on growth stocks that are valued based on the growth of their long-dated future profits. This played out in January when one of the hardest hit sectors in the stock market was Information Technology, which fell -8.3%.

For bonds, their price falls when interest rates rise which explains why bonds have delivered negative returns over the past month and year. To illustrate why using a simplistic example, if a bond is issued in 2021 with an interest rate of 2% it’s worth less if interest rates have risen and there are new bonds coming to market at 3%.

It's also important to note that interest rates don’t need to actually rise in order to affect markets. There just needs to be an expectation for them to rise. Like always the stock market is forward looking and so while neither the US nor NZ actually raised rates in January, the expectation that they will drove a volatile month.