Market Update February 2025

By Mike Ross

By Mike Ross

Global Share Market

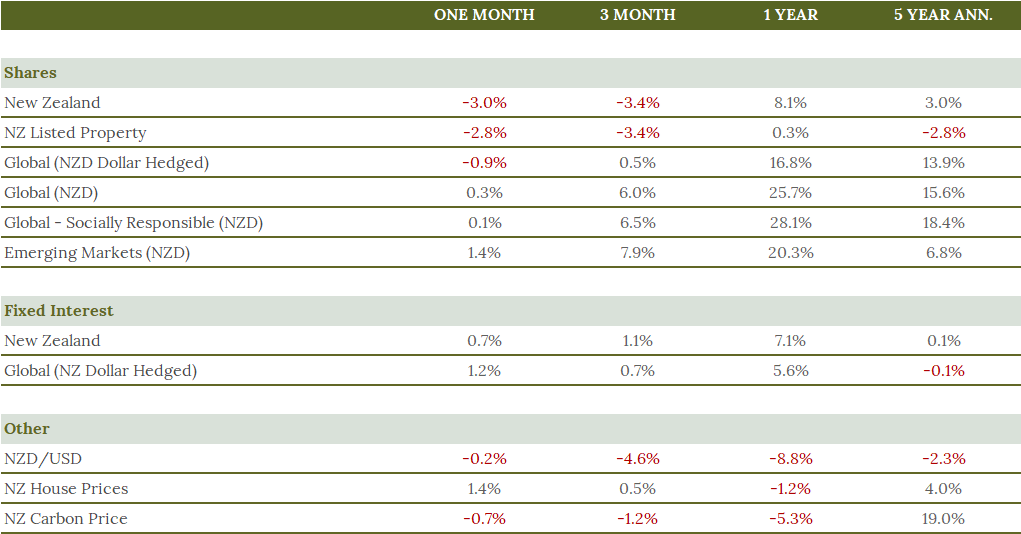

Global share markets exhibited mixed performance in February 2025. Developed markets experienced a slight downturn, while emerging markets demonstrated greater resilience. Overall, global shares declined by 0.7%, primarily due to the subdued performance of US equities, particularly within the tech sector, where policy uncertainty remained a concern. Contrary to this trend, emerging markets advanced, with the MSCI Emerging Market Index rising by 0.5%, driven by a robust rally in Chinese stocks which surged by 11.7% in dollar terms.

New Zealand Share Market

The NZ share market encountered challenges in February, with the S&P/NZX 50 Index declining by 3%. The domestic earnings season was generally weak, reflecting the headwinds faced by NZ companies. Telco Spark downgraded its earnings expectations for the fourth time in less than a year, resulting in a decline of over 20% in value. Spark’s value has now dropped by more than 60% from its peak approximately two years ago. Retirement village provider Ryman Healthcare announced a plan to raise $1 billion in equity to reduce debt amid slowing sales. Ryman shares fell by 30% during the month. Although some positive results were reported, including a stand-out performance by A2 Milk, these were insufficient to counterbalance the overall decline.

Fixed Interest

Global bond markets acted as an effective hedge against equity losses in February, serving as valuable diversifiers. Despite persistent inflationary signals arising from tariffs and unexpectedly sticky inflation data, bond markets responded positively to concerns about US growth and sentiment. Treasury yields decreased throughout the month, yielding positive returns for fixed income assets. The Bloomberg Global Aggregate Index gained 1.4% in February, demonstrating the importance of multi-asset diversification strategies. This indicates a continued expectation of central bank easing, potentially marking an inflection point for fixed income following a period of rising rates.