Market Update February 2024

By Mike Ross

By Mike Ross

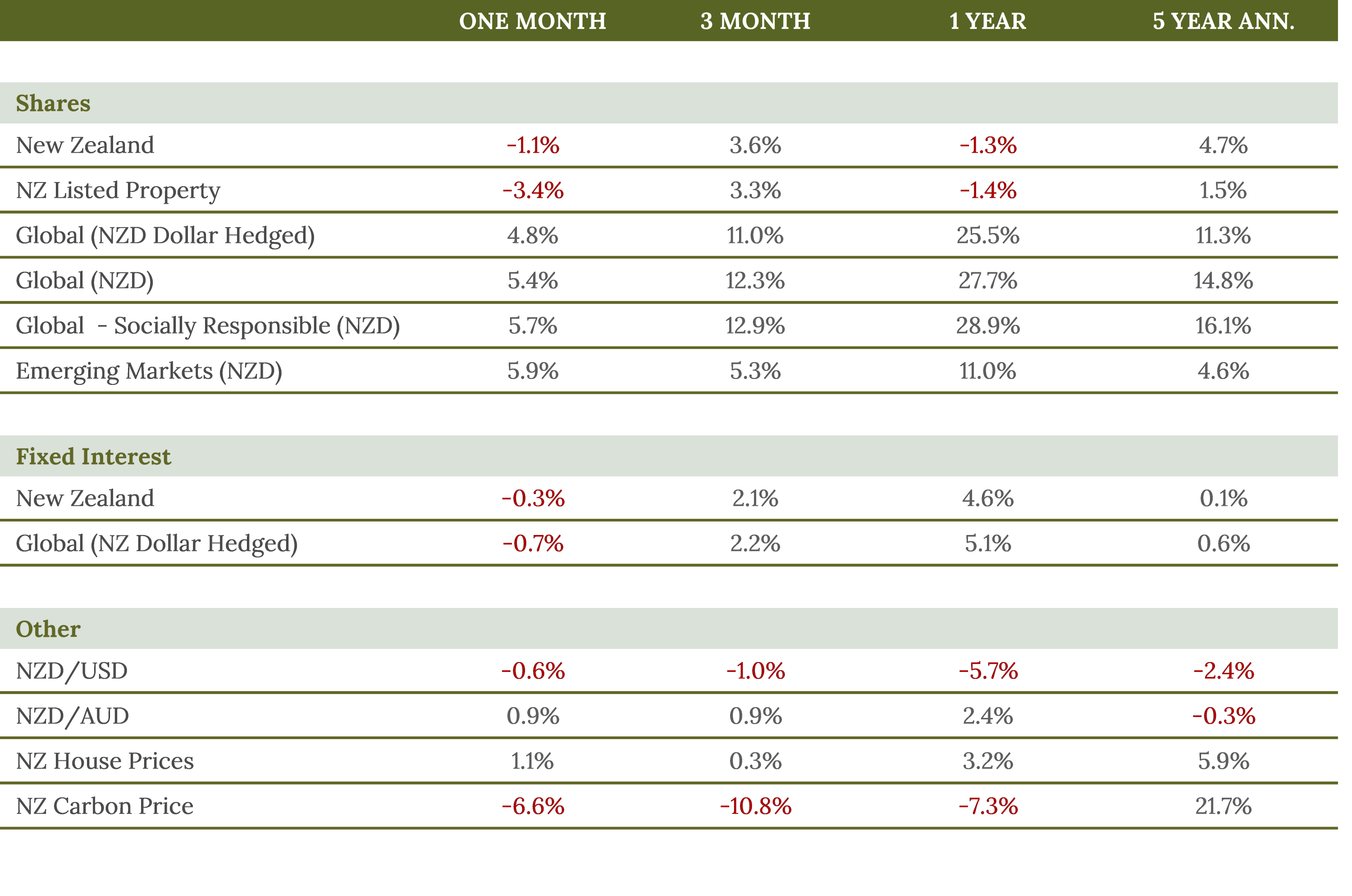

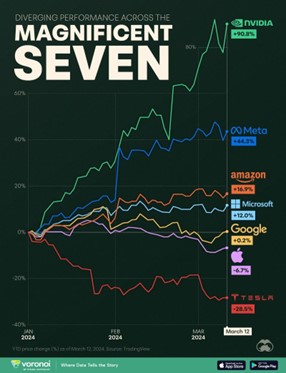

In February 2024, global share markets continued their positive momentum, returning 5.4%. Sector performance was predominantly positive, with consumer discretionary and information technology leading the way. Chip maker Nvidia, who is benefiting from the stellar growth in AI, led the way once again returning 26%, making up for negative returns from the likes of Tesla and Apple. Emerging markets also had a strong month, returning 5.9%.

Despite this global trend, the New Zealand share market fell, down -1.1%. This was due to a weaker-than-expected earnings reporting season, marked by profit downgrades from key companies like Air New Zealand, Fletcher Building, and Ryman.

NZ bonds fell by -0.2%, while global bonds lost -0.7% as a results of interest rate rises. The 10-year government bond yields in the US saw a slight increase, reaching 4.3%.

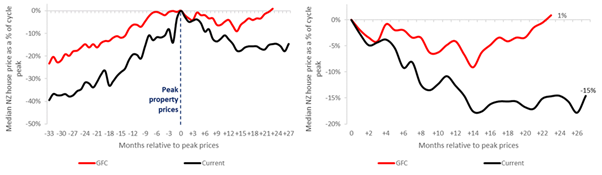

The NZ economy has fallen into a technical recession (again). The local share market fell in February and is still down on a one-year basis when global markets are up more than 25%. And even the New Zealand housing market, which had been expected to bounce back strongly this year, is just treading water. While house prices have recovered somewhat over the past 6-12 months, sales volumes are significantly down on historic levels, while house listings are at record highs. The analysis below from Craigs Investment Partners:

The two charts below illustrate the current trajectory of house prices relative to the GFC – around August 2008 house prices appeared to have bottomed but the rally couldn’t sustain itself and a “double dip” occurred less than 6 months later. The probability of another “double dip” scenario in 2024 is real given the weak liquidity in the housing market – prices need to fall in the short term for inventory to clear.

Of course, the quid pro quo for the current dire state of the market is that the Official Cash Rate is likely to fall sooner rather than later – market consensus is currently for two OCR cuts (5.5% c5%) by November. However, it may not take this long for homeowners and investors to see some relief – the unemployment and CPI prints in early August for 1HCY24 will be critical in this respect and could see the RBNZ cutting soon thereafter (even before the GDP print)….in the meantime be wary of the double dip scenario.

New Zealand is currently doing it tough, which is a timely reminder of the benefits of investing globally.