Market Update February 2022

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

Shares

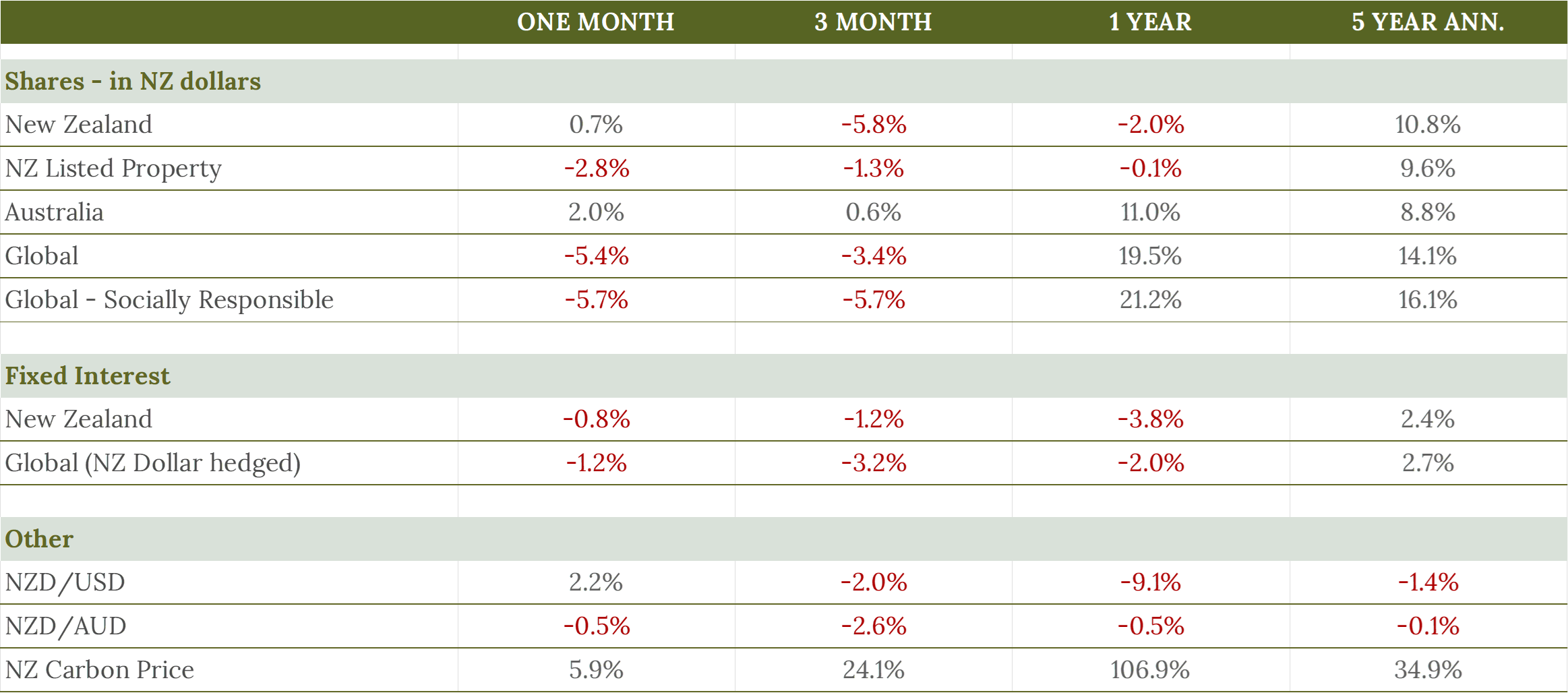

February continued the rough start to 2022 for global share markets which closed out the month down -5.4%. Markets started February in positive territory but turned downward as fears that Russia would invade Ukraine became a reality. Inflation is currently a key concern for investors and the war in Ukraine will exacerbate inflationary pressures given Russia is a major oil producer. The oil price spiked to more than $130 per barrel, a level not seen since 2008, as the war put further stress on an already tight European gas market. There was some good news during the month as global economic data improved and Omicron cases globally declined, though this was relegated to being just a footnote against the Russian invasion.

The New Zealand share market also had a volatile month although it managed to end February up 0.8%. Many companies report earnings in February and results were generally positive, with Meridian (+14.6%) and Spark (+4.0%) results well received by investors. This is despite the widespread rise in Omnicron cases during the month which once again shows that share markets are forward-looking and seem to have expected this level of outbreak.

Bonds

In times of uncertainty bonds often have positive returns as investors seek safer, more stable assets. In February this was not the case as bond investors focused more on the persistent, high inflation and the central banks raising rates, rather than the war in Ukraine. This caused a negative return in both NZ (-0.8%) and Global (-1.3%) fixed interest markets.

The Reserve Bank of New Zealand (RBNZ) again increased the Official Cash Rate (OCR) in February, taking the OCR to 1.0%. The US Federal Reserve has also indicated that it will commence increasing its cash rate in March 2022 for the first time since 2018.

The long view

It can be stressful to read about volatility in markets and the potential risks, but it’s important to keep a long-term perspective in mind when it comes to investing. If you consider the entirety of the last year, global share markets are still up a very healthy 19.5%, and even emerging markets (of which Russia is a member) are only down -3.7%.