Market Update December 2024

By Mike Ross

By Mike Ross

Global Share Market

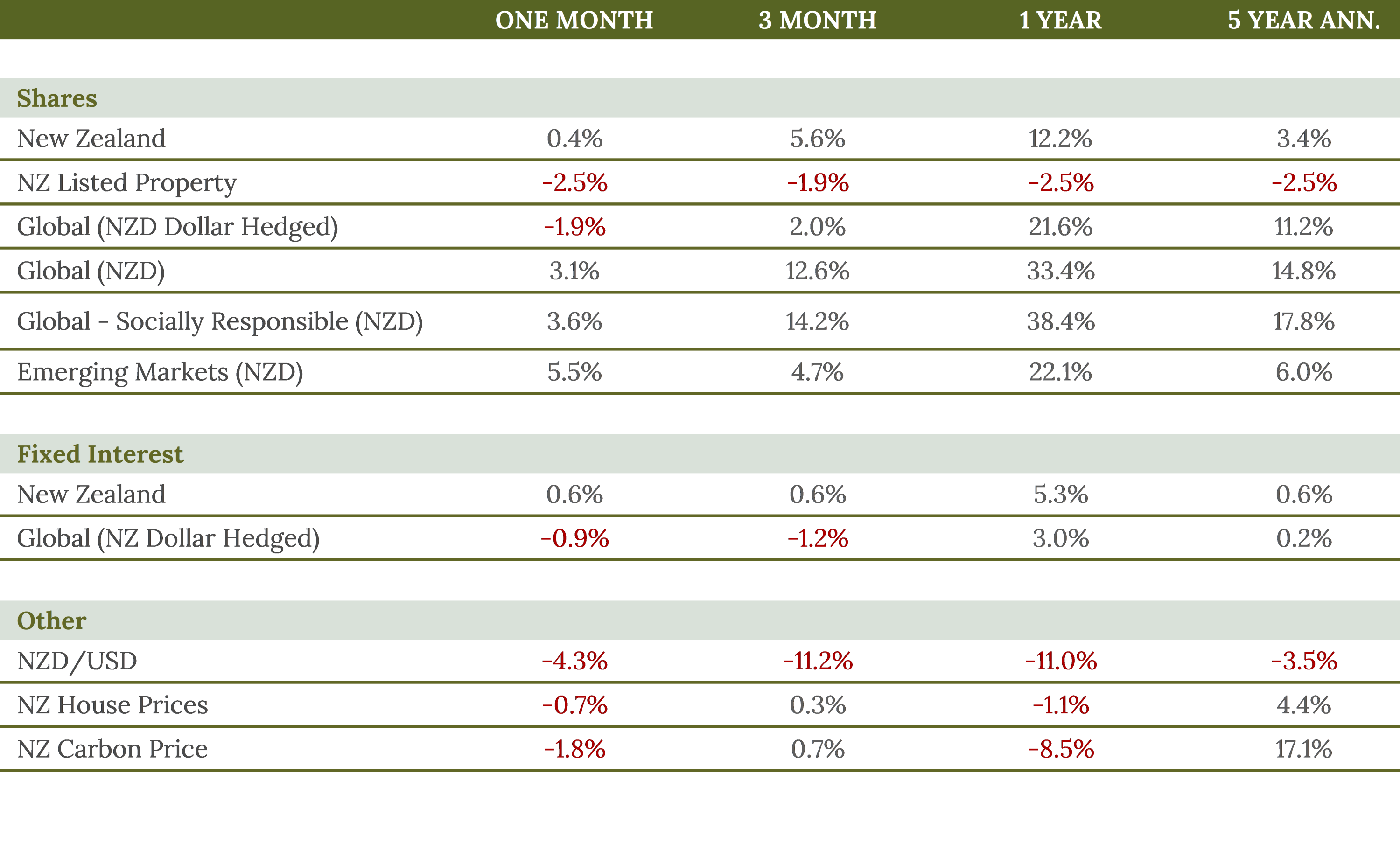

Global share markets ended 2024 on a mixed note in December. The MSCI World Index (NZD Hedged) fell 1.9% for the month, with major markets like the US and Europe experiencing declines. However, when measured in New Zealand dollars, global shares actually rose 3.1% due to the weakening NZD. This currency effect significantly boosted returns for unhedged NZ investors, with global shares returning an impressive 33.4% for the year in NZD terms. Emerging markets outperformed developed markets in December, rising 5.5% in NZD terms.

New Zealand Share Market

The New Zealand share market bucked the global trend, with the S&P/NZX50 Index gaining 0.4% in December. This capped off a solid year for NZ equities, which returned 12.2% in 2024. The domestic market benefited from falling interest rates, improved corporate confidence, and inflation returning to the RBNZ's target range for the first time since 2021. However, the NZ listed property sector underperformed, declining 2.5% for both the month and the year.

Fixed Interest

Bond markets showed divergent performance in December. New Zealand bonds posted positive returns, up 0.6% for the month and 5.3% for the year. This was supported by declining local interest rates and expectations of further rate cuts by the RBNZ. In contrast, global bonds (NZD Hedged) fell 0.9% in December, with US bond prices decreasing as the 10-year US Treasury yield rose by 0.4% to 4.57%.

Outlook

Looking ahead, the outlook for markets remains mixed. The RBNZ is expected to cut rates further in 2025, which could support both bonds and equities. Globally, markets will be watching for potential impacts from Donald Trump's return to the White House and ongoing developments in AI technology