Market Update December 2023

By Mike Ross of Evergreen Advice

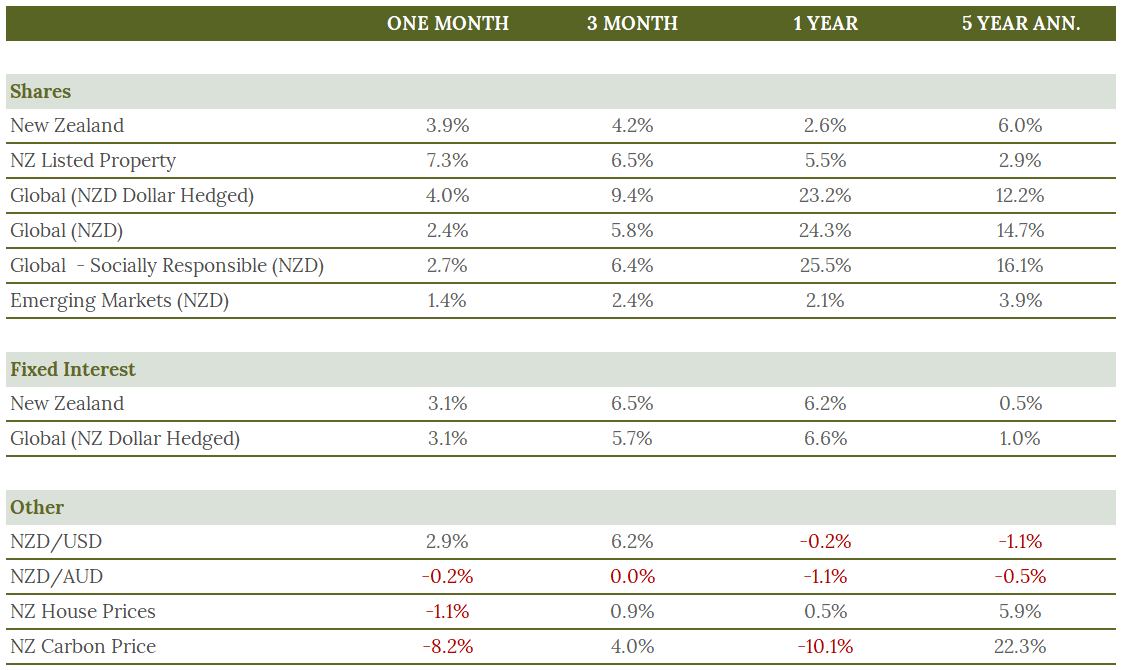

Global share markets experienced a strong finish to the year, posting a 4.0% return (in NZ dollar-hedged terms) for the month. For the year global shares returned 23.2%, the fourth-highest annual return this century. Dovish commentary by the US Federal Reserve in December, implying that interest rate cuts would likely happen during 2024, contributed to a positive market sentiment globally. All sectors, except energy, produced positive returns for the month.

The New Zealand share market delivered a solid performance in December, supported by falling interest rates. The NZ market was up 3.9% for the month, which gave it a positive return for the year (+2.6%). However, challenges within the New Zealand economy were evident, with a number of companies (including Air New Zealand, Heartland Group, Kathmandu, and Sky City) announcing earnings downgrades during the month.

Fixed interest markets also delivered positive returns in December, to end the year on a strong note. NZ Bonds rose 3.1% and returned 6.2% for the year. Global bonds also returned 3.1% in December, and marginally outperformed local bonds for the year, returning 6.6%.

The net result was a return of more than 10% during the year for 'Balanced' portfolios which feature a mix of shares (60%) and bonds (40%), defying assertions from many "experts" that this strategy was dead.