Market Update December Quarter 2022

By Consilium

Fighting inflation

The cost of living crisis was one of the big talking points of 2022 with prices, particularly at the supermarket and at the petrol pump, rising uncomfortably quickly at times.

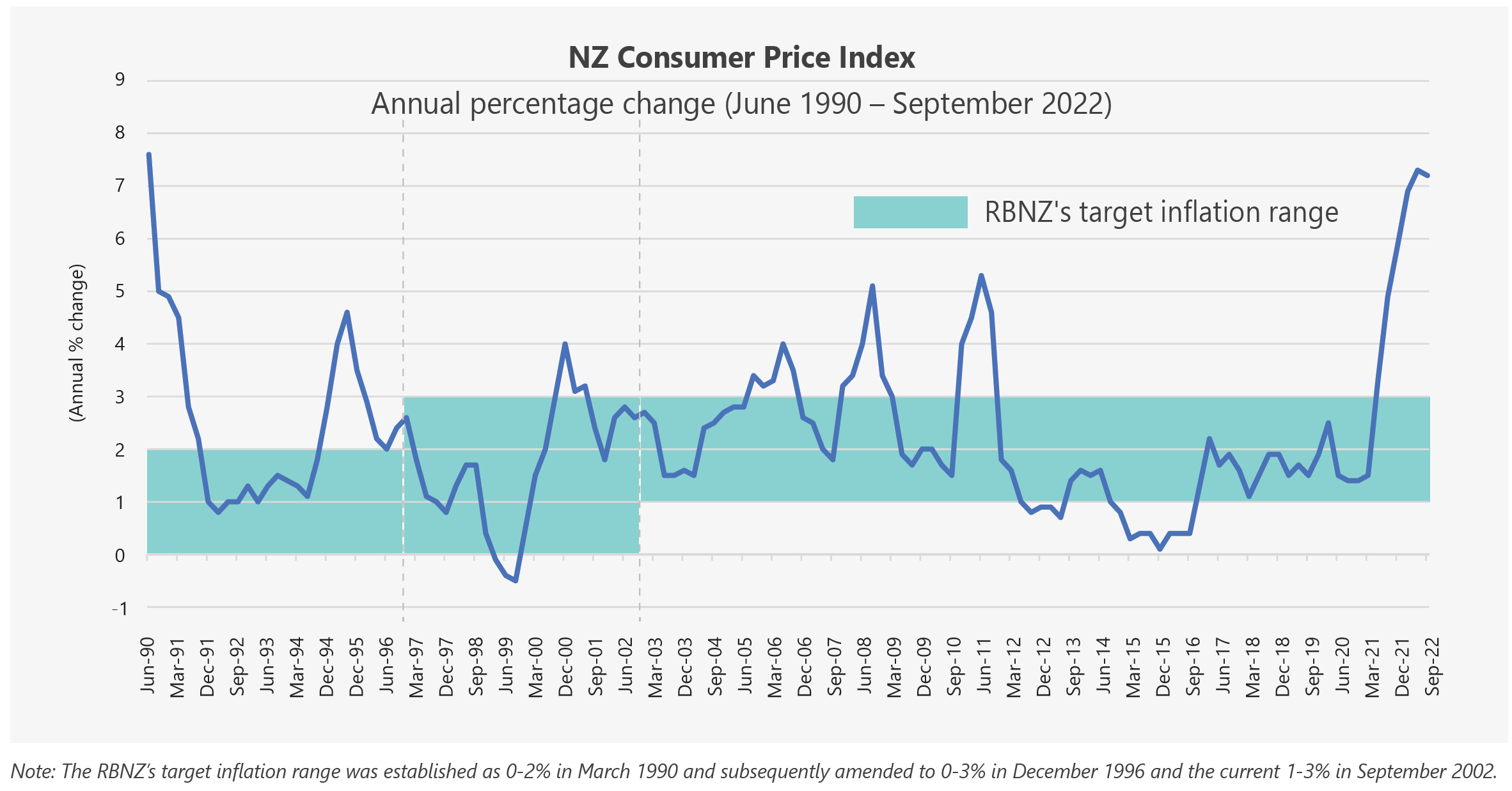

Having successfully controlled inflation within their target range of 1-3% over most of the last decade (as the following chart shows), the Reserve Bank of New Zealand (RBNZ) had also very effectively managed our collective inflation expectations. That is, we all generally expected average inflation of around 2% (give or take) to persist into the future, and our spending and investment behaviours reflected those expectations.

However, following the post-Covid surge in inflation from 2021 to the current level of 7.2% pa (as at 30 September 2022), the RBNZ has become increasingly concerned about the risk of a potential ‘de-anchoring’ of our collective inflation expectations. In other words, they are concerned we may begin to expect much higher levels of inflation into the future than we had previously.

If we begin to expect higher inflation, this is likely to impact our decision-making in relation to savings, investment and spending. It is also likely to impact other areas such as wage negotiations, putting pressure on wages to continue to rise higher and higher to meet rising costs. This, in turn, flames the inflationary pressures we are already facing.

If our inflation expectations were to be reset at higher levels, it presents a much bigger challenge for the RBNZ to quickly get price inflation back down towards the levels we had previously been experiencing.

Galvanised by these concerns, the RBNZ hiked New Zealand’s official cash rate (OCR) by another 0.75% at their November meeting to 4.25%, and revised their projection for the OCR to now reach a peak of 5.50% in 2023. This revised peak is a full 1.40% above the OCR forecast of 4.10% from their August announcement.

How successful the RBNZ are at curbing inflation will be something to watch this year. The chart shows that when inflation has historically reached a short term peak of 4% or more, it has subsequently fallen reasonably quickly (usually after the RBNZ has moved interest rates higher).

If something similar can be achieved within the next one or two inflation updates, there is still a chance the projected OCR peak of 5.50% may not be required. For now we watch and wait for more inflation data.

It should also be noted that with much of the global economy experiencing similar inflationary issues, the coordinated interest rate rising that is occurring around the world will act as a headwind to global growth in 2023. If that headwind blows too hard for too long, it increases the chances that we will see a period of lower or negative growth in some countries/regions later this year. Clearly, a delicate balancing act for central banks around the globe.

Energy sector outperforms

While it wasn’t a good year overall for share markets, there was one standout performer – the energy sector.

Higher oil and gas prices were a feature of the year, and it was one of several factors that contributed to rocketing global inflation. Although higher oil prices are generally bad news for consumers and travellers, it was great news for the energy industry (and it's investors).

As oil prices soared, so too did the performance of many listed energy companies. In the US, the energy sector returned more than 65% in 2022 - its best year on record - and in Europe it was also easily the leading sector, up more than 37%. These returns are even more remarkable in a year when global share markets were broadly negative. This represented a dramatic turnaround from the depths of 2020, when the energy sector was initially the largest casualty of the global shutdown that followed the arrival of the Covid-19 pandemic.

A much better outlook for bonds

The combination of rising interest rates and higher inflation in 2022 led not only to a bear market in shares, but the worst year for bonds in modern financial history.

As interest rates rose faster and further than all early predictions, bond prices declined by significantly more than we are accustomed to. As the year wore on, it led to some investors considering potential alternative assets, particularly ones that could also help to offset traditional share market risk.

However, just as investors may be starting to lose faith in the role that bonds play within diversified portfolios, the forward-looking prospects for bonds are now better than they have been in years.

As at 30 December, the S&P/NZX A-Grade Corporate Bond Index in New Zealand had a running yield of 5.4%, while the Global Aggregate Bond Index was yielding 4.9% in New Zealand dollar hedged terms, (having touched over 5% in recent months).

With central banks now well into their interest rate tightening cycles, early signs of global inflation beginning to moderate and consumer demand seemingly softening, we have an environment for stronger bond returns than we have seen in recent years.

Also noteworthy, is that bond yields are now at levels where they have room to rally (i.e. room for bond prices to rise) if, for example, a non-inflationary macroeconomic shock were to occur and policymakers were to respond by lowering interest rates.

This more positive outlook may be tempered a little by the fact that the large government deficits that built up during the early and mid-stages of the Covid pandemic, are likely to remain elevated for some time. Even if governments are successful in taking a more frugal approach to future spending, they will need to continue selling more bonds to the private sector, and that will be happening in a financial system with reduced overall liquidity. This could limit the scope for bond yields to decline much as headline inflation falls back from peak levels.

However, even in a scenario where bond yields may remain more consistently at or around their current levels, the running yields alone, as outlined above, make them an attractive component of diversified portfolios.

These returns are even more remarkable in a year when global share markets were broadly negative.

All eyes on 2023

The final quarter of 2022 provided a very positive end to an otherwise challenging year for investors.

It was encouraging that in spite of the lack of clarity on a number of high profile macroeconomic, and geopolitical issues, the markets were able to look through these matters and conclude that many asset prices were increasingly looking attractive.

One strong quarter in no way guarantees that the recent challenging market conditions are fully behind us, but it is a positive sign, and it takes us into the new year with more reason for optimism about the potential for better times ahead.

If the uneven transition from Covid lockdowns to a global economic reopening has shown us anything, it’s that governments, central banks and investment markets don’t have a proven playbook about how to seamlessly return the world back to its pre-Covid state. As a result, the last few years have thrown up economic outcomes and market eccentricities that have been well outside our normal expectations.

With the potential for inflation pressures to ease in 2023 and for interest rates to stabilise, it is not unreasonable to hope that some of these eccentricities also begin to moderate.

In the meantime, when markets are as difficult to navigate as they have been lately, the very best approach is always to stay invested, stay well diversified, keep costs low, and stay patient.

Market Movements

International shares

Investors were generally balancing ongoing central bank caution with signs that elevated global inflation could begin to ease, and indications that the current pace of policy tightening would slow.

Gains in the UK were also helped, in part, by the country emerging from its September crisis when the former prime minister and chancellor announced huge fiscal stimulus, with little detail on how it would be funded.

In a reversal of recent price action, the New Zealand dollar was very strong through the quarter. While this was good news for anyone buying foreign currency over the holidays, it was not so good for investors holding unhedged foreign assets, as these holdings, when reported in New Zealand dollar terms, are worth less. Conversely, any NZD hedged securities were insulated from this and given the volatility in currency markets in 2022, it underlines the perils of being fully hedged, or fully unhedged, in these highly unpredictable times.

Emerging markets shares

The relaxation of Covid restrictions in China and the weakening in the US dollar were the main themes in emerging markets through the quarter, driving up returns in local currencies.

Investors welcomed the relaxation of China’s Covid regulations, which helped boost optimism regarding an earlier- than-expected re-opening of the economy. This propelled the Chinese share market to a double-digit return and via its significant weight was the main driver of the strong index returns.

Poland and Hungary also rebounded strongly following months of underperformance resulting from the war in neighbouring Ukraine.

Weaker energy prices over the quarter led to Middle Eastern markets generally underperforming, with soccer world cup hosts Qatar, stumbling to a double-digit decline for the quarter.

New Zealand shares

The New Zealand market, as measured by the S&P/NZX 50 Index, shook off a negative October to post a welcome gain of +3.7% for the quarter. Unfortunately, the index still recorded a -12.0% return the year, remarkably, the first negative calendar year for the NZ share market since 2008.

Three of the top 15 companies by market capitalisation, made strong contributions to the overall index performance – Fisher & Paykel Healthcare (+23.1%), a2 Milk (+20.6%) and Ebos Group (+16.7%). For a2 Milk and Fisher & Paykel in particular, both of having had their share prices under some pressure at different times throughout the Covid disruptions, it was a very pleasing result.

At the other end of the spectrum, a trio of Healthcare companies: Ryman (-36.5%), Arvida (-19.1%) and Summerset Group (-17.9%) all struggled, continuing a downward trend in the performance of each of these shares over the last 18 months.

Australian shares

The Australian share market (ASX 200 Total Return Index) closed out a relatively robust year delivering +9.4% in local currency terms through the quarter.

This strong quarterly result is less surprising when the two largest components of the index – BHP Group and Rio Tinto – delivered returns (in Australian dollars) of +18.5% and +24.7% respectively. Both of these mining firms have benefitted considerably from a more than 50% rally in iron ore prices since the beginning of November.

Other large index constituents include the 'Big Four' banks (CBA, NAB, Westpac and ANZ) which all delivered quarterly returns ranging from +7.0% to +16.2% as their revenue expectations continue to benefit from a higher interest rate environment.

Although the Australian share market was strong overall, the reported returns to unhedged New Zealand investors were much lower due to the relative strength of the New Zealand dollar over the quarter. For the full 2022 calendar year, the ASX 200 was slightly negative (-1.1% in AUD and -0.1% in NZD terms). However, relative to most other asset classes, the ASX was a very resilient performer during a highly challenging period for investment markets.

International fixed interest

Bond markets ended the year on a mixed note in the final quarter. Government bond yields edged higher towards the end of the year, reflecting some disappointment at the still hawkish tone from some central banks, despite mounting evidence of slowing economic growth.

The US Federal Reserve raised interest rates twice during the quarter, with the Fed Funds rate ending the year at 4.5%. The Bank of England also announced two rate hikes, bringing the UK interest rate to 3.5%, while the Bank of Japan announced a modification to its yield curve control policy.

Credit spreads (the extra return investors need to encourage them to invest in bonds with lower credit quality) generally tightened across the quarter on improved risk sentiment. This resulted in US and European investment grade bonds generally outperforming government bonds.

The eurozone faced its most challenging year for inflation in its history, although indicators late in the year signalled slowing headline inflation, helped by falling energy price pressures. Nevertheless, the European Central Bank (ECB) continued to tighten monetary policy conditions and maintained its aggressive stance about future rate hikes.

Over the quarter, the US 10 year bond yield rose from 3.83% to 3.88%, with the two year bond yield rising from 4.27% to 4.43%. Germany’s 10 year bond yield increased from 2.11% to 2.56%. The UK 10 year yield decreased from 4.10% to 3.67%, after the country’s new prime minister reversed most of his predecessor’s ‘mini budget’ proposals, which had been very poorly received by the markets.

The FTSE World Government Bond Index 1-5 Years (hedged to NZD) returned +0.5% for the quarter and -4.6% for the year. The broader Bloomberg Global Aggregate Bond Index (hedged to NZD) advanced +0.8% in the quarter but declined -11.7% for the year, comfortably the worst calendar year for this asset class.

Source: FTSE World Government Bond Index 1-5 Years (hedged to NZD)

New Zealand fixed interest

The Reserve Bank of New Zealand (RBNZ) raised the Official Cash Rate (OCR) twice more in the fourth quarter taking this benchmark rate to 4.25%.

In their 23 November statement, the RBNZ noted that to meet its policy remit of low annual inflation while supporting maximum sustainable employment, both 'actual and expected' inflation needed to decline substantially. Accordingly, given the extent to which domestic spending was contributing to higher and more persistent actual and expected inflation outcomes, the RBNZ determined that a November rate hike of 0.75% to 4.25% was warranted and revised their projections for a higher OCR peak (now targeting 5.50%) in 2023.

Similar to the broad trends overseas, the New Zealand 10 year bond yield opened the quarter at 4.29%, briefly touched 4.00% in early December, and finished the quarter at 4.55%.

The S&P/NZX A-Grade Corporate Bond Index rose +0.2% for the quarter, while the longer duration but higher quality S&P/NZX NZ Government Bond Index gained +0.1%. Both indices ended the year well down at -5.1% and -9.1% respectively.

Source: S&P/NZX A-Grade Corporate Bond Index