Market Update August 2024

By Mike Ross

By Mike Ross

Global Share Markets

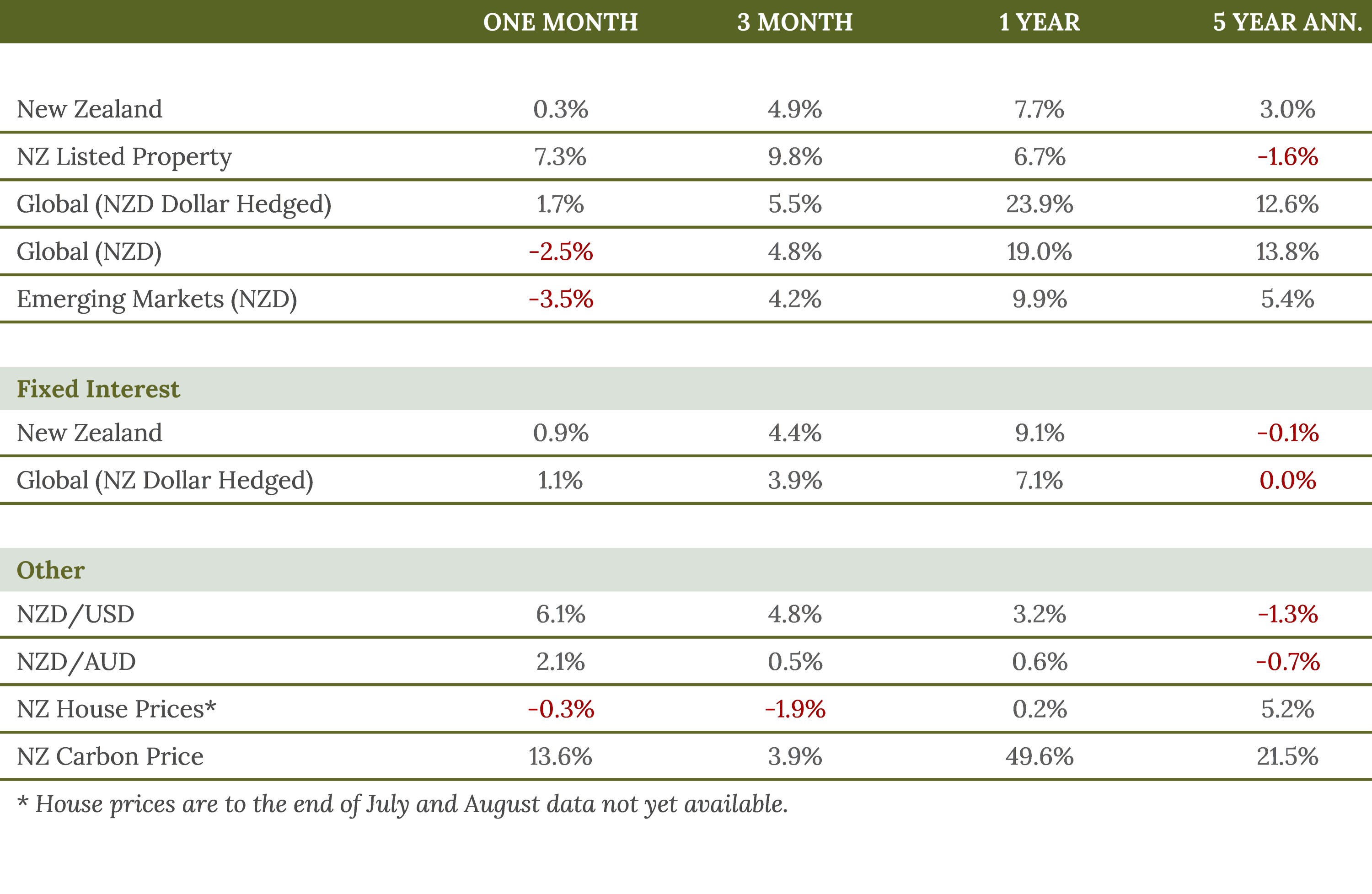

Global share markets experienced significant volatility at the beginning of August 2024, with a sharp downturn triggered by concerns over a potential US recession. The sell-off was particularly pronounced in Japan, where the share market fell by 12%, its worst performance since 1987. The Japanese market's extreme reaction was attributed to a combination of factors, including disappointing US job growth data, rising unemployment, and unexpected interest rate hikes by the Bank of Japan.

New Zealand Share Market

Despite the global market turbulence, the New Zealand share market demonstrated resilience in August, posting a 0.3% increase. The local market's stability was bolstered by the strong performance of the listed property sector, which surged by 7.3% in August. This positive trend in New Zealand contrasted sharply with the volatility seen in other markets.

Bonds Markets

The bond markets presented a mixed picture in August, with global government bonds returning 1.1% (NZD hedged) for the month. New Zealand fixed interest investments saw a 0.9% increase for the month and an impressive 9.1% rise over the year. The global bond market faced some volatility, with yields initially rising due to concerns about potential inflationary policies. However, as recession fears grew, bond yields ultimately ended lower, with the US 10-year Treasury yield falling to 4.03%.

Outlook

The sharp market declines at the start of August have heightened investor anxiety and increased expectations of potential interest rate cuts by central banks, particularly the US Federal Reserve. will be closely monitoring economic indicators and central bank policies in the coming months. The upcoming US presidential election adds another layer of uncertainty to the market landscape.