Market Update August 2023

By Chelsea Traver

By Chelsea Traver

Central banks are continuing to agonise over policy settings that appropriately reflect inflation concern and slowing economic activity. At one end of the spectrum, the Reserve Bank of Australia maintained its policy stance at its August meeting, partly due to a substantial drop in consumption growth as households respond to cost-of-living pressures and higher interest rates. On the other hand, Federal Reserve Chair Jerome Powell emphasised the central bank's commitment to lowering inflation to the 2 percent target in his speech at the Jackson Hole Economic Symposium in late August. Powell noted that, despite progress evident in a further slowing in job growth and ongoing disinflation, more work was needed to achieve price stability.

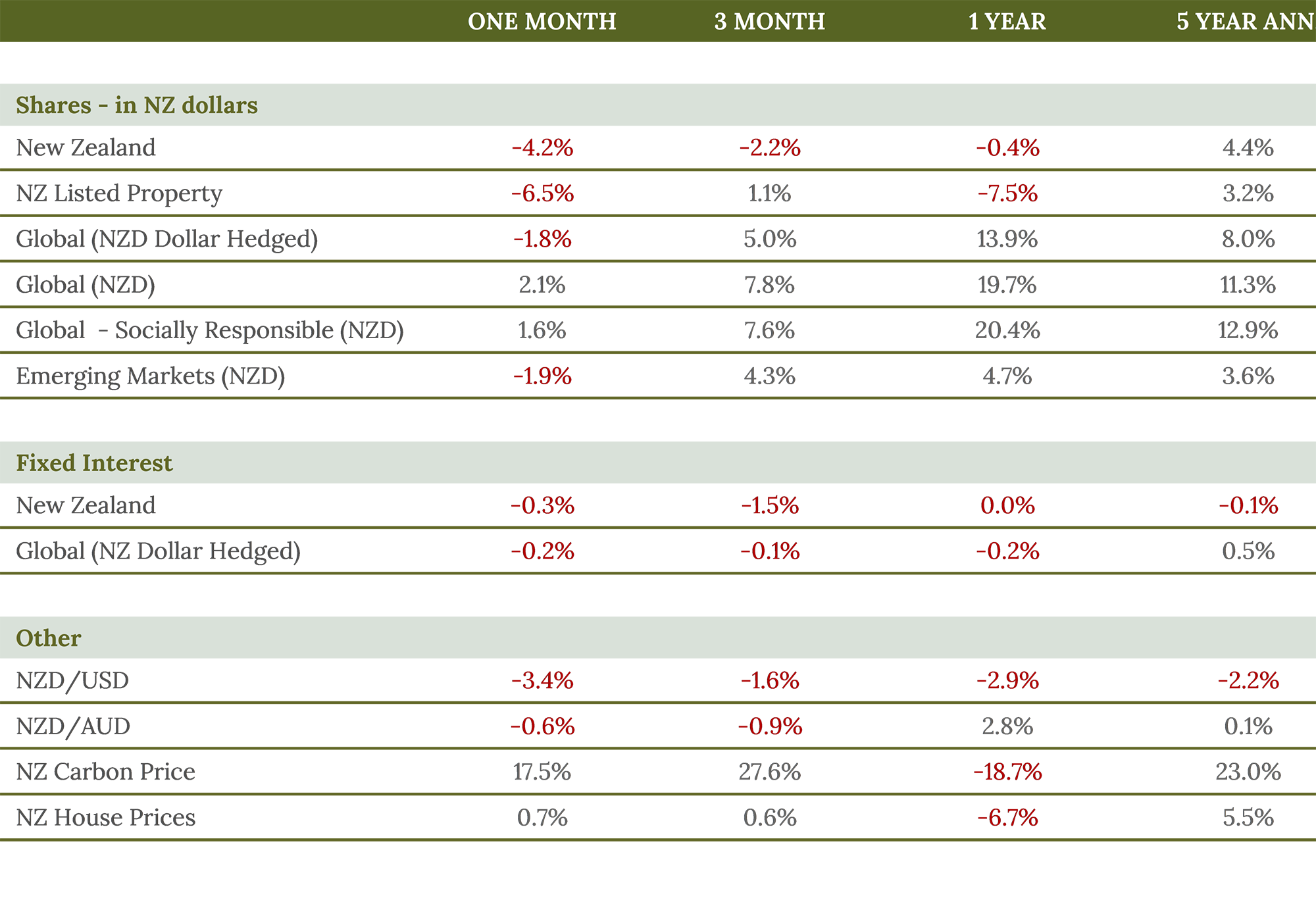

This has contributed to the retreat in investment returns over the month, which was particularly pronounced in NZ equities, an asset class that is heavily influenced by interest rates. Central bank expectation of ‘higher for longer” has also led to a slightly negative return in global fixed interest.