Is a recession coming?

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

What’s going on?

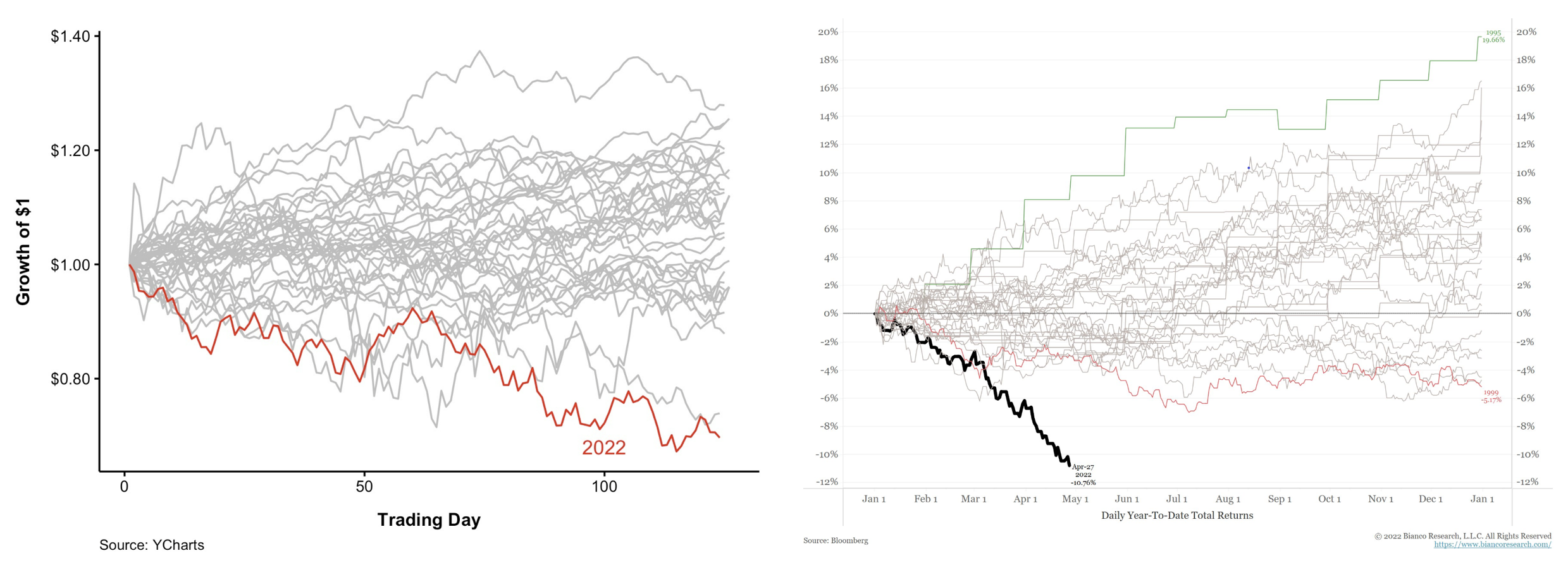

It’s been a bad first half of the year for investors. Like really bad

Share (Nasdaq) and Bond (Bloomberg Global-Aggregate) January to June Performance

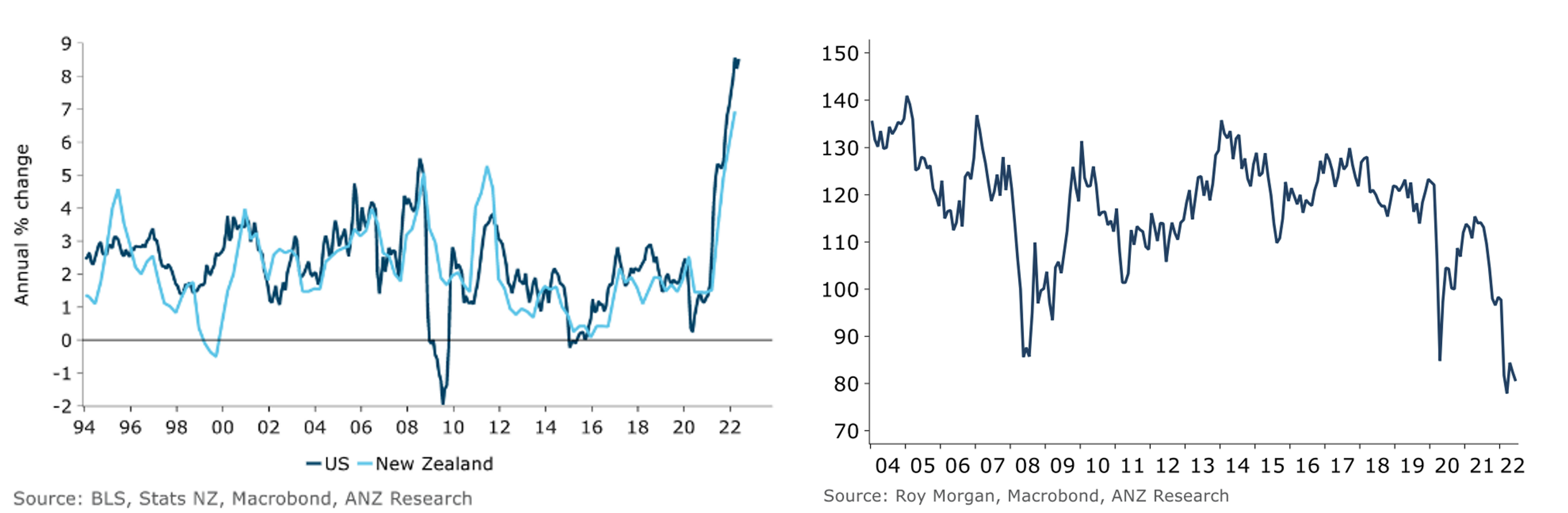

Inflation is at all-time highs and consumer confidence is at record lows.

'US & NZ CPI Inflation' and 'ANZ- Roy Morgan Consumer Confidence'

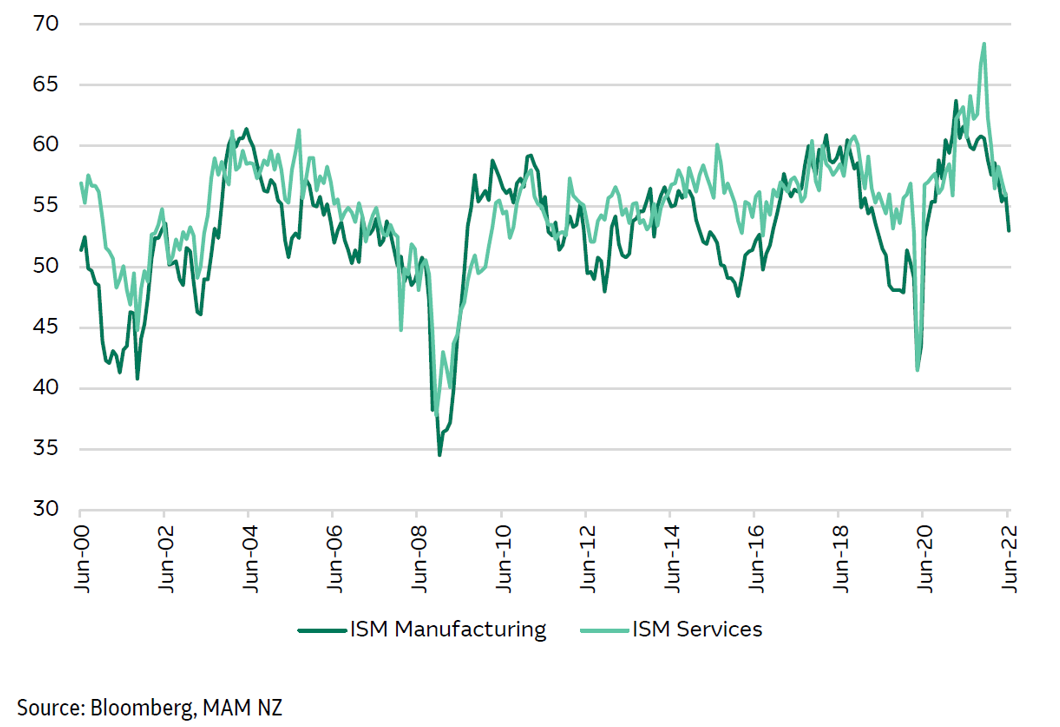

Manufacturing has been slowing, as has spending on services.

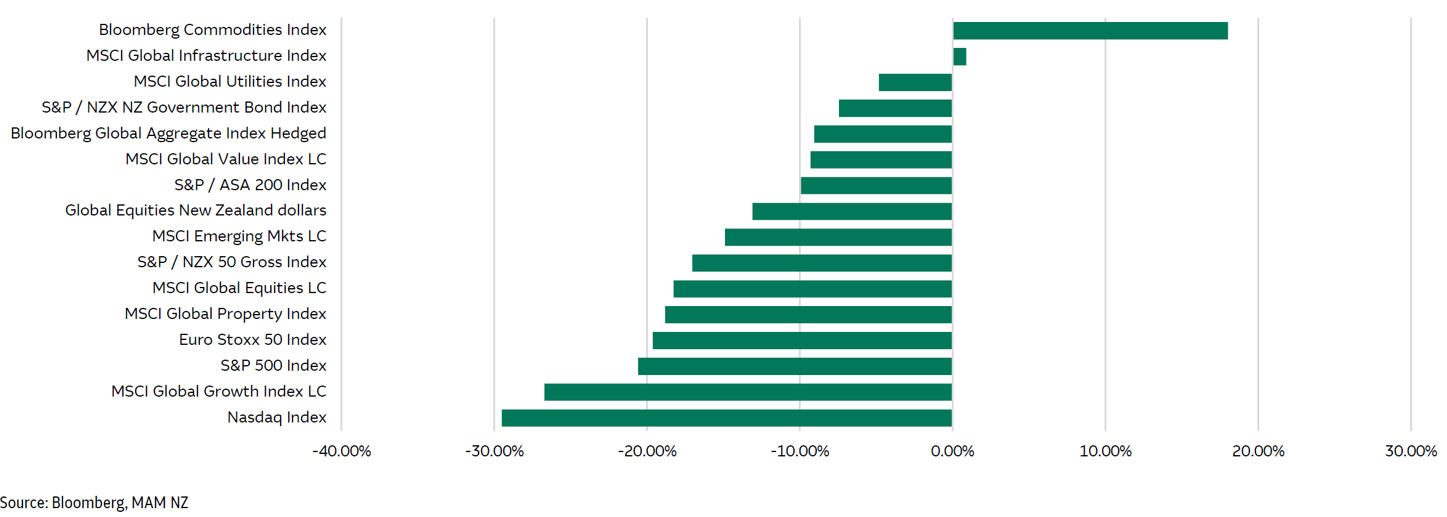

The usual champion of portfolio construction, diversification, hasn’t helped investors much either as both shares and bonds were hit hard and almost all asset classes performed poorly. There was (almost) nowhere to hide

Is this a recession? Is one coming?

There’s actually no universal definition of a recession but in NZ the technical definition is six months of negative growth in the gross domestic product (GDP). Essentially, it looks at 'is the economy moving backwards'. As of the time of writing, NZ’s GDP went down by -0.2% in the March quarter with June’s data yet to be released.

However, this definition isn’t a particularly useful one. Recessions are memorable: the great recession of the mid-2000s, or the fuel crisis and resulting recession in the 1980s. We remember these not because “GDP had negative growth for two quarters” but because there were widespread, sustained financial hardships. People lost their jobs, their houses and even those who weren’t directly affected financially, often were emotionally impacted after listening to the dire news for months or years.

A more accurate description of a recession is perhaps the one used by economists in the United States: "a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales". It is understood that the two factors they weigh the highest when determining a recession are income and employment. What’s interesting is by these two measures, the economy is still solid.

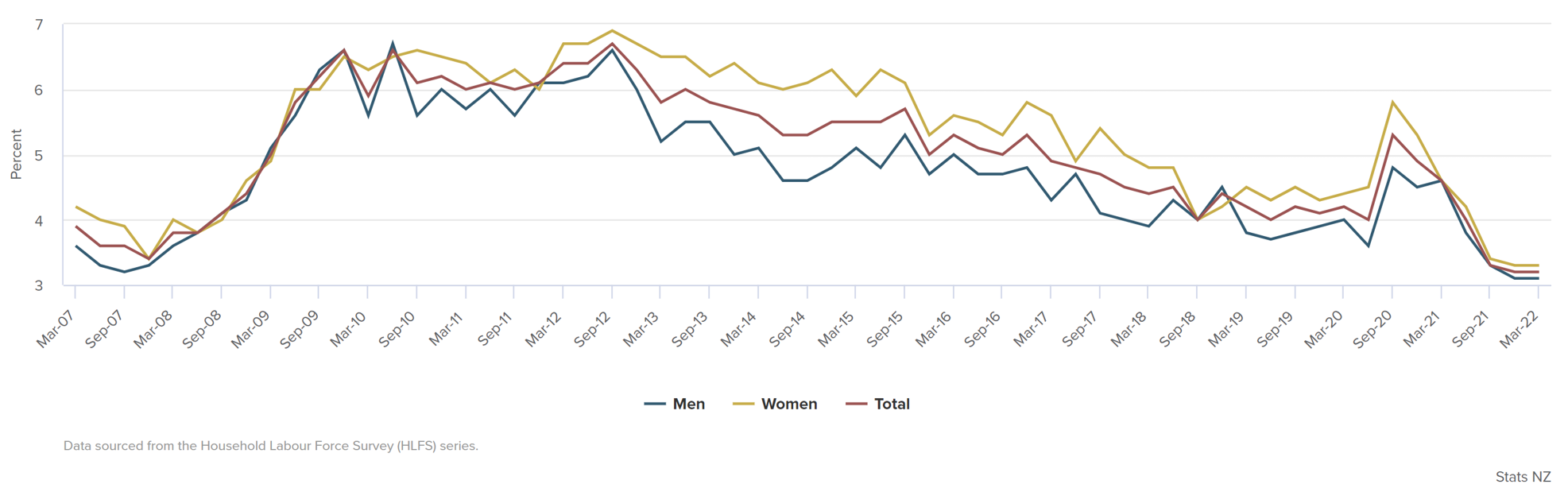

NZ Unemployment Rate

Key Takeaway

So, what does this mean? Should we take the inflation and slowing economic indicators as a sign that a recession is on the horizon? Or should the low unemployment figures reassure us that this is just a minor setback? It’s even possible that both might be true. That the economy will contract without the major loss of jobs or income. It’s too soon to tell and most importantly for investors, by the time we know it’s a recession the market might have already started to recover.

The indicators that measure how an economy is doing are backward-looking, in other words, they look at the prior month, quarter or year and tell you what happened in the past. As such the share market can, and generally does, start recovering well before these types of economic indicators show a rosy picture.

It has been a bad six months in the market. These types of downturns are never comfortable but it’s more important than ever to be careful about making predictions about what’s coming next.

Disclaimer: This article is general in nature and does not constitute financial, tax or legal advice in any way. Should you require such advice, please contact Evergreen Advice or a suitably qualified professional.