Impact Investment and the Climate Venture Capital Fund

By Mike Ross

By Mike Ross

There has been a growing interest in Impact investing yet it is still an area which can be opaque and hard to understand. In this article, we explore private impact investing and analyse a new investment opportunity: the Climate Venture Capital Fund Extension. Impact Investing can be a great way to invest your money with the goal of doing some good. However, they are some important risks to consider as well.

What is Impact Investing?

Impact investments are designed to generate measurable, positive social and environmental outcomes alongside financial returns. These investments should also provide additionality, meaning they create benefits beyond what would occur without the investment.

There is debate about whether buying listed shares qualifies as impact investing – since it usually involves purchasing shares from sellers rather than funding new projects. This article focuses on a private fund that aims to make a strong impact by investing directly in businesses and supporting them to succed. This is just like a Private Equity or Venture capital which also invest in companies that are not publicly traded.

An example: the Climate Venture Capital Fund Extension (CVCFe)

To illustrate a real world example of impact investment we analyse the Climate Venture Capital Fund Extension (CVCFe). This is one of the few private impact funds available in NZ and is a good example of how impact investing works in practice.

Fund Description

The CVCFe invests in companies that deliver high returns on investment, as well as significant climate impact. It focuses on New Zealand and Australian companies and is managed by experienced Venture Capital investment manager 2040 Ventures. The fund targets market-leading returns (over 20%) and verifiable emissions reductions. Initially seeded in 2021 as the Climate Venture Capital Fund, it is now raising money for its new iteration: the Climate Venture Capital Extension Fund.

The Manager

Fund manager 2040 Ventures has a long and strong track record managing the Punakaiki Fund. Established in 2013, the Punakaiki Fund has invested in over 30 start-up businesses and is now valued at approximately $95 million. Over its lifetime, the fund delivered an annual return (annual IRR) of 18%.

Investments made in the (original) Climate Venture Capital Fund

The table below provides examples of investments made in the Climate Venture Capital Fund, including energy storage, de-carbonising horticulture and low-waste cleaning products. This article by fund co-founder Rohan MacMahon discusses where some future investment opportunities might be.

Potential Returns and Risk

The fund’s target annual IRR return is 25%. It should be noted that this is only a target. As mentioned, the Punakaiki Fund has achieved an annual return of 18%, which is still a strong result. More generally, venture capital and private equity investments have historically outperformed share market investments, both globally and in New Zealand and Australia.

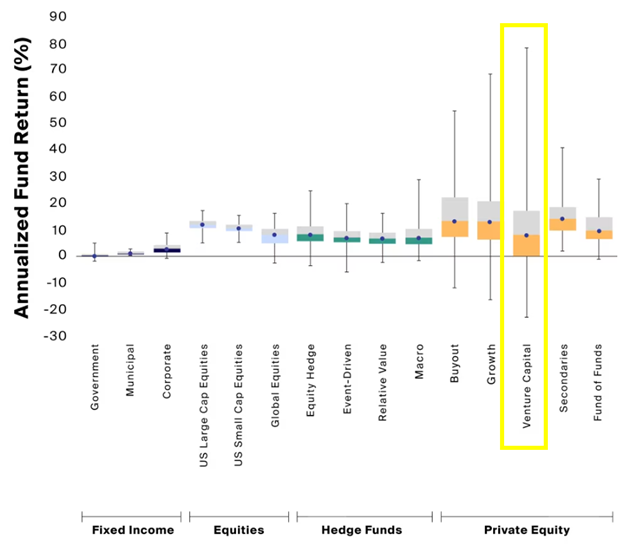

We would generally expect lower returns, possibly around 10% annually, with a wide range of potential outcomes. The graph below shows the variance in outcomes for Venture Capital Funds compared to other investment types, based on 40 years of global data. While the least successful venture funds may lead to a loss of the majority (90%) of your initial investment, the most successful ones can yield substantial multiples growth:

As illustrated in this graph, if one were to invest $100,000:

- Low Return potential: An annual return of -20% per year over a 10-year period would leave you with just $11,000.

- High Return potential: An annual return of 50% per year over a 10-year period would leave you with $5.8m.

Fund Structure

The fund structure differs from those of standard retail funds that most investors are familiar with. In a traditional fund (like a PIE fund or an ETF), investors can buy any amount and sell their position at any time, usually receiving the sale proceeds back in a few days. Investors may also receive cash dividends.

Venture capital funds operate differently. Investors commit a minimum amount, for example in the CVCFe the minimum commitment is $100,000. The manager then calls that commitment over a three year (investment period) as investment opportunities arise. The manager then supports the investment companies to grow and succeed, with the goal of selling them within the fund’s 10-year term. Upon successful sale of the companies, proceeds are returned to investors. More detailed information about venture capital fund structures can be found here.

While it is possible to sell your investment, we strongly recommend planning to hold it for the life of the fund. If you do need to sell, it may take some time, and you may have to sell at a discount to the estimated value.

Investor Eligibility

To invest in the fund, you must be a wholesale investor:

- The law normally requires people who offer financial products to give regulated information to investors before they invest. This information is designed to help investors make an informed decision.

- These usual rules do not apply to offers of financial products made to wholesale investors. As a result, you may not receive a complete and balanced set of information, and you will also have fewer other legal protections for these investments.

Wholesale investment funds (particularly wholesale property funds) have developed somewhat of a bad reputation in recent years for being mis-sold to inappropriate investors. But in this case, we think there is good justification for impact funds being wholesale:

- There is a cost to completing the required compliance for a retail fund (documentation, ongoing compliance, paying a supervisor), and it is uneconomic, particularly for these impact funds, which tend to be smaller.

- In addition, the minimum investment is $100,000. Given the nature of the fund's investments and the lack of liquidity, we recommend investing a relatively small percentage of your assets in such a fund.

Conclusion

We are seeing a growing interest from our clients to make impact investments, i.e those that make a positive, measurable social and environmental impact alongside financial returns.

CVCFe is a private impact fund that seeks financial returns and greenhouse gas emissions reductions through investments in start-up growth businesses and technologies. It is exclusively available to wholesale investors who meet specific criteria.

While it poses liquidity risks and requires careful consideration within an investment portfolio, it presents a compelling opportunity for investors seeking impactful investments in the climate space. If you want to learn more visit the website https://climatevcfund.com/funds/cvcfe/ and request more information from the manager.

If you are interested in impact investing and want to know whether the fund is right for you, your situation, and your overall investment strategy, contact Evergreen Advice.

More Information

Disclaimer: This article is general in nature and does not constitute financial advice. Should you require such advice, please contact Evergreen Advice or a suitably qualified professional.