Geo-political risk and returns

Geo-political risks, both perceived and real—such as wars, terrorist attacks, political instability, and trade tensions—are a staple of our news and, at times, completely dominate the headlines. While such events can have profound impacts on the lives of individuals, communities and nations impacted, do they matter for long term asset returns? Below we address what the empirical literature suggests, and the implications for investors.

Geo-political risk impacts in principle

As with most things in markets it is useful to distinguish between the short and longer terms. Over the short-term the literature suggests geo-political events can lead to abrupt equity market sell-offs, and increased volatility and market risk premiums. But crucial in this is the proximity of the event to the market concerned, the magnitude of the event, and the impact across different sectors and countries.

The literature also suggests that such events are at best co-incident with volatility and short-term declines in equity markets. In other words, it is exceedingly difficult to forecast future returns given geo-political risks.

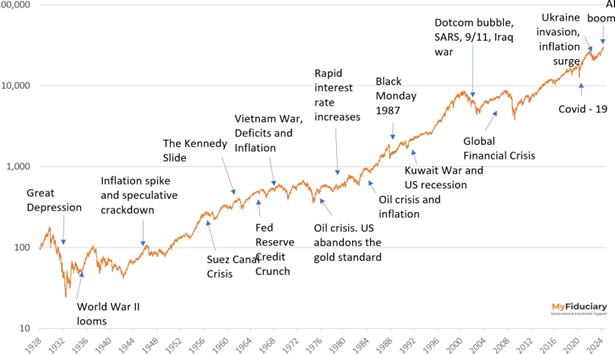

The longer-term impacts depend on how the ‘shock’ is resolved and whether it has an enduring influence on economic growth, corporate earnings and profitability. In general, we can say that over time markets recover even from the largest of such events like World Wars. The figure below shows the long - term march upward of markets as a whole through geo-political and other hits to markets. But that is not to say there aren’t enduring impacts on specific companies, sectors or even countries and regions.

The benefit of having a long time horizon: S&P 500 Price Index from 1928 to October 2024

Source: Morningstar Direct, MyFiduciary

Case study – Russian invasion of Ukraine

To illustrate this with a recent example, the full-scale Russian invasion of Ukraine in February 2022 had the largest short-term impact on neighbouring countries. Poland and Hungary’s equity markets fell around 40% and European equity markets overall initially fared worse than the US. But in the year following the invasion European equities had fully recovered while the US market was down around 9%, even though European economies were much more negatively impacted by rising energy prices. And now, some 2.5 years on, most equity markets have reached new highs, with the US leading the pack. In contrast, Russian equity markets have become un-investable following the dropping of their markets from indexes and funds.

Nevertheless, there have been enduring impacts. Energy markets have been completely re-configured within Europe and some commentators suggest the war has hastened transition away from fossil fuels. Defence industry spending has rocketed up. In contrast, most Western companies with Russian ties have essentially had to write-off their business and assets held within Russia.

Implications for Investors

For investors diversification across markets and asset classes is essential for managing geo-political event risk, in line with managing market risk in general. Bonds and asset classes such as gold typically rally when there is an increase in short-term global uncertainty and equity market volatility. A ‘shock’ that has an enduring negative impact on a country or sector can be mitigated by holding broadly diversified exposures across different sectors and countries. And time, as always, is the ultimate diversifier. Most markets, most of the time, recover.

Another implication of the literature is that it is likely unfruitful and potentially counter-productive to adjust portfolios in response to geo-political risk. Markets are impacted by many forces, and as discussed above the medium and longer run impacts are very uncertain. An investor selling European stocks after the Russian invasion to buy, say, US stocks on the view that the European economy would be more at risk, would have been right on the economic impact, but wrong on the impact on markets over 2022. Defence spending has massively increased since the invasion, but defence stocks overall have not outperformed.

Finally, while we caution against reducing exposure to risky assets because of concern that geo-political risk will impact future investment returns, there may still be good reasons to adjust based on Responsible Investment (RI) considerations, subject to materiality and the practicality of making any adjustments. Many investors sold (or wrote off) their holdings of Russian stocks on RI grounds following the Ukrainian invasion, which in the event was facilitated by fund managers and index providers dropping these exposures in response to Western government sanctions.