Annual Market Update March 2022

By Chelsea Traver at Evergreen Advice

By Chelsea Traver at Evergreen Advice

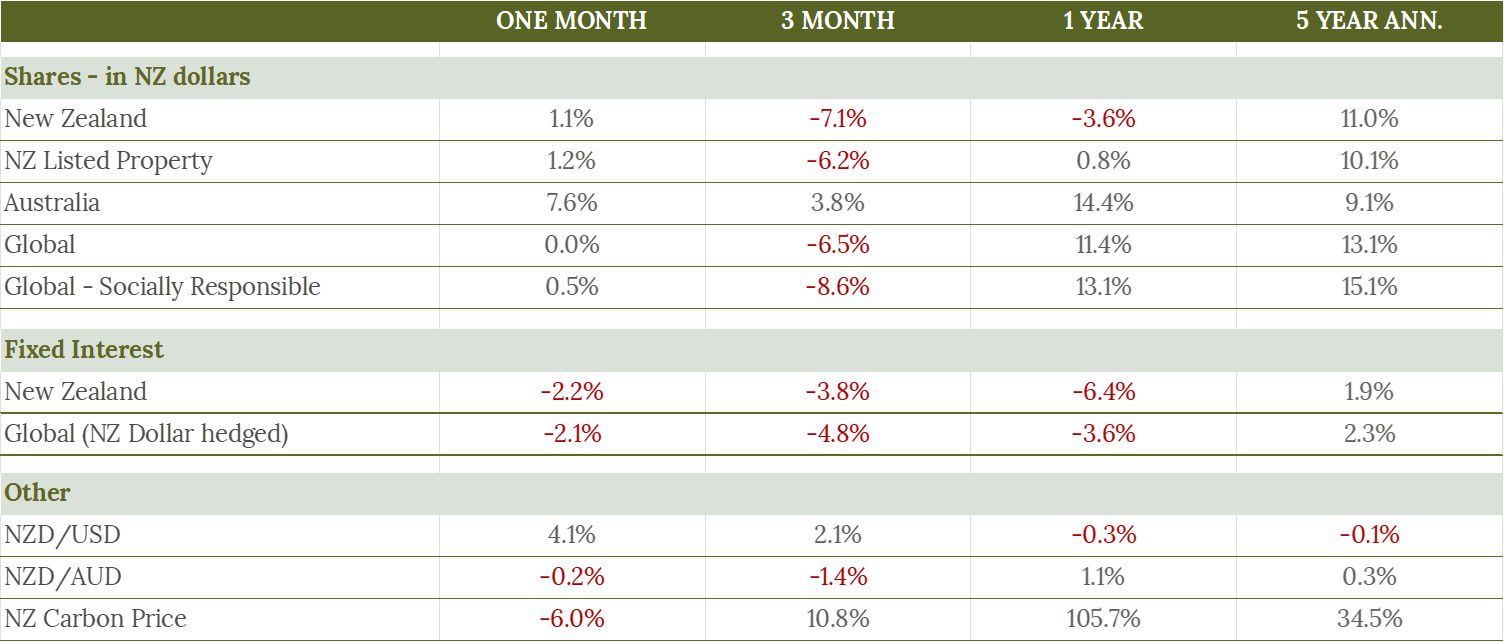

In March we like to look back on the past 12 months to explore what’s been going on in investment markets over the longer term. This time there is a very distinct split in how the markets performed in 2021 and how they performed in 2022.

In 2021, Global shares were still steadily climbing, and NZ shares & Fixed interest had just slightly rocky performance. Now, three months into 2022 almost all investment markets have had significantly negative performance to start the year, including generally reliable Fixed Interest. If we put these periods together and look at the entirety of the last 12 months the picture gets a rosier for global equities although both NZ shares and all Fixed Interest had negative performance.

There are currently two major issues that have driven performance so far in 2022 and will likely continue affecting markets:

1. The war in Ukraine

2. How to slow inflation without hurting the economy

The War in Ukraine

We’ve heard from many investors who are very concerned that the war in Ukraine will be the start of World War 3. Markets started reacting to this conflict in early February and continued a downward trend as Russia invaded Ukraine on 24 February. Global share markets bottomed out around 15 March before partially recovering to end the month.

The effects of this war are more than just local, Russia is a major supplier of oil to Europe and international markets. There is also the concern that China may become involved as they are potentially a supporter of Russia. And hanging over every update that we hear is whether the war could turn nuclear. This in particular has some investors wondering if now is the time to get out of markets.

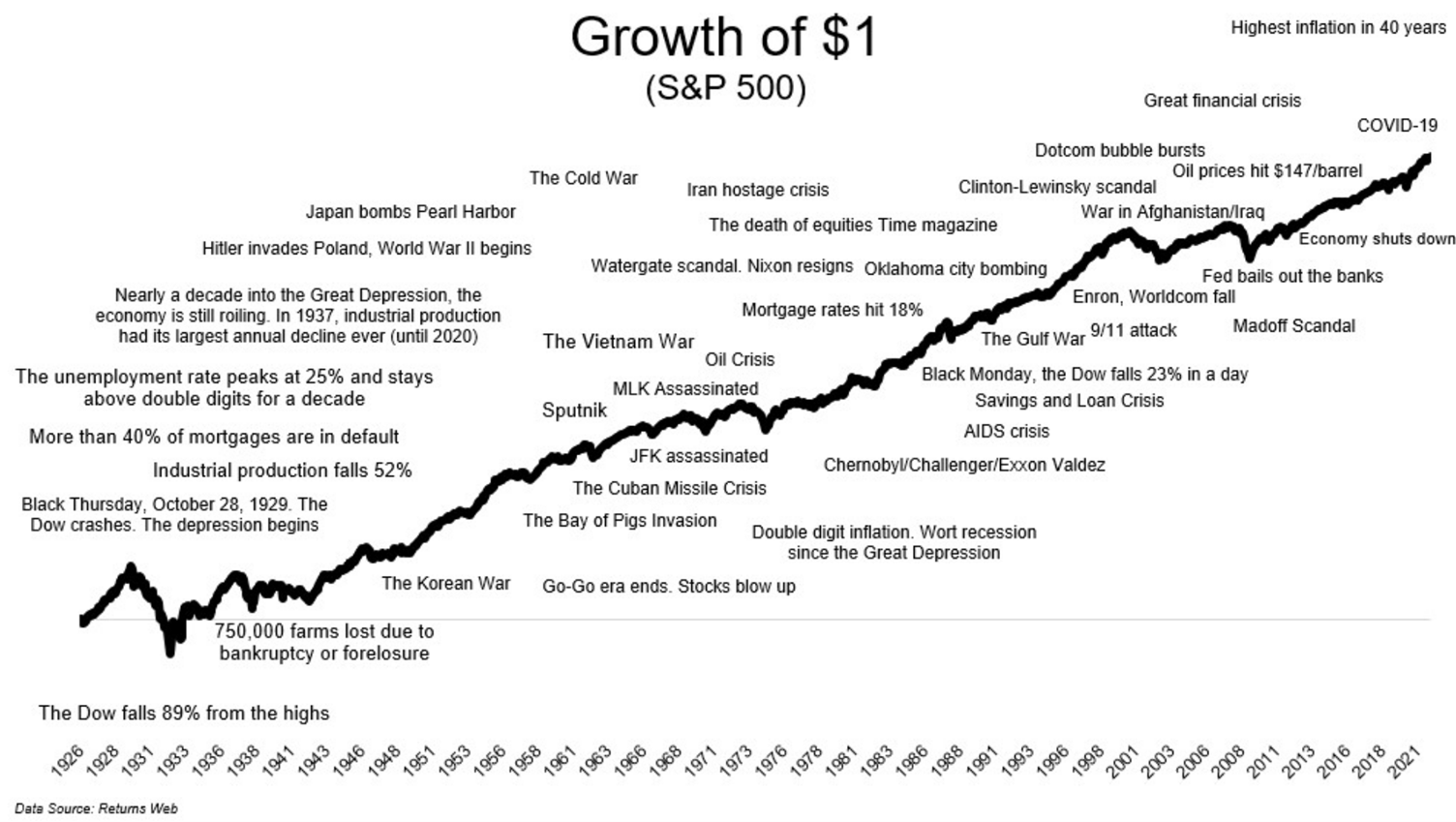

While we do not know what will happen with international relations; we do know that historically wars impact the long term share market less than you might think, even World Wars. Investors who stayed in the market achieved significant returns over the long term.

How to slow inflation without hurting the economy

Inflation was the original driver of the negative performance in January 2022 and continues to affect both equity and fixed interest markets. Higher inflation means interest rates also need to be higher to compensate investors appropriately for their bond investments. Interest Rates are a key driver of returns on all assets and because of the makeup of the NZ share market it is particularly affected by interest rate changes, hence its negative performance.

In equities interest rates affect businesses and their share price in various ways:

- Many companies use debt. If interest rates go up, so do their mortgage costs, reducing the company’s profitability.

- Companies that pay dividends can become less attractive when interest rates go up – if an investor can get an increased return by putting money in a savings account or term deposit, they are less likely to want to take on risk by investing in shares for income.

- Technology stocks tend to have high valuations based on expectations of strong growth and future profits. As interest rates increase, investors demand a higher return on all investments, and this has a magnified effect on growth stocks that are valued based on the growth of their long-dated future profits. This played out in January when one of the hardest-hit sectors in the stock market was Information Technology, which fell -by 8.3%.

For bonds, their price falls when interest rates rise which explains why bonds have delivered negative returns over the past year. To illustrate why using a simplistic example, if a bond is issued in 2021 with an interest rate of 2% it’s worth less if interest rates have risen and there are new bonds coming to market at 3%, especially if inflation is also eating into its returns.

Looking forward central banks around the world are being forced to respond to inflation numbers not seen since the early 1980s by increasing their local cash rates to cool down the economy and ensure inflation does not stay elevated. NZ has started this upward hike in rates, with the US and other markets joining in as well. Their challenge will be slow growth…but not too much.