A rough start to 2022 in markets: should you be worried?

By Mike Ross at Evergreen Advice

By Mike Ross at Evergreen Advice

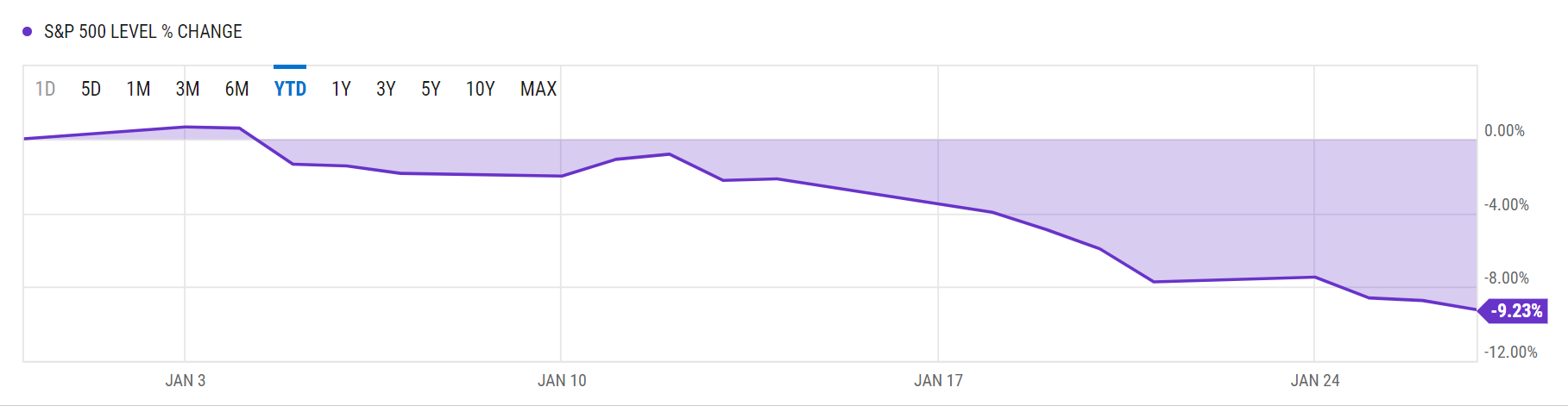

The beginning of 2022 has made headlines as the worst start to any year on record in US share market. This is an unwelcome sight for anyone returning from holiday and checking their investment portfolio. It is especially jarring considering global stock markets were so resilient last year with a stellar 29% return, to then fall so significantly over the first few weeks of January.

This drop is primarily in reaction to high inflation and increasing interest rate expectations. US shares are now down approximately -9% since the 1st day of 2022. A similar experience was felt in the NZ share market which has fallen -8% over the same time frame.

Share market sell-offs are never pleasant, and that is particularly the case if you have just invested some of your hard-earned savings. However, it is important to keep a few things in mind:

1. Market declines of this size are relatively frequent.

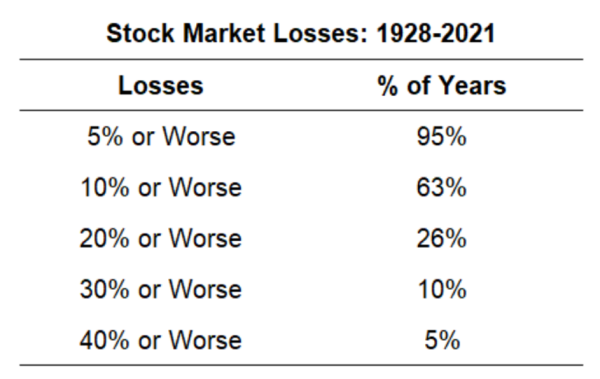

According to Ben Carlson, the average decline from the top to the bottom in any given year is about -16%. Almost two-thirds of the time there was a double-digit correction at some point during the year:

These market losses are from the U.S. share market which makes up more than 60% of the global market and the story is similar for other countries including here in New Zealand.

2. You must take the downs if you want the ups.

Over the long-term shares deliver 8% to 10% per year. After accounting for fees and taxes, this means you can double your investment on average every 10 years. This is well in excess of other investment options such as term deposits.

The price you must pay for these higher returns is volatility – you have to accept that your investments will fall in value, sometimes significantly. No one can successfully predict what the share market will do over the coming days, weeks or months and so there is no way to avoid it. Selling shares when markets are going down, often leads to investors missing the market recovery, and therefore not achieving the 8% to 10% long term returns that shares can provide.

3. Your portfolio is built for you to weather this.

Your investment strategy should be consistent with your goals. More conservative investments such as bonds or term deposits provide stability in your investment portfolio and counterbalance the volatility of shares.

An integral part of any investment strategy is ensuring that the make-up of your investment portfolio is consistent with your investment timeframe and risk tolerance. The longer you plan to invest, the more share exposure you can take, so you have time for shares to recover if and when they decline.

We know it can be hard to see fast, sharp portfolio declines. When shares fall it feels like they’re going to continue falling. If they fall 10%, surely they are going to keep plummeting…until they don’t.

To quote Ben Carlson once again:

The reasons for the correction don’t really matter in the grand scheme of things. Sometimes stocks go down.

It happens.

You don’t know when and you don’t know why but you know it’s going to happen

Plan accordingly.