Tailoring your finances to achieve your goals

Ethical investments that align with your values.

Financial Planning

We provide comprehensive financial planning services to help you reach your financial goals.

Using plain language advice and financial modelling, we distil your goals into actionable items to ensure you are on the right path. We help you to prioritise your spending, saving and investment decisions. A plan helps you stay focused and motivated, leading to a better financial future.

Whether you've recently inherited assets, are approaching retirement, or are welcoming a new addition to your family, we are by your side. As your trusted financial partner, we evolve with you, offering timely advice and support throughout life's milestones.

1. Confirm your goals

![]() Fund your retirement

Fund your retirement

![]() Support your children financially

Support your children financially

![]() Travel

Travel

![]() Retire early

Retire early

2. Optimise your assets

3. Implement a plan

![]() Analyse total potential income including pensions, properties, and investments

Analyse total potential income including pensions, properties, and investments

![]() Estimate how much you need to save

Estimate how much you need to save

![]() Clarify how long you need to work or when you can reduce your hours

Clarify how long you need to work or when you can reduce your hours

Investment Advice

We review your financial situation, create a plan for your future, and stay by your side to make it happen.

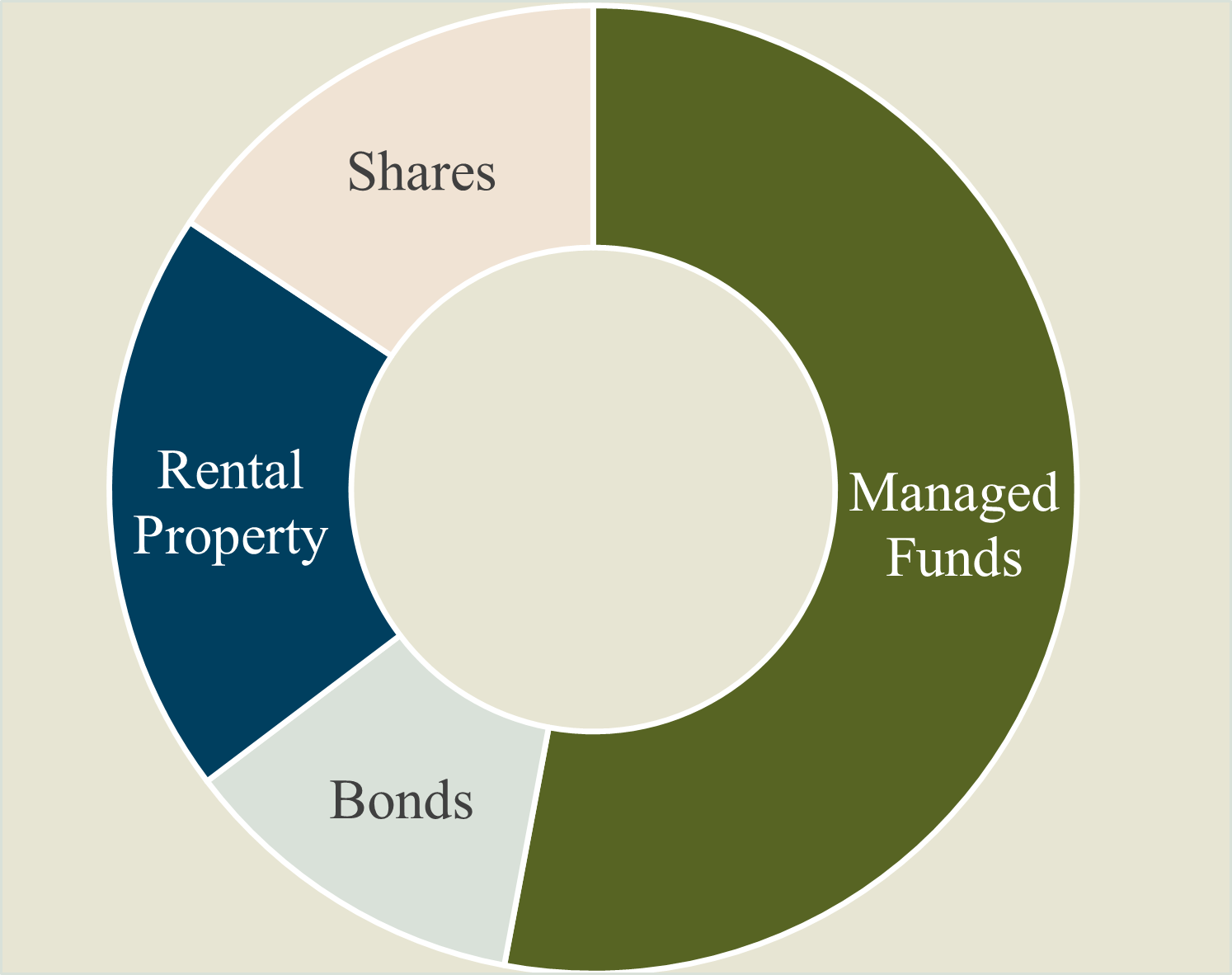

We provide investment advice covering personal investment portfolios, KiwiSaver, and UK pension transfers. We also specialise in ethical investing and tax-efficient investment strategies for US citizens.

We build diversified investment portfolios based on your specific needs, goals, and ethical investing preferences. Some people want to earn the highest return possible, while for others, stability and income are more important to support their retirement. When investing responsibly we ensure the portfolio suits the client's preferences whether that be primarily excluding harmful companies or investing in solutions. We build your portfolio to make sure you achieve your goals while not taking unnecessary risks.

More information on our investment approach

![]()

Investment Portfolios

Evergreen Advice allows you to outsource ongoing investment management. Additionally, we offer investments that are not available on retail platforms to give you a truly personalised experience. We manage and update your portfolio on an ongoing basis to keep up with what’s happening in the market and ensure you are invested in the best funds available.

For those who would prefer to manage their own investments or who are just starting, we also provide self-managed advice to help you set up an investment portfolio.

![]()

KiwiSaver Advice

We review your Kiwisaver and recommend a provider, fund and contributions that best suit you. We consider your goals, ethical investment preferences, and risk tolerance while ensuring that your KiwiSaver compliments your other investments.

We also offer the KiwiWRAP KiwiSaver Scheme, an option that enables us to tailor your KiwiSaver to your personal circumstances and values by selecting from more than 400 investment options.

![]()

US citizens in NZ

If you are a US citizen living in Aotearoa New Zealand, you have increased tax considerations and unique investment needs. We provide investment and financial planning advice to ensure your investments are tax-efficient from both a US and NZ perspective.

As a US citizen, Chelsea has personal experience with the US tax system, and the considerations that need to be made when investing. Investing in KiwiSaver or New Zealand managed funds can result in punitive taxes and onerous reporting requirements due to the PFIC regime. We work with specialist US tax accountants to build investment strategies for US citizens that are tax-efficient and right for you.

![]()

UK Pension Transfers

If you have decided to permanently live in New Zealand but still have a United Kingdom pension, we can help you decide if transferring it to New Zealand is in your best interests.

We give you independent advice and work with Qualifying Recognised Overseas Pension Scheme (QROP) providers to move your pension to New Zealand. From there, we regularly meet with you to ensure the investment strategy is still appropriate for your current circumstances.